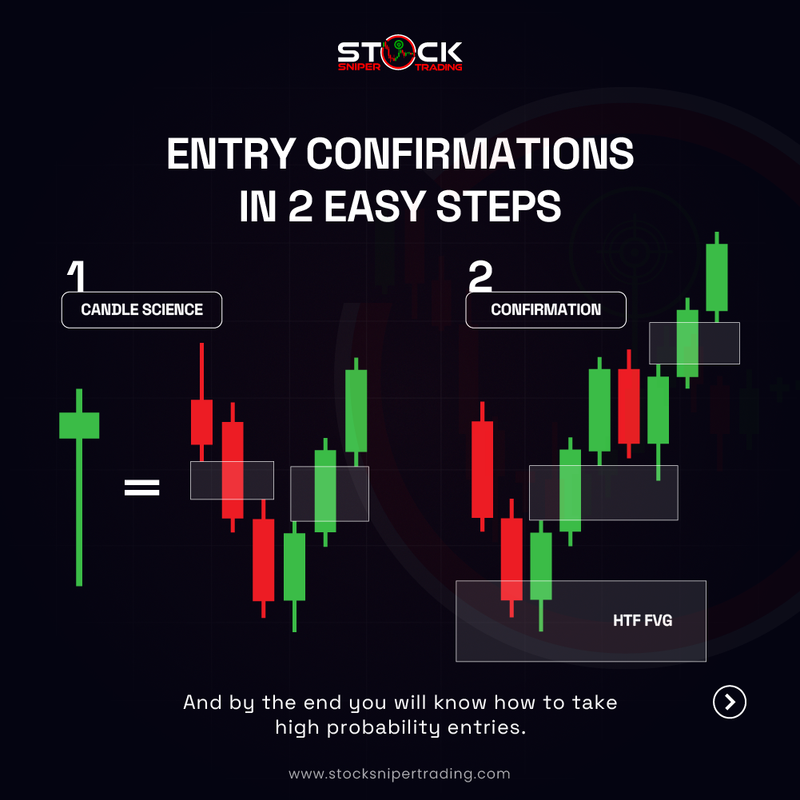

Step 1: Candle Science and Higher Timeframe Confluence

Candle science is crucial for analyzing price movements in financial markets. When evaluating price action, higher timeframes are often more reliable due to their ability to display broader market trends and significant price levels. This helps traders identify strong confluences, which are multiple factors indicating the same trading decision. By acknowledging these on higher timeframes, traders enhance their probability of successful trades because these timeframes capture more comprehensive market dynamics.

Step 2: Looking for Confirmations

Once a potential trading opportunity is identified on a higher timeframe, the next step is to seek confirmations on lower timeframes. These confirmations might include specific candle patterns, trend line breaks, or moving averages, which reinforce the initial analysis. This multi-timeframe approach aims to increase the accuracy of trade entries by using smaller timeframes to fine-tune and verify setups identified on larger scales.

In brief: Use higher timeframe candle analysis for market trend and lower timeframe for precise trade confirmations to improve accuracy.

