Let's break down the Scalper Pro Trade Idea algo's two trades on USDJPY and discuss the importance of risk management, as well as the concept of demand and supply levels in trading.

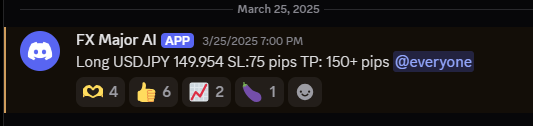

Scalper Pro Long on UJ:

1. Long USDJPY at 149.954

- - Position: Buy

- - Entry: 149.954

- - Stop Loss (SL): 75 pips below the entry, which places the stop at 149.179 (149.954 - 0.75).

- - Take Profit (TP): Targeting 150+ pips (the exact number is unclear, but it would aim for a level above 150.000).

Demand Level:

- - The entry for the long position was at a demand level, which indicates that the price had previously fallen to this point and showed signs of finding support. A demand level is a price zone where buying interest is strong enough to prevent further declines, often marked by previous price action or a technical level (like a key support level or a trendline).

- - In this case, 149.954 likely represented a level where the market was oversold or where buyers were likely to step in and push the price upward. This would explain the reasoning behind entering long at this price.

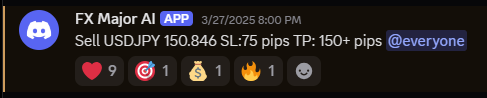

Scalper Pro Short on UJ:

2. Sell USDJPY at 150.846

- - Position: Sell

- - Entry: 150.846

- - Stop Loss (SL): 75 pips above the entry, which places the stop at 151.596 (150.846 + 0.75).

- - Take Profit (TP): Targeting 150+ pips below the entry, implying the TP could range from 149.900 to 149.500.

Supply Level:

- - The entry for the short position was at a supply level, which is a price zone where selling pressure is strong enough to prevent further price increases. A supply level is the opposite of a demand level: it represents a price area where the market has previously topped out, and sellers are likely to enter to drive the price lower.

- - At 150.846, the price was likely at a point of resistance or a level where the market had previously failed to push through. This is where the scalper identified an opportunity to sell, expecting the price to reverse and head back lower.

Risk Management:

- - Stop Loss and Take Profit:

- - Proper risk management is crucial for maintaining a favorable risk-to-reward ratio and avoiding large losses. In this case, the scalper used a 75-pip stop loss on both trades, which is relatively tight, indicating a focus on quick, small gains. This requires precision and a good understanding of the market's movement and timing.

- - The take profit (TP) levels were set to capture at least 150 pips or more, which means that the scalper is aiming for a 2:1 or higher risk-to-reward ratio. For every 1 pip risked (via SL), the scalper aims to make at least 2 pips in profit.

- - Position Sizing:

- - Using a stop loss of 75 pips in combination with a larger reward (150+ pips) highlights the importance of position sizing. The scalper can choose a position size that allows for proper risk management based on the account size. For instance, if they risk 1% of their capital per trade, they can adjust their position size accordingly.

- - In this strategy, the stop loss is set to limit losses, while the take profit is set to maximize profits from the anticipated price movement. Even though there’s risk in the market, the risk-to-reward ratio can work in favor of the trader if managed well over time.

The Importance of Risk Management:

Protecting Capital:

- - Without proper risk management, a trader can wipe out their capital with a few poor trades. The 75-pip stop loss is crucial in this regard. It limits potential losses if the market doesn’t move as expected.

Consistency:

- - Trading without proper risk management can lead to emotional decisions, such as holding onto losing positions too long or chasing trades. By setting stop losses and take profits at calculated levels, the scalper is more likely to stay disciplined and execute the strategy consistently.

Psychological Stability:

- - Knowing that there is a set plan in place (stop loss and take profit) helps the trader to avoid emotional reactions. It can be easier to stick to the plan when you're confident in your risk management strategy.

Risk-to-Reward Ratio:

- - The 2:1 risk-to-reward ratio is a key aspect of a successful trading strategy. It allows for profitability even if the trader wins only half of their trades. If they risk 1% per trade and make 2% on winning trades, they’ll be profitable in the long run, even with a 50% win rate.

Demand and Supply Levels:

- - Demand Level (Long): Identifying demand zones allows the trader to enter at levels where the price is expected to find support. This is especially important in scalping, where precise entries can maximize small price movements. In this case, the scalper identified the demand level at 149.954, expecting the market to reverse from this point.

- - Supply Level (Short): Similarly, the scalper identified a supply level at 150.846, expecting that the market would encounter selling pressure at this price. Selling at supply levels allows traders to capitalize on market reversals, as price often struggles to break through these levels.

By combining proper risk management with the understanding of demand and supply levels, the Scalper Pro algorithm is designed to execute trades with precision, potentially maximizing profit while minimizing risk. This methodical approach ensures that even though scalping involves small movements, the trader can capitalize on these movements consistently and safely.

Enjoy 50% off Premium 3 month and 1 Year Membership

Code: SST50

Click Here to Join