XAUUSD – Gold Trade Recap

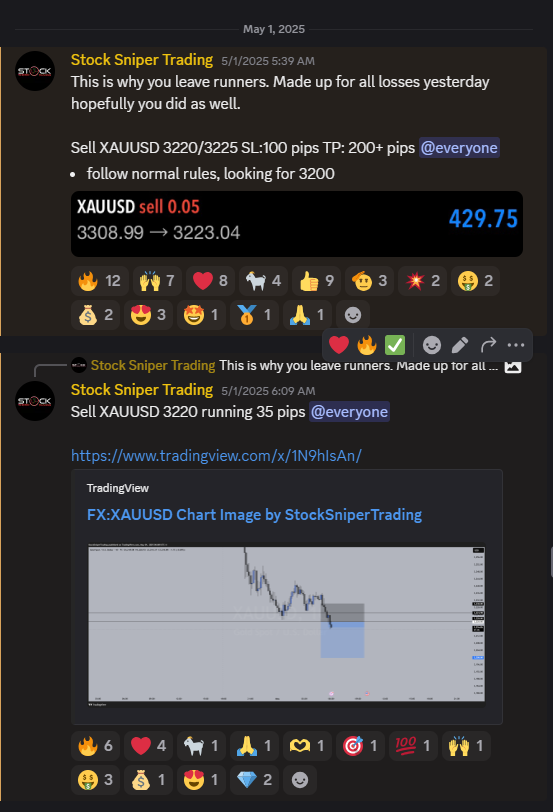

This week, we sent a clean short idea on Gold to our Discord group. The plan was simple: watch the 3220–3225 resistance zone and execute short positions if price respected structure.

Price dropped 35 pips from 3220, pulled back, then triggered our 3225 add-on entry before continuing lower for a full take profit — delivering +200 pips from the second entry and +150 pips from the first.

Join the Team

Trade Idea

Sell XAUUSD 3220 / 3225

Stop Loss: 100 pips

Take Profit: 200+ pips

Breakdown

Price approached the 3220–3225 resistance zone after a series of lower highs on the higher timeframes. Our first entry at 3220 caught the initial reaction, but we planned for a deeper pullback — and that’s exactly what we got.

Price pulled back and tagged 3225 before respecting the level and aggressively reversing. The 3225 add-on offered an even cleaner entry with tighter confirmation on the lower timeframes.

Break and Retest Logic

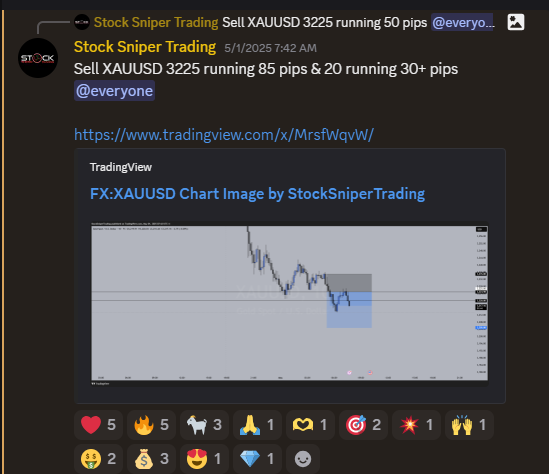

This trade was based on a textbook break-and-retest setup. The market broke structure to the downside from the 3220 zone, creating the initial leg down.

The pullback to 3225 was not random — it was a retest of broken support turned resistance, lining up perfectly with prior structure.

These setups work because they allow us to trade with confirmation, not speculation. We aren’t guessing tops — we’re waiting for price to commit, then looking to enter when the market retests a key level and shows rejection.

The cleaner the structure, the cleaner the trade — and this one was precise.

Higher Timeframe Bias

Before we ever dropped to the execution timeframes, we identified the 3220–3225 zone on the 4H and Daily charts. Both timeframes showed clear bearish rejection candles from prior swing highs and supply zones.

We had a defined trend: lower highs and lower lows were intact. That’s what gave us confidence that this short setup was valid.

Lower timeframe trades without higher timeframe confluence are noise. But when everything lines up — direction, structure, timing — the probability of success increases dramatically.

This is why top-down analysis is non-negotiable in our process.

Trade Management

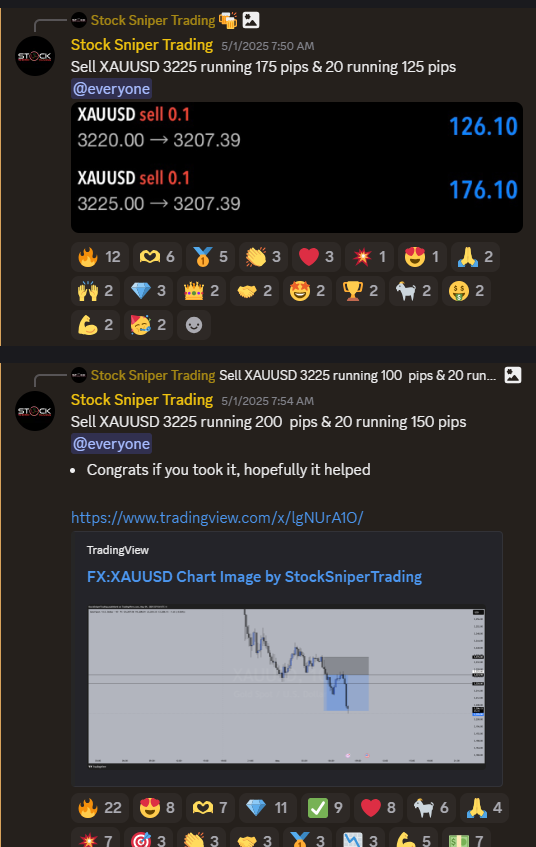

We didn’t panic when price pulled back after the 3220 entry — that was part of the plan. The 3225 add-on was not emotional; it was strategic, structured, and part of our trading framework.

Once price rejected the level and formed lower highs on the intraday chart, we let the trade play out to our target.

It’s this kind of patience that separates rushed trades from high-quality ones.

Risk Management

Risk management is everything. Both entries were placed with a shared 100 pip stop, which was pre-determined and never moved.

We calculated lot sizes to stay within our 1–2% risk range, and we made sure that even with the add-on, our total risk exposure did not exceed our plan.

There was no overleveraging. No revenge trading. No emotional scaling.

When trades are built around structure and protected by discipline, it’s easier to hold them through fluctuations and let them hit their targets.

This is how professional traders approach risk — with control and consistency.

Result

- - 3220 entry: +150 pips

- - 3225 entry: +200 pips

- - Both trades hit full TP with clean structure from entry to exit

Conclusion

This Gold short is a perfect example of how structure, patience, and discipline combine to create a high-quality trade.

By using higher timeframe bias, waiting for a proper break and retest, and managing risk with precision, we were able to let the trade develop naturally and secure a strong result.

Let this serve as a reminder: the best trades are built, not chased.

Trade with purpose. Trade with structure.

– Stock Sniper Trading