The risk-to-reward ratio is a fundamental concept in trading that measures the potential reward of a trade as compared to the potential risk of loss. It is a tool that traders use to determine whether a trade is worth taking or not. The risk-to-reward ratio is determined by dividing the potential reward by the potential risk.

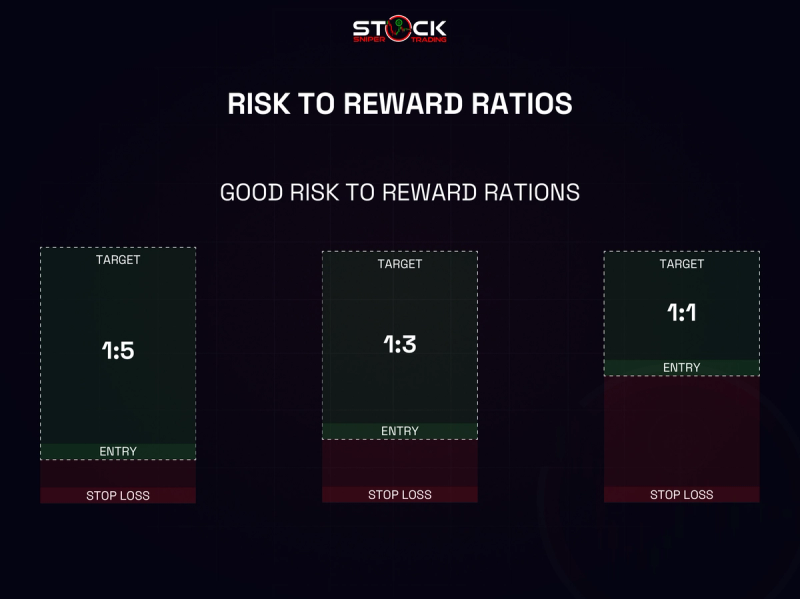

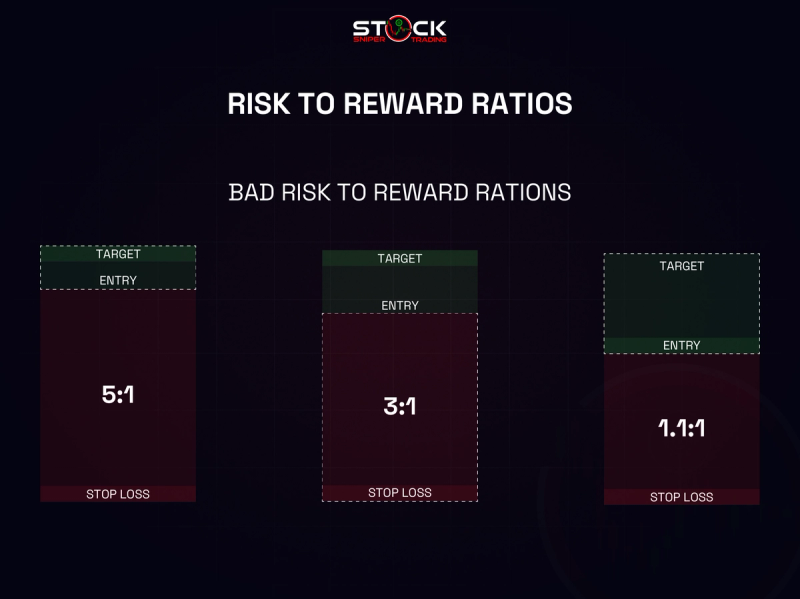

For example, if a trader has a potential reward of $300 and a potential risk of $100, the risk-to-reward ratio would be 3:1 ($300/$100). A ratio of 1:1 means that the potential profit equals the potential loss. A ratio greater than 1:1 indicates that the potential profit is greater than the potential loss, which is generally considered a favorable trade. A ratio less than 1:1 means that the potential loss is greater than the potential profit, and the trade may not be worth taking, unless the trader has a higher degree of confidence in the trade. Having a favorable risk-to-reward ratio is crucial for a trader's long-term success.

While a high reward potential is enticing, a trader must always be aware of the potential risk and have a plan to manage it with stop-loss orders and other risk management techniques. By analyzing trades based on the risk-to-reward ratio, traders can assess the potential profitability of a trade and avoid taking risks that do not align with their risk appetite.