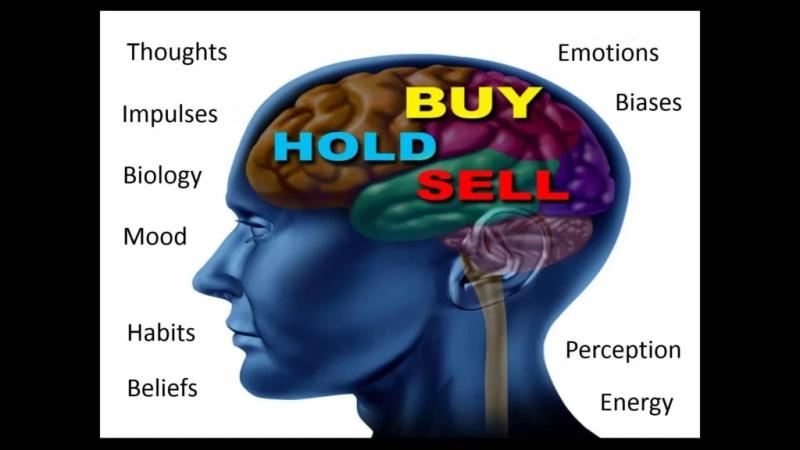

Achieving success in trading requires more than just technical skills and market knowledge; it demands a strong and resilient mindset. A trader's mindset encompasses their attitudes, beliefs, and emotional responses to market fluctuations. Understanding and cultivating a healthy trading mindset can significantly influence a trader's profitability and long-term success.

Understanding the Trader's Mindset

1. Emotional Discipline: Emotions like fear and greed can heavily influence trading decisions. A trader who lets fear dictate their actions may exit trades prematurely, while one influenced by greed might hold positions longer than advisable, hoping for unrealistic gains.

Example: A trader experiences a string of losses and starts to panic, closing positions early to avoid further losses. This reaction can lead to missing potential recoveries or profitable trades later on.

2. Patience and Timing: Successful traders know that patience is critical. They often must wait for the right setup to materialize rather than forcing trades based on impatience or the desire to be active in the market.

Example: A trader identifies a high-probability trade setup but rushes to enter because they feel the need to be 'in the market.' This often leads to entering trades that do not align with their strategy, resulting in losses.

3. Adaptability: Markets are constantly changing, and successful traders adapt to new conditions rather than cling rigidly to previous strategies that may no longer be effective.

Example: If a particular stock or market style becomes volatile, a trader who is inflexible might continue to apply previous strategies that are unsuitable, leading to more losses.

Overcoming Setbacks

1. Accept Losses as Part of the Game: Every trader faces setbacks, including losses. Understanding that losses are a natural part of trading helps to maintain psychological resilience.

- Strategy: Develop a risk management plan that allows for losses. For instance, only risk a small percentage of total capital on any given trade (e.g., 1-2%). This way, one can absorb losses without significant emotional or financial distress.

2. Reflect and Learn: Instead of succumbing to frustration, use setbacks as learning opportunities. Analyze past trades to identify what went wrong and create a plan to improve.

- Strategy: Keep a trading journal where you document every trade, including the reasoning behind the decision, market conditions, emotional responses, and outcomes. Review this regularly to identify patterns and areas for improvement.

3. Mindfulness and Stress Management: Trading can be stressful. Techniques such as mindfulness, meditation, or even physical exercise can help manage stress and improve mental clarity.

- Strategy: Set aside time daily for mindfulness exercises or meditation practices. Engage in physical activities that you enjoy to reduce stress levels.

Achieving Profitability

1. Clear Trading Plan: Developing a detailed trading plan that defines your trading strategy, entry and exit criteria, and risk management rules can help keep emotions in check.

- Example: A trader could establish a rule to enter a trade only when the market reaches a specific technical indicator, such as a moving average crossover. By adhering to this rule, the trader avoids emotional decisions.

2. Consistent Evaluation: Continually reviewing your performance, strategies, and market analysis helps identify what works and what doesn’t, enabling ongoing improvement.

- Strategy: Set a regular interval (weekly or monthly) to review your trading performance and refine your strategies based on observed outcomes compared to your trading plan.

3. Developing a Growth Mindset: Cultivating a mindset oriented towards growth can positively affect your approach to trading challenges. Believing in your ability to improve and learn will help you navigate the ups and downs of your trading journey.

- Example: View challenges as opportunities for growth rather than setbacks. For instance, if market conditions change, instead of feeling defeated, recognize the chance to learn new techniques or strategies that may become beneficial.

Conclusion

Mastering the trader's mindset is an ongoing process that involves self-awareness, emotional management, and continuous learning. By cultivating emotional discipline, patience, adaptability, and resilience, traders can overcome setbacks and work towards long-term profitability. A strong mindset not only helps guide trading decisions but also promotes a healthier, more balanced approach to the inevitable challenges of the trading world.

Join the Sniper Trading Team and take your trading to the next level Stock Sniper Trading