Understanding Intraday Demand Activity

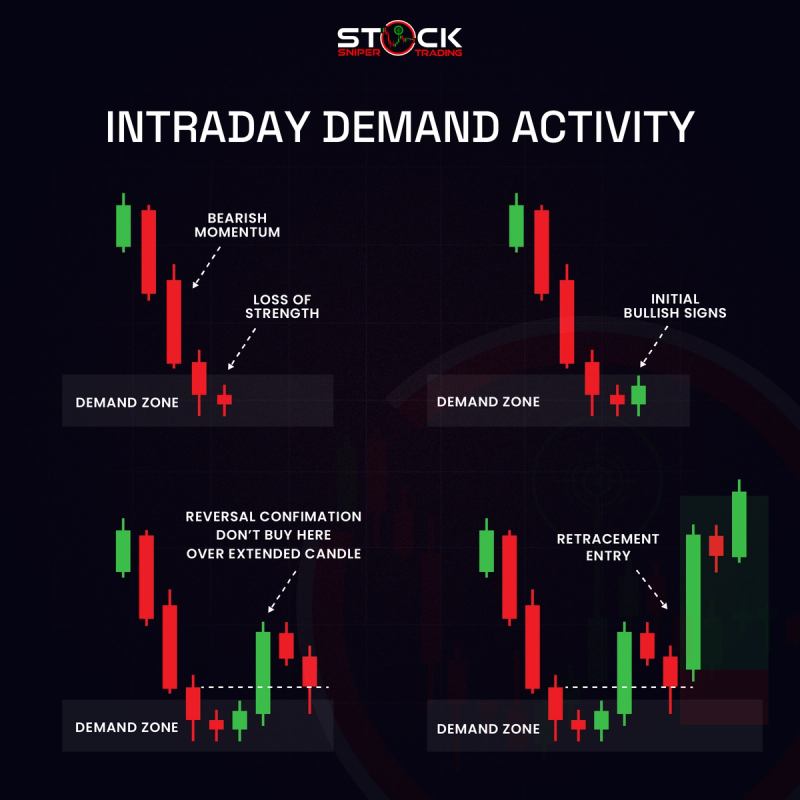

Intraday demand activity plays a crucial role in the decision-making process for traders aiming to capitalize on short-term market movements. The concept revolves around identifying demand zones—areas where buying interest potentially outweighs selling pressure. These zones often provide insights into possible reversals, helping traders make informed entry and exit decisions. Let's dive deeper into how traders can interpret intraday demand activity through four distinct phases.

Phase 1: Identifying the Demand Zone and Assessing Bearish Momentum

Initially, the market may exhibit a strong bearish momentum as prices descend towards the demand zone. This area signals a potential base where price may stabilize or reverse due to increased buying interest. During this phase, traders are on the lookout for signs of waning selling pressure, which suggest that the overwhelming bearish sentiment is beginning to dissipate. Recognizing this shift is crucial for predicting possible turning points in the market.

Phase 2: Spotting Initial Bullish Signs

As the market continues to trade within the demand zone, traders begin to observe initial signs of bullish activity. These may include smaller bullish candles, increased volume, or other technical indicators suggesting buying strength is emerging. The presence of these early bullish signals highlights a potential change in market sentiment, where buyers are starting to challenge the previously dominant selling pressure.

Phase 3: Bullish Breakout as a Reversal Confirmation

Combining insights from the earlier phases, the market may witness a breakout characterized by a strong bullish candle emerging from the demand zone. This breakout serves as a confirmation of a reversal, indicating a shift from a bearish to a bullish trend. However, the breakout candle is often overextended, suggesting the movement might be too strong to immediately enter a trade. Traders exercise caution at this stage, knowing that entering on such an overextended move may carry risks.

Phase 4: Strategizing Entry on Retracement

Understanding the importance of not chasing price, seasoned traders wait for the market to retrace back to the demand zone. This retracement provides a second chance to enter the market with improved risk-to-reward ratios. With a bullish candle confirming the entry, traders position themselves to ride the upward movement, targeting previous highs as potential profit zones.

Conclusion

Intraday demand activity analysis is a critical skill for traders aiming to harness short-term trading opportunities. By thoroughly understanding and implementing these phases, traders can enhance their ability to predict potential reversals, make timely entries, and optimize their trading strategy within the dynamic environment of intraday markets. Through disciplined observation and strategic planning, traders can effectively navigate price fluctuations and capitalize on market trends.