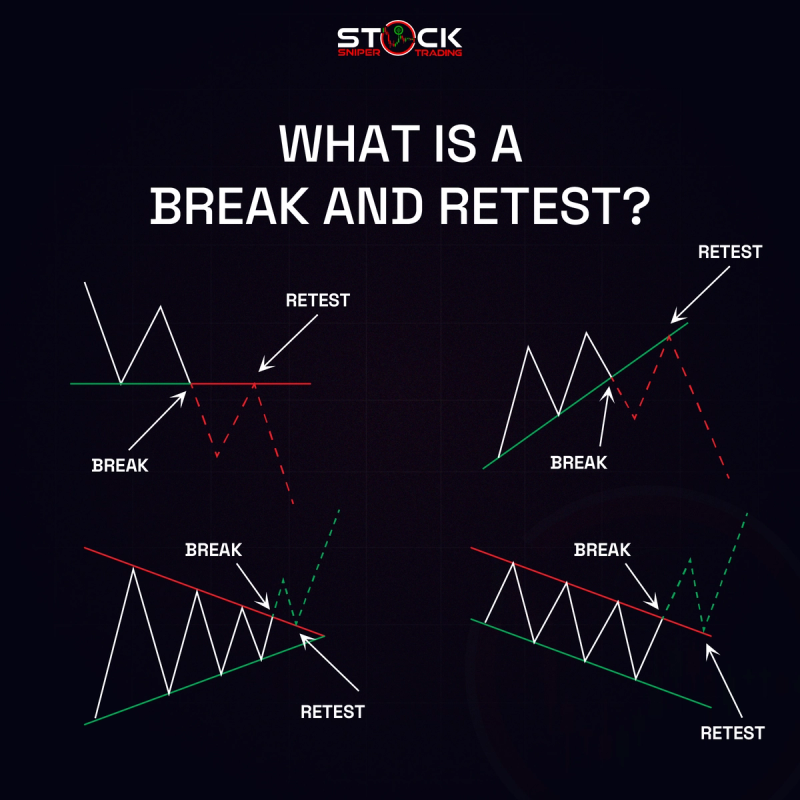

What is a Break and Retest?

In forex trading, a "break and retest" is a popular price action strategy that traders use to identify potential trading opportunities. Here's how it works:

Breakout: This occurs when the price moves beyond a significant support or resistance level. It "breaks" through a point where there was previously strong buying (support) or selling (resistance) pressure.

Retest: After the breakout, the price often pulls back to the broken level. For example, if the price breaks a resistance level, it may return to that level (now acting as support) for a retest. This pullback gives traders a second chance to enter the trade in the direction of the breakout.

Key Points

- - Confirmation: Traders typically look for confirmation during the retest. This can come in the form of price action patterns, candlestick formations, or other indicators that signal a potential reversal at that level.

- - Risk Management: It is essential for traders to have a risk management strategy in place. With break and retest strategies, traders often set stop-loss orders just below the retested level (for a long position) to minimize potential losses.

- - Higher Odds: The break and retest strategy can signal a higher probability of continuation in the direction of the breakout, as it provides a clearer entry point with potentially better risk-reward ratios.

Overall, the break and retest technique is a useful method for traders looking to capitalize on price movements around significant market levels.