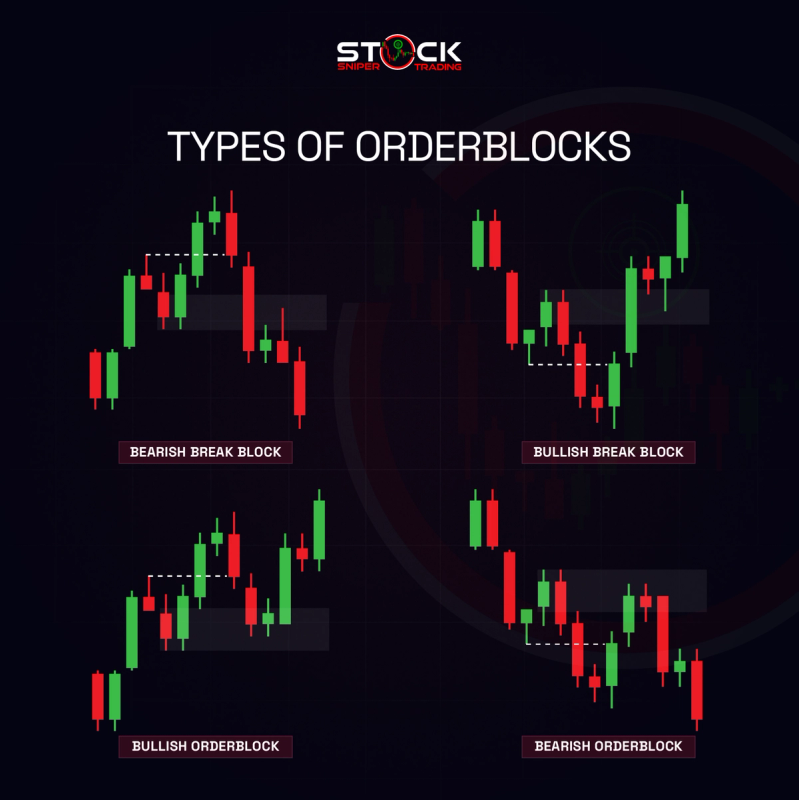

Types of Orderblocks

Explore the intricate world of orderblocks in trading with our detailed guide. Understand the key types: Bearish Break Block, Bullish Break Block, Bullish Orderblock, and Bearish Orderblock, to enhance your trading strategies and improve decision-making skills.

Bearish Break Block:

A pattern signifying potential downward market transitions, crucial for traders aiming to anticipate declines.

- - Patterns signaling market reversals are examined for clear identification.

- - Techniques are shared for capitalizing on bearish movements.

- - Insight into market momentum and its effect on break blocks.

Bullish Break Block:

Indicators of impending upward market reversals that suggest potential entry points for buying opportunities.

- - Identification of key indicators preceding bullish trends.

- - Strategies to distinguish bullish signals amidst market volatility.

- - Leveraging break blocks for favorable trade entries.

Bullish Orderblock:

Price areas showing strong buying interest, often indicating substantial upward price action.

- - Methods to pinpoint areas of increased buying power.

- - Timing tactics for initiating trades during formation.

- - The role of institutional buying in establishing orderblocks.

Bearish Orderblock:

Zones where selling pressure is intense, offering clues for potential short sell opportunities.

- - Techniques to recognize strong selling points in the market.

- - Balancing risk and reward in bearish trends using orderblocks.

- - Understanding how major sellers influence price dynamics.