Candlestick patterns are a cornerstone of technical analysis, offering intricate insights into market sentiment through chart representations. Each candlestick reflects a specific time-fraction in which it shows four critical prices: open, high, low, and close. This visualization helps traders understand whether the market is in a bullish or bearish phase during the covered timeframe.

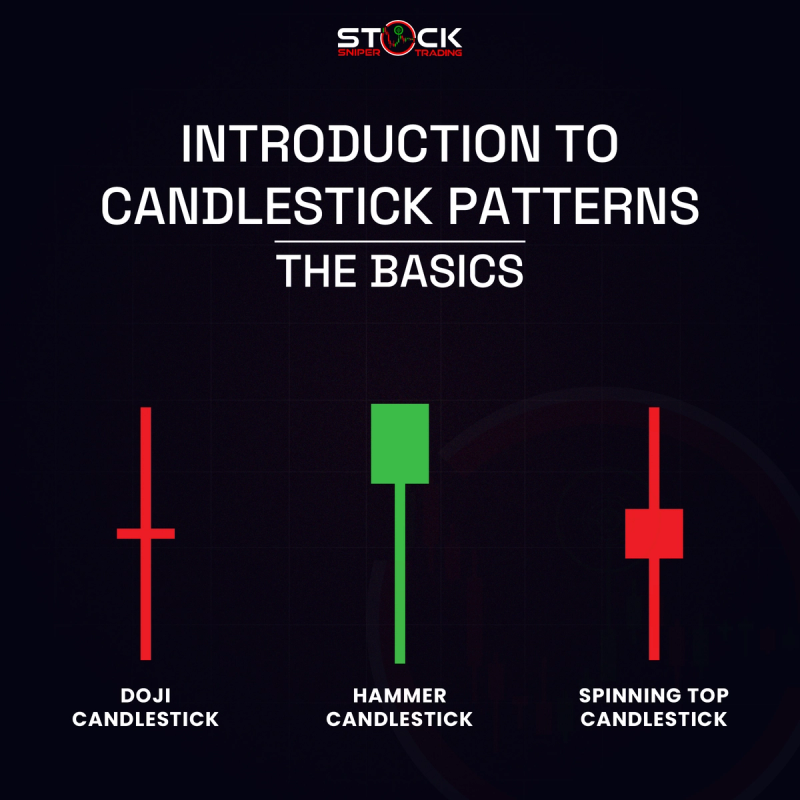

Basic candlestick types include:

- - Doji: Characterized by nearly equal open and closing prices, indicating indecision in the market. These are significant during trend reversals.

- - Hammer: A candle with a small body and long lower wick, suggesting potential trend reversals from bearish to bullish, typically found at the bottom of downtrends.

- - Spinning Top: Shows a small body with upper and lower shadows, indicating indecision with potential trend reversals.

By recognizing these patterns, traders can predict potential market shifts. For instance, a doji that appears after a strong bullish trend might suggest a bearish reversal, prompting traders to prepare for short positions. Understanding such basic patterns complements other analytical tools, helping traders make more informed decisions.

Enhancing your candlestick charting skills involves not just identifying basic patterns, but also understanding their implications within their specific market context. Some traders use candlestick patterns in conjunction with momentum indicators, like stochastic or RSI, to strengthen their predictions. For example, identifying an engulfing pattern confirmed by an RSI that signals overbought or oversold conditions can reinforce a trading decision. This integration can make candlestick analysis not just a standalone tool but a critical component of a comprehensive trading strategy.

- - Doji Pattern: Signals market indecision

- - Hammer Pattern: Indicates potential bullish reversal

- - Spinning Top: Highlights indecision and possible reversals