Welcome to today’s trade breakdown, where we take you inside the logic, execution, and management of our latest NAS100 long position. This trade wasn’t just about catching a move — it was about patience, precision, and applying disciplined risk management in real time. Whether you're a beginner looking to learn or a seasoned trader refining your edge, this recap offers a clear look at how to approach volatile sessions like the NYSE open with structure and confidence.

Full Trade Breakdown – NAS100 Long (May 23, 2025)

Entry: 20,757.3

Stop Loss: 75 pips

Take Profit: 150+ pips

Result: Full TP hit

Risk-to-Reward: 1:2+

Pre-Trade Plan & Setup:

We came into the NY session with a clear plan:

- - Wait for NYSE volatility to clear out weak positions

- - Look for price to react off a key demand zone

- - Let structure confirm the reversal before entering

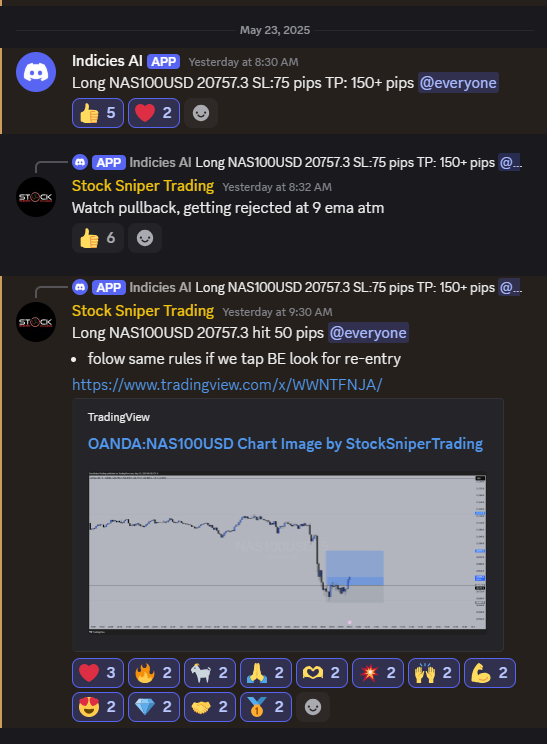

At around 8:30–9:00 AM EST, NAS100 flushed lower into the 20,750 region — a well-marked level of previous interest. This move aligned with our expectations: a liquidity grab into support during the NYSE open, often followed by a reversal.

Rather than jumping in early, we waited for confirmation:

- - Price wicked below structure but closed back above

- - A bullish engulfing formed at the low

- - We saw a break of micro structure to the upside, signaling buyers stepping in

That’s when we pulled the trigger.

Why It Was a Proper Risk-Managed Trade:

Defined Stop Loss:

We placed a tight 75 pip SL just under the demand zone low. It wasn’t random — it was based on structure, ensuring we were protected if the setup failed while allowing enough breathing room for volatility.

Calculated Position Size:

We sized the trade based on the 75 pip SL, meaning we risked only 1–2% of our capital depending on the account. This kept emotions out of the trade, knowing the downside was capped.

High R:R Ratio (1:2+):

The target was 150+ pips, giving us a clean 2x reward. Even if we hit on just 50% of trades like this, we come out ahead over time — this is the foundation of profitable trading.

Trade Management – Breakeven Is Your Best Friend:

Once price moved +50 pips in profit, we emphasized the importance of moving SL to breakeven (B/E). Why?

- - At +50 pips, the market had proven the trade idea was valid

- - Protecting capital is rule #1 — if price reversed, we’d exit flat, not in loss

- - It allows you to let trades run stress-free toward TP

This move to B/E de-risks the trade, turning it into a “free option” — where downside is 0, and upside is fully open.

End Result:

Price continued climbing with higher lows, hitting full TP shortly after — clean, controlled, and by the book.

Key Takeaways for Snipers:

- - Wait for the setup — NYSE fakeouts are common

- - Let structure guide your entry, not emotion

- - Always trade with a defined SL and calculated size

- - Move SL to B/E when the market gives you reason — protect first, profit second

- - R:R is everything — without it, even good trades bleed capital over time

This NAS100 trade wasn’t luck — it was the result of a well-defined plan, sharp execution, and rock-solid risk management. By waiting for the NYSE pullback, confirming structure, and moving our stop to breakeven once we were up 50 pips, we locked in control and let the market do the rest. These are the habits that separate emotional trading from professional setups. Stick to the process, and the profits will follow.