Market Maker Models

Market Maker Models are strategies used by financial institutions and individuals to provide liquidity, ensuring markets operate smoothly. They involve quoting buy and sell prices for financial instruments and making profit from the bid-ask spread. Understanding these models helps traders anticipate price movements and enhance their trading strategies.

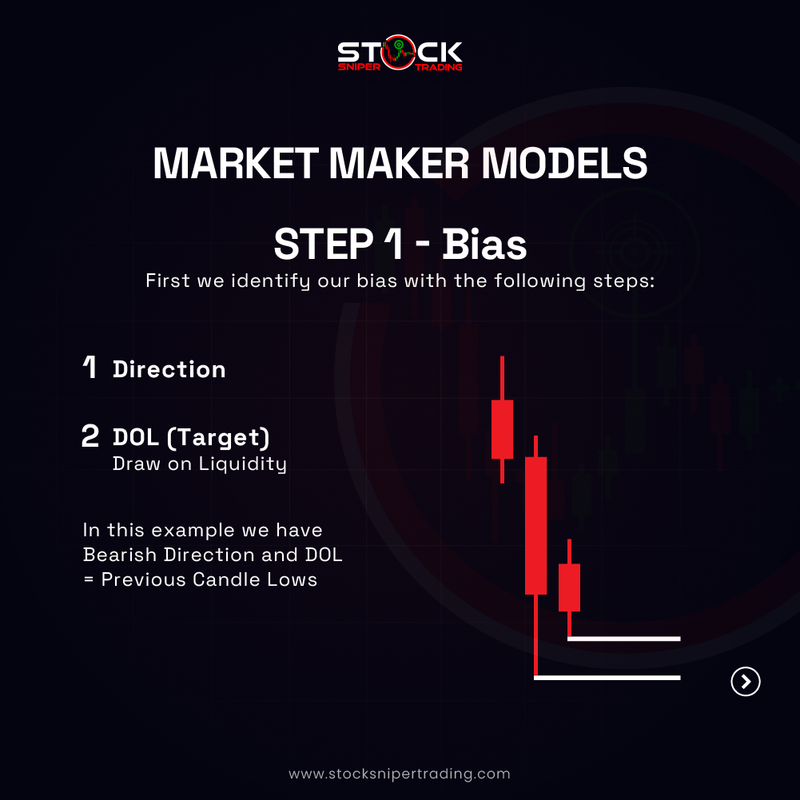

Step 1: Bias

The first step is to determine the market bias and establish a target for where liquidity might be drawn. This involves analyzing the overall market conditions to decide if the trend is bearish or bullish.

- - Direction: Analyze market indicators and patterns to define the overall direction, which might be influenced by macroeconomic factors, recent news, or technical indicators. In this example, the bias is bearish, suggesting that prices are expected to fall.

- - Draw On Liquidity (DOL): Identify key liquidity points that the market may move toward. For a bearish scenario, this might be the lows of previous candles where stop-loss orders or pending orders are likely placed, such as the previous candle’s lows.

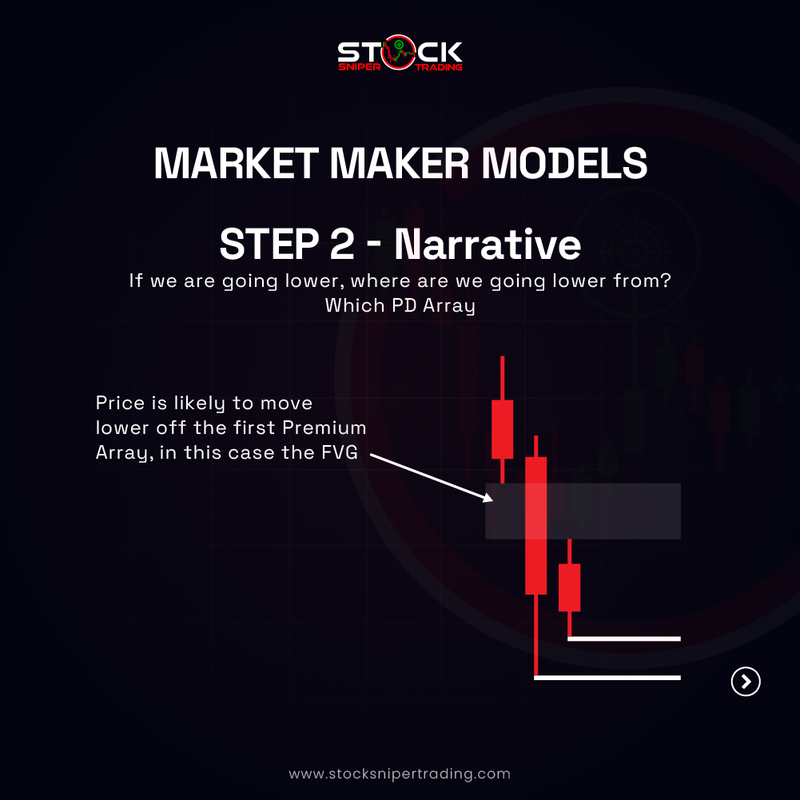

Step 2: Narrative

Narrative sets the stage for where and why prices might move in the determined direction.

- - Where are We Going Lower From?: This involves identifying the point of reversal or the origin of the trend change. If the market is bearish, determine where the downward move starts, which is typically from a price zone where selling pressure is anticipated.

- - PD Array: PD, or Premium Discount Array, refers to where the price is either more favorable for buyers (discount) or sellers (premium). In a bearish context, the price may move lower from the first Premium Array, such as the Fair Value Gap (FVG), which represents an area of previous inefficiency that the market might fill.

