Risk Management

Risk management in forex trading refers to the techniques and strategies traders use to identify, assess, and mitigate potential losses in the dynamic currency market. This is crucial because of the inherent volatility that characterizes this market, where exchange rates can fluctuate due to various factors, including economic indicators, geopolitical events, and market sentiment. By employing effective risk management practices, traders can protect their capital, reduce potential losses, and ultimately enhance their chances of long-term success in forex trading.

The Importance of Risk Management

Understanding and implementing risk management is essential for any forex trader, whether they are a novice or an experienced professional. One of the main reasons for this is that trading without a clear risk management plan increases the likelihood of emotional decision-making, which can lead to significant financial losses. Additionally, the use of proper risk management techniques helps traders to maintain a balance between risk and reward. This balance enables them to pursue profitable trades while safeguarding against unforeseen market movements that could negatively impact their positions.

Different Styles of Risk Management

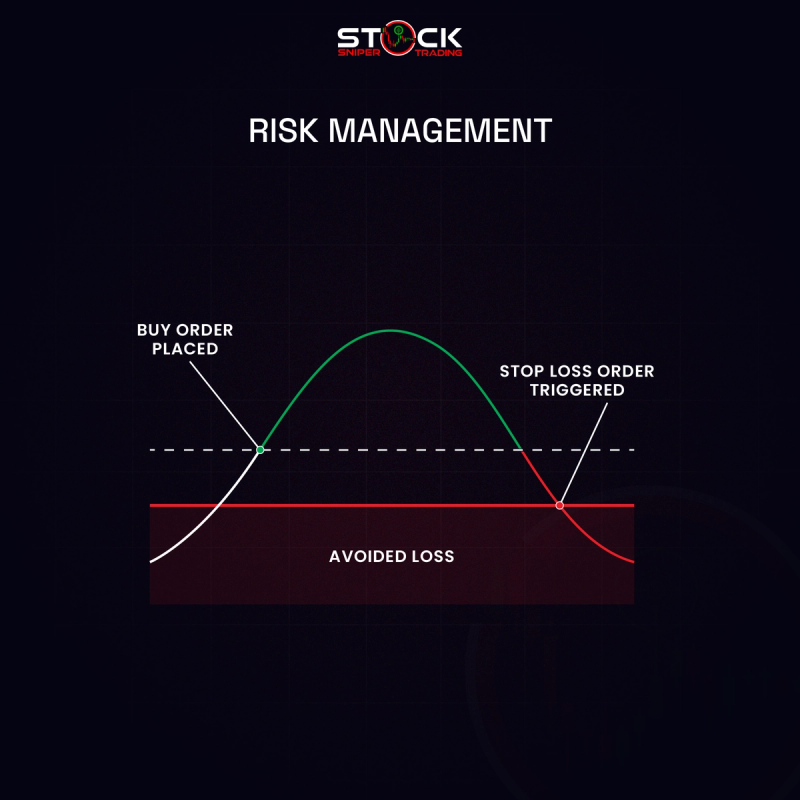

There are several styles of risk management that traders can adopt, each tailored to their individual trading strategies and risk tolerance. These styles often include setting stop-loss and take-profit orders, diversifying currency pairs in a portfolio, and employing position sizing techniques. Stop-loss orders allow traders to limit their potential losses by automatically closing a position when it reaches a predetermined level. Meanwhile, take-profit orders enable traders to secure gains by closing a position at a specified profit target. Diversification, on the other hand, reduces exposure to any single currency by spreading investments across multiple pairs, while position sizing involves calculating the appropriate amount to risk on each trade based on the trader's overall capital and risk appetite.

Implementing Effective Risk Management Strategies

To effectively implement risk management strategies in forex trading, traders should start by establishing a comprehensive trading plan that outlines their specific goals, risk tolerance, and preferred trading style. Additionally, they should regularly review and adjust their strategies based on market conditions and personal performance. Continuous education is also vital for traders to stay informed about the latest trends and risk management techniques within the forex market. By prioritizing risk management, traders can better navigate the complexities of forex trading, enabling them to focus on strategic decision-making rather than the emotional stress that could arise from potential losses.