The Tokyo trading session is part of the Asian trading session and marks the start of the global forex market opening each day. It typically runs from 00:00 to 09:00 GMT, although trading activity might begin as early as 23:00 GMT, depending on when liquidity providers start offering prices. The session is characterized by lower volatility compared to the London and New York sessions, but it still offers opportunities for traders, especially those interested in Asian markets.

Characteristics of the Tokyo Trading Session

1. Lower Volatility:

- Generally, the Tokyo session sees lower volatility than the London or New York sessions. However, significant movements can occur based on regional news, economic releases, or geopolitical events.

2. Currency Pairs:

- Pairs that include the Japanese yen (JPY), such as USD/JPY, EUR/JPY, and AUD/JPY, are often more active. This is because local businesses and investors may engage in transactions involving their domestic currency.

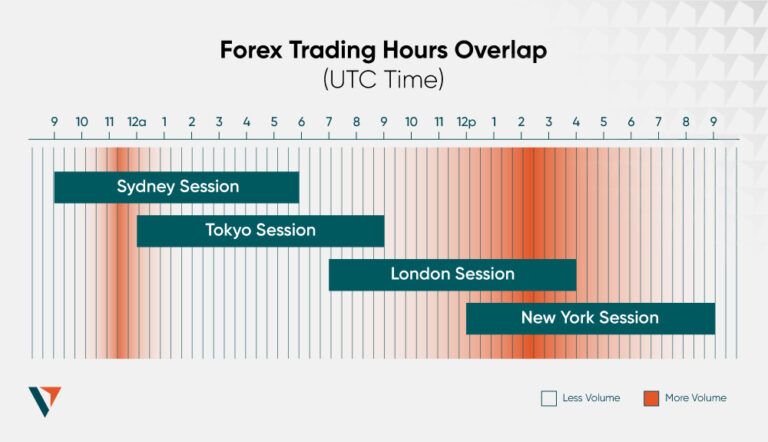

3. Market Overlaps:

- There is a slight overlap with the Sydney session, allowing for increased activity in currency pairs involving the Australian dollar (AUD) and New Zealand dollar (NZD).

Tips for Trading During the Tokyo Session

- Focus on JPY Pairs: Given the local influence, currency pairs like USD/JPY and EUR/JPY often see better movements during this time.

- Monitor Economic Data: Be aware of key economic data releases from Japan, Australia, and China, as these can influence market sentiment and cause price fluctuations.

- Consider Carry Trades: Low volatility might benefit carry trades, where traders profit from interest rate differentials between currencies.

- Use Technical Analysis: With less noise, technical patterns may hold stronger during this session, making it ideal for range-bound strategies.

Specific Securities to Trade

1. Currency Pairs: As mentioned, USD/JPY, AUD/JPY, and NZD/JPY tend to be popular choices.

2. Stock Indices: Nikkei 225 (Japan) and ASX 200 (Australia) offer equity index traders opportunities aligned with regional business activities.

3. Commodities: Traders might also look at commodities related to the region's economies, such as gold and oil, though less frequently during this session.

Trading Gold in the Tokyo Session

Analysis Overview:

- Volume and Liquidity: Gold trading volume tends to be lower during the Tokyo session. However, traders should watch for increased activity around major economic news from Japan and China, both significant consumers of gold.

- Price Movements: Price movements can be more subdued compared to later sessions. However, they can provide clues about market sentiment leading into the London session.

- Opening Days: Pay attention to how gold prices open on Monday mornings in the Tokyo session, which can set the tone for the week ahead, especially in reaction to weekend news.

Strategies:

- Range-Bound Strategy/Zone to Zone: Given the lower volatility, a range-bound strategy might be effective, where traders identify support and resistance levels and trade bounces within these ranges.

- News Trading: If expecting news from China or a significant event affecting Asian economies, be prepared for potential spikes in gold prices.

- Technical Indicators: Utilize moving averages and oscillators like RSI (Relative Strength Index) to identify potential entry and exit points during consolidation phases.

By understanding the dynamics of the Tokyo session, traders can better align their strategies to capitalize on the unique opportunities presented by this segment of the trading day.

Join the Sniper Trading Team and take your trading to the next level! Stock Sniper Trading