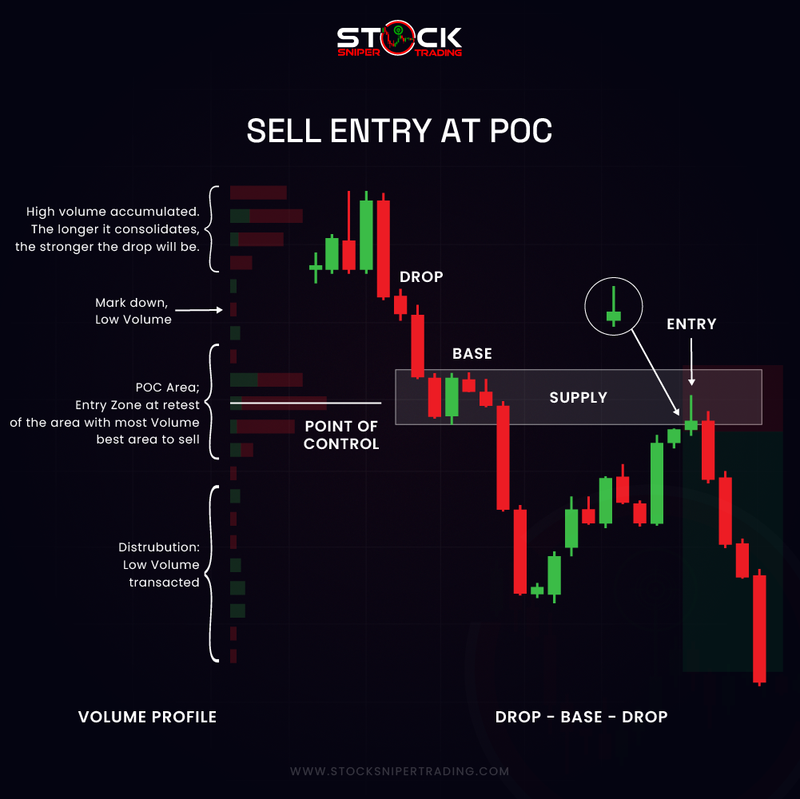

In trading, the Point of Control (POC) is a key concept derived from Volume Profile analysis. It represents the price level at which the highest amount of volume was traded during a specific time period. Here's a description of selling entry at a POC area using the Volume Indicator:

Selling Entry at a POC Area

Understanding the POC: The POC is used to identify areas of high trading interest and liquidity. It indicates the price level where buyers and sellers are most active, making it a strong area of support or resistance.

Volume Indicator Role: Volume indicators help traders understand the strength and conviction behind price movements. When combined with POC, they provide insights into potential price reversals or continuations.

Identifying the POC: In a trading chart with a Volume Profile overlay, the POC is typically marked with a visible line or highlighted area. Traders look for the POC to determine key levels that may influence future price action.

Setting a Selling Entry:

- - Resistance Identification: When the POC aligns with a strong resistance level, it may present a selling opportunity if the price approaches or retests this area.

- - Volume Confirmation: Before entering a sell trade, traders look for a spike in volume as the price nears the POC, which might signal an increased likelihood of a reversal or rejection from this level.

- - Candlestick Patterns: Traders may also look for bearish candlestick patterns like a bearish engulfing candle or a shooting star near the POC to confirm a potential sell entry.

- - Market Context: Analyse market trends and conditions to ensure alignment with a broader bearish sentiment before executing a sell order.

Risk Management: Implementing effective risk management strategies is crucial. Set stop-loss orders above the POC or resistance area to mitigate potential losses if the market moves contrary to expectations.

Monitoring and Adjustment: After entering a sell position, closely monitor the trade. Be prepared to adjust stop-losses and take-profit levels based on new volume information and price action dynamics.

In summary, using the POC in conjunction with the Volume Indicator can help traders make informed decisions about selling entry points by providing insights into market sentiment and potential turning points.