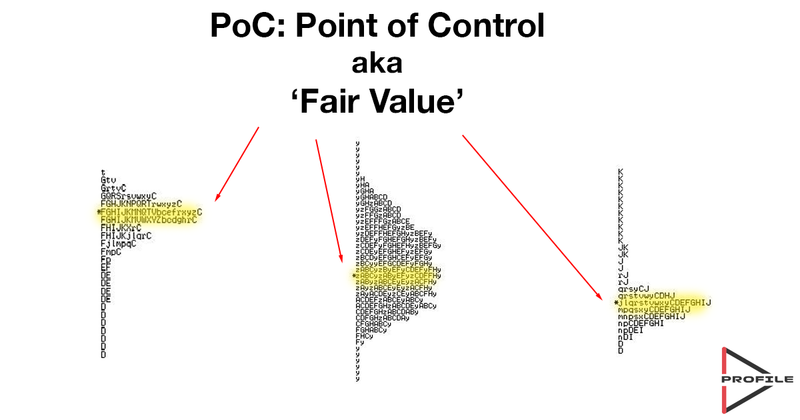

The Point of Control (POC) is a key concept in market profile analysis, which is used by traders to understand the price levels at which significant trading activity occurs. The POC represents the price level where the highest volume of trades occurred over a specific period. It is an essential part of volume profile analysis, which displays the distribution of trading volume across different price levels. Understanding the POC can provide traders with insights into market sentiment, potential support and resistance levels, and areas of value.

Identifying the POC

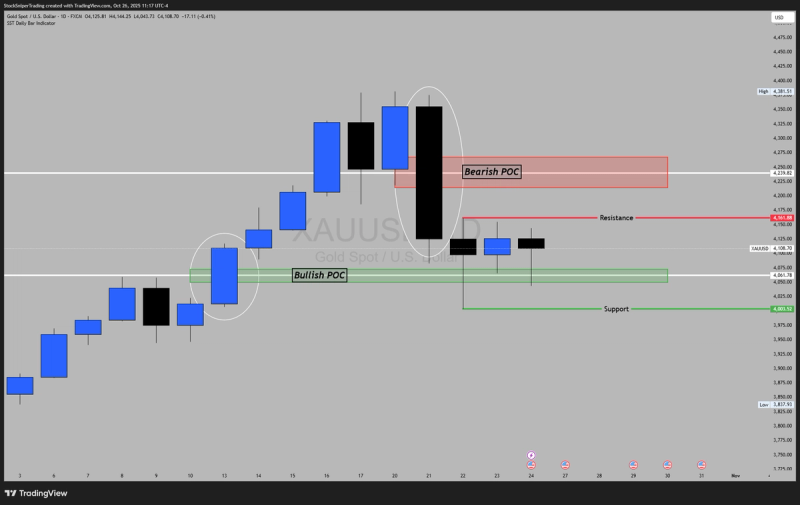

1. Volume Profile Indicator: To identify the POC, traders often use a volume profile indicator on their trading platforms. This indicator plots horizontal bars on the price chart, each representing the amount of trading volume that occurred at specific price levels during a given time period.

2. Highest Volume Node: The POC is the price level where the largest volume bar is located within the volume profile. This indicates that the most trading activity happened at this price, making it a focal point for traders.

3. Time Frames: Traders can observe the POC over various time frames, such as daily, weekly, or monthly charts, depending on their trading strategy and objectives.

Significance of the POC

- Support and Resistance: Since the POC represents a price level where market participants have shown significant interest, it often acts as a strong level of support or resistance. Prices may tend to bounce off or consolidate around the POC.

- Value Area: The POC is often surrounded by the "value area," which encompasses the price range where about 70% of the trading volume took place. This area indicates where price equilibrium exists.

- Market Sentiment: A POC that shifts upward suggests bullish sentiment, while a downward shift may indicate bearish sentiment. Monitoring changes in the POC helps traders understand evolving market dynamics.

Implications for Trading

1. Entry and Exit Points: Traders might consider entering positions near the POC, expecting price action to either consolidate or reverse. Similarly, exiting positions at the POC can be prudent if it's expected to act as a barrier to further price movement.

2. Risk Management: Using the POC as a reference, traders can set stop-loss orders just beyond this level, using it as a natural barrier based on historical trade concentration.

3. Price Action Confirmation: Combining POC analysis with price action strategies provides more robust trade confirmations, improving decision-making and timing.

Why Traders Should Learn More About POC Analysis

- Improved Market Understanding: Mastering POC analysis enhances a trader’s ability to interpret volume and price action, leading to better-informed decisions.

- Strategic Advantage: Understanding the dynamics around the POC and its implications can give traders an edge, especially in volatile markets where other indicators may lag.

Tips for Traders

1. Combine with Other Indicators: Use the POC alongside moving averages, RSI, or Fibonacci retracement levels to validate signals and reduce false entries.

2. Dynamic Adjustments: Regularly update your understanding of the POC as new data comes in, since market conditions and sentiment can shift quickly.

3. Backtesting and Practice: Before implementing POC strategies, backtest them on historical data and practice in demo accounts to gain confidence and refine your approach.

By integrating POC analysis into their trading toolkit, traders can enhance their interpretative skills related to volume and price movements, ultimately contributing to more strategic and potentially profitable trading decisions.

Join SST and take your trading to the next level! Stock Sniper Trading