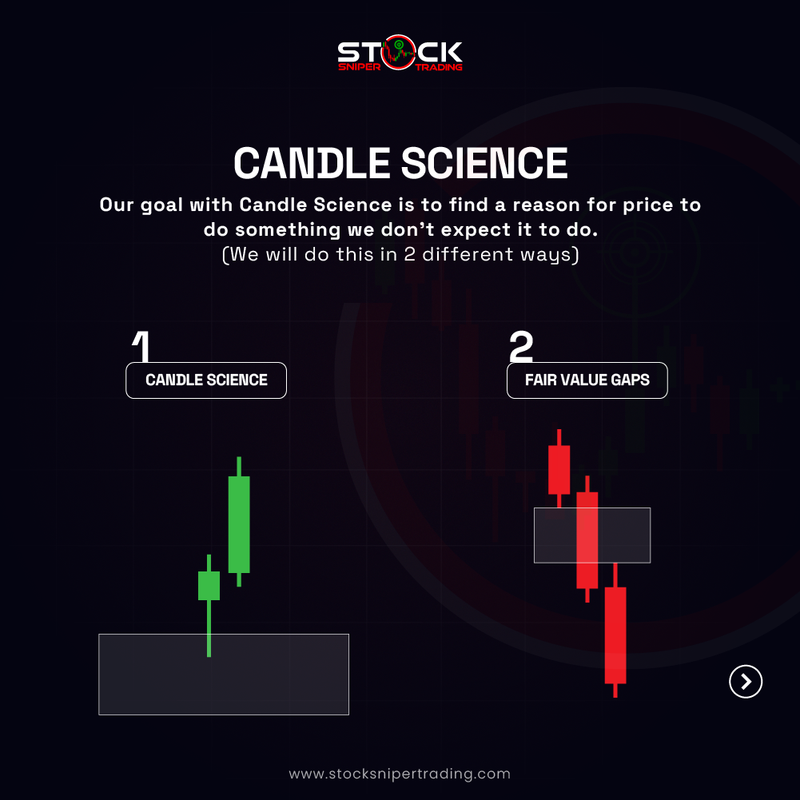

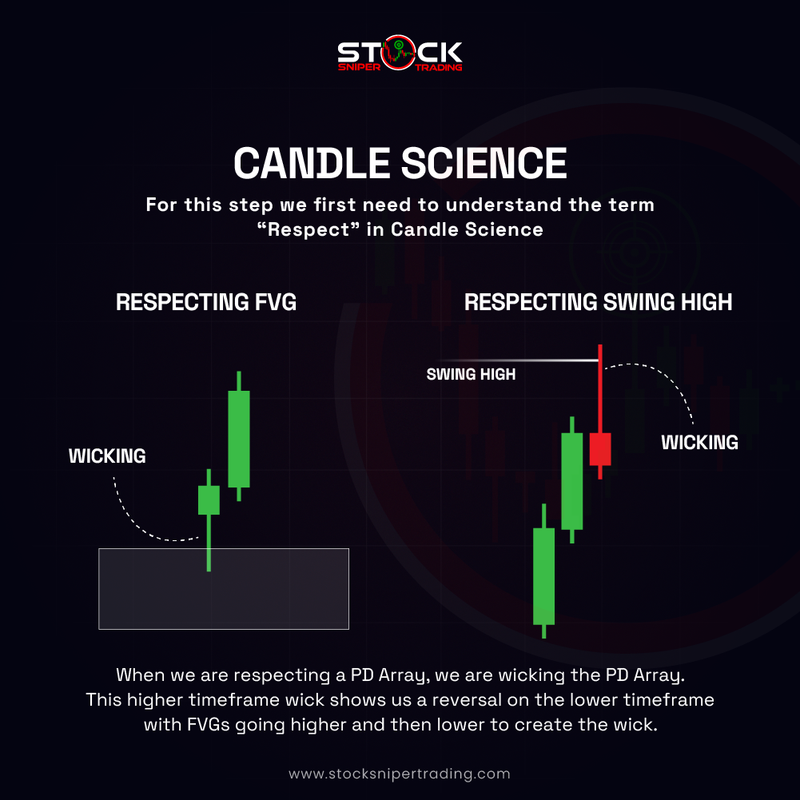

. Respecting Fair Value Gaps (FVGs) and Swing High Wick

In trading, Fair Value Gaps (FVGs) refer to price areas lacking efficient two-way trade. FVGs occur when prices leave a zone quickly, suggesting an imbalance or inefficiency. Recognizing these gaps can help traders anticipate future price movements, as the market often returns to these levels to achieve balance. When a candle wick respects an FVG or a swing high, it indicates a test of these levels without breaking them significantly. This signifies potential reversals or continuations, providing insight into market psychology and dynamics.

In brief: FVGs reflect price inefficiencies, and wicking shows tests of these levels, hinting possible reversals or continuations.