What are Fair Value Gaps (FVGs)?

Fair Value Gaps are areas on a price chart where there has been a significant and rapid price movement, resulting in a "gap" between two candles or bars. These gaps typically appear when the market moves quickly due to strong buying or selling pressure, leaving a void where little or no trading occurred.

In essence:

- FVGs are price ranges where the market "skipped" over, leaving a gap in the chart.

- They represent an imbalance between supply and demand.

- They often indicate areas where the market might revisit later for price correction or “gap-filling.”

How to Identify Fair Value Gaps

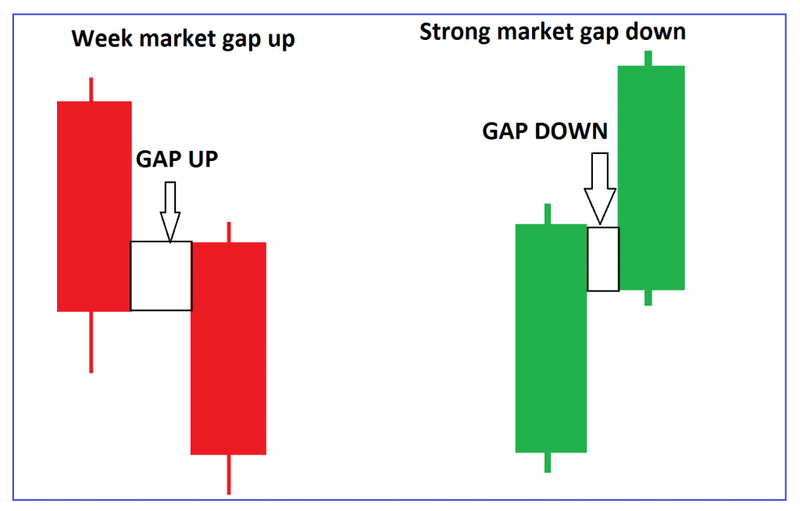

1. Recognize the gap pattern:

- On candlestick charts, a gap appears when the low of one candle is above the high of the previous candle in an uptrend, or the high of one candle is below the low of the previous in a downtrend.

Why are Fair Value Gaps Important?

1. Indicate Market Imbalance:

- FVGs reveal areas where buying or selling was so strong that the market moved swiftly, leaving a void. This suggests a temporary imbalance.

2. Potential Reversal or Continuation:

- Gaps often get filled — the price may retrace back into the gap area before continuing its trend.

- Trade opportunities:

- Traders often watch these gaps for potential entries, either for trades aiming to fill the gap or for confirming trend continuation.

3. Support and Resistance:

- Gaps can act as support (in an uptrend) or resistance (in a downtrend). When prices revisit these gaps, they might bounce or reverse.

4. Confirmation of Trend Strength:

- Large gaps in direction (e.g., a strong upward gap) may signify bullish strength, while downward gaps can indicate bearish momentum.

Practical Application & Strategy

- Gap-filling trades: Wait for the price to return to the gap area before taking a position.

- Monitoring breakouts: Gaps can act as zones to watch for trend continuation or reversal.

- Combine with other indicators: Use volume, candlestick patterns, or moving averages to confirm signals around gaps.

Summary

Fair Value Gaps (FVGs) in trading are areas on a price chart where there has been a rapid, impulsive move, creating a gap or void between two price levels. These gaps occur because the price moves so quickly that some price levels are skipped over, leaving little or no trading activity in that range.

In simple terms:

- FVGs are unfilled spaces in the chart where the price "skips" over certain levels during fast movements.

- They reflect an imbalance between supply and demand at that moment.

- Traders see these gaps as potential areas where the market might return to "fill" before continuing its trend.

Why are Fair Value Gaps important?

- They often act as support or resistance levels.

- They indicate strong buying or selling momentum.

- The price tends to revisit these gaps, making them useful for predicting entries or exits.

In short:

Fair Value Gaps are gaps in the chart caused by fast price moves, and they can serve as important zones for future price reactions or reversals.