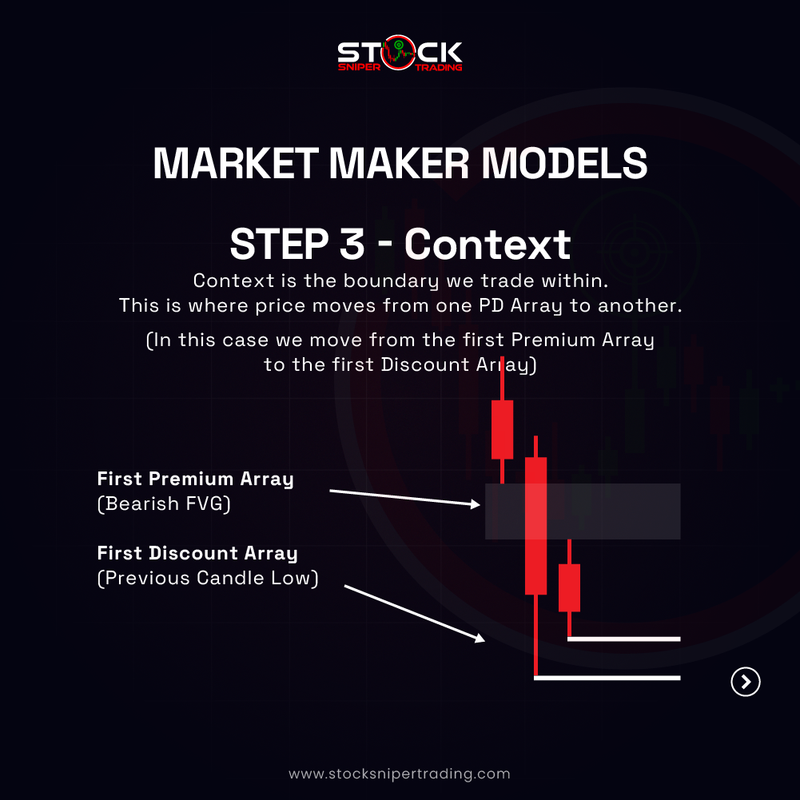

Step 3: Context

Context defines the trading environment, framed by transitions between Premium and Discount Arrays.

- - Trading Boundaries: This is where you define the zones within which trading will occur. Price transitions from one zone to another provide clues for future movements.

- - First Premium Array to First Discount Array: In this scenario, the market moves from the first bearish Premium Array, identified as a Fair Value Gap (FVG), to the first Discount Array, such as the previous candle low. Traders monitor these transitions to predict significant price changes.

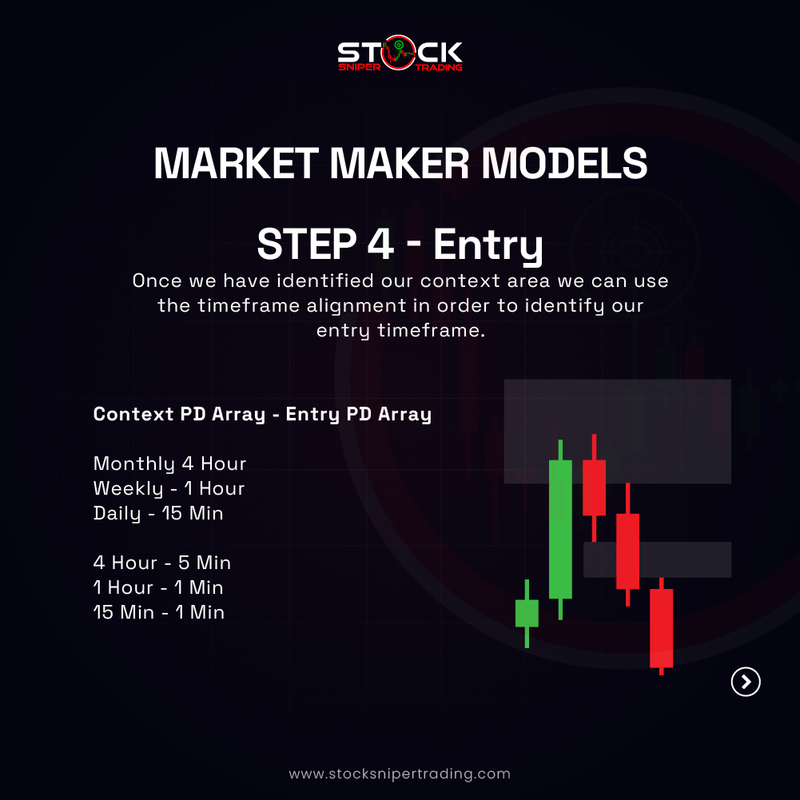

Step 4: Entry

Aligning entries within the identified context ensures precision in execution.

- - Timeframe Alignment: Use multiple timeframe analyses to refine entry points. By aligning larger and smaller timeframes, traders can capture more precise movements. For instance:

- - Monthly to 4 Hour provides insights into broader trends and optimal entry points.

- - 4 Hour to 5 Min helps fine-tune entries within identified zones.

- - Context PD Array - Entry PD Array: Ensure that the entry timeframe aligns with the context’s PD Arrays to maximize the strategic advantage.

Step 5: Risk Management

Managing risk effectively is key to ensuring long-term profitability and reducing potential losses.

- - FLOD and LLOD: Utilize First Line of Defense (FLOD) and Last Line of Defense (LLOD) to manage risk. This involves strategically placing stop-loss orders that shift to breakeven or beyond once the trade progresses in favor, minimizing unforeseen losses.

- - Adjusting Stop-Loss: As the trade develops and price action confirms the desired direction, move the stop-loss to breakeven to secure initial capital and protect gains.