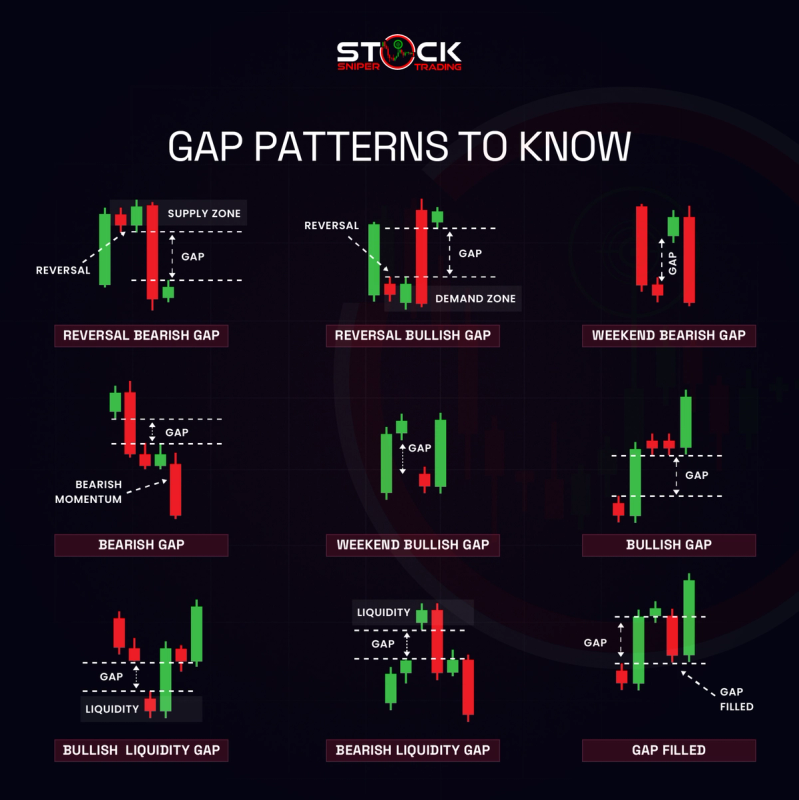

Gap patterns are key technical analysis phenomena in financial markets, where a security's price leaps between two trading periods, leaving a price gap. Understanding these patterns can provide traders with insights into market sentiment, potential reversals, and liquidity zones.

Reversal Bearish Gap

A reversal bearish gap occurs when a stock opens below the previous day's close, signaling a potential trend reversal from bullish to bearish. This pattern is often followed by further downward movement, indicating a change in investor sentiment.

Reversal Bullish Gap

In contrast, a reversal bullish gap happens when a stock opens above the previous day's close, suggesting a potential shift from a bearish to a bullish trend. This gap is typically accompanied by increased buying interest, reflecting optimism in the market.

Weekend Bearish Gap

Weekend bearish gaps arise between Friday's close and Monday's open, often influenced by news or events occurring over the weekend. These gaps can indicate a negative outlook as markets react to unforeseen developments during the break.

Bearish Gap

A bearish gap is a general term for when a stock opens lower than the prior day's close, signaling selling pressure. This pattern can suggest a continuation of a downward trend or a reaction to negative news.

Weekend Bullish Gap

Weekend bullish gaps occur from Friday’s close to Monday’s open, driven by positive news or sentiment over the weekend. This pattern reflects a stronger market outlook as traders react to events that occurred during the closed market.

Bullish Gap

A bullish gap describes a situation where a stock opens higher than the previous day's close, often due to optimistic news or expectations. This gap can indicate strong upward momentum and increasing investor confidence.

Bullish Liquidity Gap

A bullish liquidity gap represents an area where price rapidly moves upward due to a lack of sufficient sell orders, often triggered by positive news or buying interest. This pattern leaves a gap in the price chart, manifesting a sudden influx of demand.

Bearish Liquidity Gap

Conversely, a bearish liquidity gap occurs when there is a sudden drop in price during a sell-off, creating a gap caused by the absence of buy orders. This pattern is typically seen in panic-sell situations or negative news releases.

Gap Filled

The "gap filled" phenomenon occurs when the market returns to the pre-gap price level. Gaps are often seen as likely to be filled because they can represent inefficiencies or short-term reactions in the market, and filling the gap can indicate stabilization or consolidation.

These gap patterns are crucial for traders in identifying potential entry and exit points, understanding market psychology, and strategizing based on predicted price movements.