Trading slumps are common in the life of a trader, regardless of their experience level. These periods are characterized by consecutive losses or underperformance, often leading to frustration, diminished confidence, and impulsive decision-making. Here’s a detailed description of how a trader might recognize such a slump and strategies to return to a rhythm of success.

Recognizing a Trading Slump:

1. Consecutive Losses:

A trader experiences multiple losing trades in a row, where each trade deviates from their typical strategy out of desperation to recover losses.

2. Emotional Decision-Making:

The trader starts making trades based on fear or greed instead of data or analysis, perhaps by holding onto losing positions too long in hopes of a turnaround.

3. Deviation from Strategy:

Abandoning a proven trading plan to try new, untested techniques due to impatience or pressure to perform.

4. Self-Doubt:

The trader questions their abilities and hesitates to execute trades, even when they align with their strategy.

5. Increased Stress and Anxiety:

Feeling overwhelmed by market volatility and unable to focus clearly on developing an effective trading plan.

Strategies to Overcome a Trading Slump:

1. Self-Reflection and Analysis:

Conduct a comprehensive review of recent trades to identify patterns or errors without placing blame. Use data analysis tools to understand what went wrong and why.

2. Revisiting the Trading Plan:

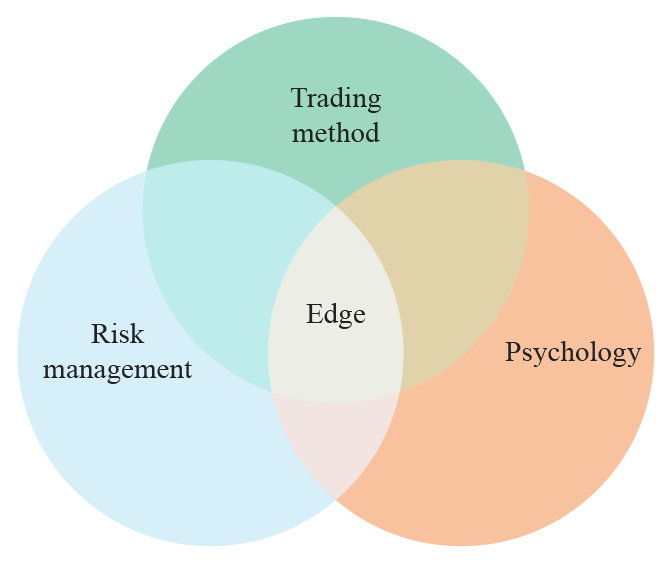

Ensure that the current trading strategy aligns with market conditions and personal risk tolerance. Adjust any parameters, like stop-loss levels, if necessary but within the framework of a tested plan.

3. Setting Realistic Goals:

Shift focus from trying to recover losses quickly to setting small, achievable goals, such as improving the win/loss ratio over a month.

4. Mindfulness and Emotional Control:

Practice mindfulness techniques, such as meditation or breathing exercises, to maintain emotional equilibrium during trading sessions.

5. Simulated Trading:

Use a demo account to practice trades without financial risk, allowing for rebuilding confidence and testing strategies in a stress-free environment.

6. Education and Skill Development:

Engage in webinars, read trading books, or take courses to refresh knowledge or learn about new market trends and techniques, with SST.

7. Seeking Professional Guidance:

Consult with a trading mentor or coach who can provide objective feedback and guidance.

8. Taking Breaks:

Stepping away from trading temporarily to clear the mind and prevent burnout, returning when ready to focus again.

9. Risk Management:

Reassess and reinforce risk management strategies to protect against further significant losses, like adhering strictly to stop-loss orders or adjusting position sizes.

By addressing both the psychological and practical aspects of trading, traders can regain their footing and establish a path back to consistent success.

Join the Sniper Team and take your trading to the next level! Stock Sniper Trading