Trading during U.S. bank holidays or when the Wall Street markets are closed can be challenging due to several factors like volume, spreads, and price action, which can adversely impact trading performance. Here’s a detailed explanation of why trading during these times might not be ideal and tips for beginner traders:

Challenges of Trading During Holidays and Market Closures

1. Low Trading Volume:

- With banks and major financial institutions closed, the market experiences reduced activity, leading to lower liquidity.

- Example: On holidays such as Labor Day, Independence Day or Thanksgiving, many institutional traders are absent, resulting in fewer participants in the market. This can lead to erratic price movements that do not reflect the true value of assets.

2. Wider Spreads:

- Low volume often leads to increased bid-ask spreads, meaning the cost to enter and exit trades is higher.

- Example: A currency pair typically has a spread of 1 pip during normal hours but may widen to 3 pips during holidays, increasing transaction costs and making it harder to profit from small price movements.

3. Choppy Price Action:

- The lack of participation by large traders can lead to unpredictable and erratic price movements, often with no clear trend.

- Example: Without the usual volume to create and sustain trends, price may oscillate within a narrow range, making it difficult to apply technical analysis effectively.

4. Emotional Stress and Poor Decision-Making:

- Watching choppy, directionless markets can lead to frustration and impulsive decisions.

- Example: Traders might enter positions out of boredom or the false assumption that they see opportunities, only to face unexpected volatility spikes.

Benefits of Taking the Day Off

1. Review and Reflect:

- Use the time to review your trading journal and analyze past trades. Identify patterns in your successes and mistakes.

- Example: Look at trades where you followed your plan successfully versus those where deviating led to losses.

2. Strategize and Plan:

- Develop strategies or refine existing ones without the pressure of live trading.

- Example: Backtest different hypothesis or strategies to see how they would have performed.

3. Rest and Recharge:

- Mental breaks are crucial for maintaining discipline and preventing burnout.

- Example: Engage in activities unrelated to trading, such as exercise or hobbies, to return with a clear mind.

Best Practices for Beginners

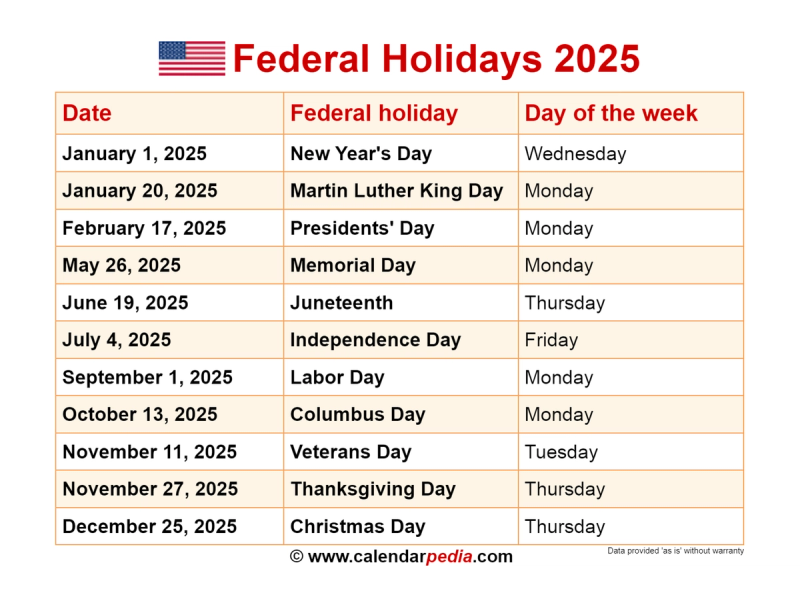

1. Know the Market Calendar:

- Keep track of public holidays and market closure days using an economic calendar.

- Example: Websites like Forex Factory or financial news sites provide calendars highlighting important dates.

2. Understand Market Hours:

- Know the opening and closing times of global markets (e.g., New York, London, Tokyo) to trade when liquidity is highest.

- Example: Focus on trading during overlapping sessions, such as the London-New York overlap, for better volume and tighter spreads.

3. Develop a Trading Routine:

- Establish a daily routine that includes pre-market analysis, actual trading, and post-market evaluation.

- Example: Start each day reviewing current news and potential market-moving events before executing any trades.

4. Practice Discipline:

- Avoid overtrading during suboptimal conditions and stick to your trading plan.

- Example: Use limit orders instead of market orders to avoid slippage.

5. Continuous Learning:

- Dedicate time to learning and improving trading skills through courses, books, or webinars.

- Example: Allocate portions of holidays to study technical analysis or risk management strategies.

By avoiding trading during U.S. bank holidays or market closures and focusing on self-improvement, beginner traders can develop better habits that contribute to long-term success.

Forex Factory | Forex markets for the smart money.

Join the Sniper Team and take your trading to the next level! Stock Sniper Trading