Common Sense Trading refers to a straightforward and pragmatic approach to trading financial assets that emphasizes simplicity, risk management, and emotional discipline. It often contrasts with more complex trading strategies that rely heavily on intricate technical analysis or sophisticated algorithms. The idea is to use common sense in decision-making and focus on what is fundamentally sound rather than getting caught up in market jargon or trends.

Key Principles of Common Sense Trading

1. Risk Management: One of the core tenets is the importance of managing risk. This includes setting stop-loss orders to protect against significant losses and only risking a small percentage of one’s trading capital on any single trade.

Example: If a trader has a capital of $10,000, they might only risk 1% on a trade, meaning their maximum loss for that trade would be $100. This helps prevent catastrophic losses and allows them to stay in the game longer.

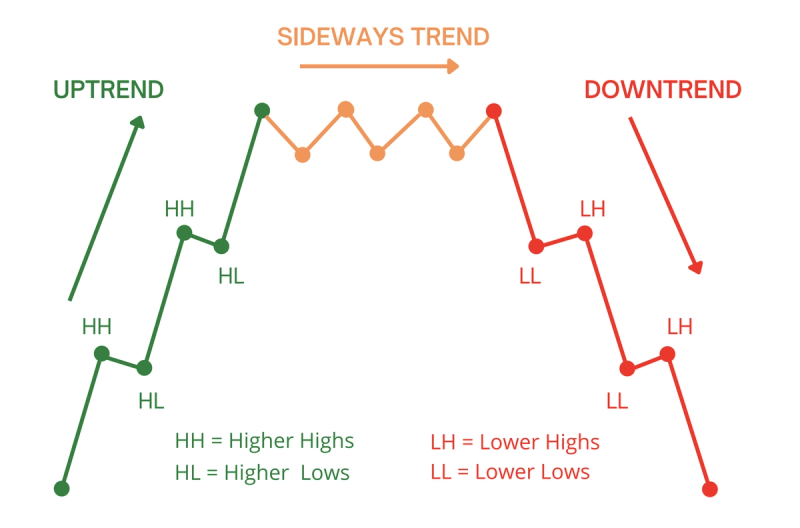

2. Understanding Market Trends: Utilizing market trends rather than betting against them is crucial. Common sense traders typically analyze the broader market to identify whether they are in a bull (upward) or bear (downward) market and make trades that align with those conditions.

Example: In a bull market, a common sense trader may focus on buying stocks, as the general trend suggests that prices will rise. Conversely, in a bear market, they may consider shorts or staying out of the market altogether.

3. Fundamental Analysis: Instead of purely relying on charts and technical indicators, common sense trading often involves understanding the underlying business behind stocks. This could involve looking at earnings reports, business models, and overall industry conditions.

Example: A trader may choose to invest in a tech company not just based on its stock chart, but upon understanding its latest product innovations, market share, and financial health.

4. Emotional Discipline: Emotions can cloud judgment, leading to impulsive trading decisions. Common sense trading promotes the idea of sticking to a plan instead of reacting to market noise or fear of missing out (FOMO).

Example: A trader might have a strategy that involves only entering trades based on certain technical signals. Even if their peers are wildly buying a popular stock due to a trend, they stick to their system, recognizing that following the herd can lead to poor decision-making.

5. Simplicity: Keeping trading strategies simple can lead to better results. Traders should focus on a few reliable indicators or methods rather than overwhelming themselves with too much information.

Example: A common sense trader might only use a simple moving average crossover strategy to determine when to buy or sell, rather than layering multiple technical indicators that can complicate decision-making.

Examples in Action

1. Stock Trading: A common sense trader sees rising inflation and decides to invest in companies that benefit from rising prices, like commodity producers. Instead of day trading, they plan to hold these stocks for several months to take advantage of the favorable environment.

2. Forex Trading: A trader observes that a country’s central bank is increasing interest rates, making its currency stronger against others. Instead of overcomplicating their strategy with multiple indicators, they decide to buy that currency and hold it until signs of reversal appear.

3. Options Trading: Rather than using complex options strategies that may provide high reward but also high risk, a common sense trader might choose to buy simple call options on a blue-chip stock, which they believe will appreciate over the long term due to strong fundamentals.

Conclusion

Common Sense Trading prioritizes logic, rationality, and clear thinking in the often chaotic world of financial markets. By focusing on risk management, understanding fundamental conditions, maintaining emotional discipline, and keeping strategies simple, traders can improve their chances of success and avoid the pitfalls that come from complexity and emotional decision-making.

Join Stock Sniper Trading and take your trading to the next level Stock Sniper Trading