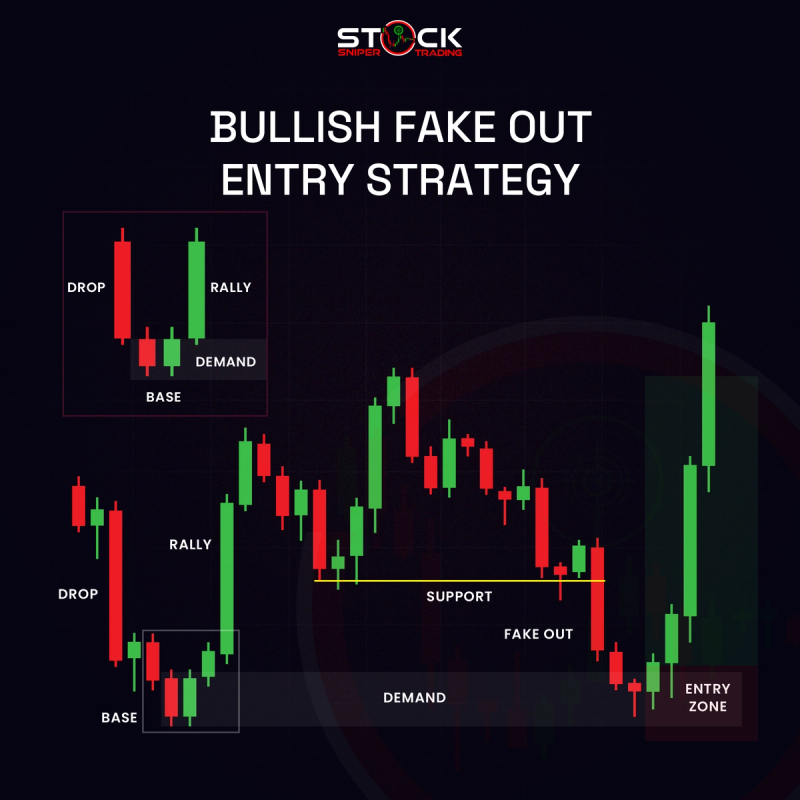

Bullish Fake Out Entry Strategy

A bullish fake out, or false breakout, typically occurs when the price briefly moves below a level of support, triggering stop-loss orders and enticing sellers to enter the market. However, instead of continuing downward, the price reverses direction and moves upward, catching many traders off guard. This creates an opportunity for traders who recognize the false breakout to enter into long positions, potentially profiting from the subsequent upward movement.

Key Aspects

Support and Resistance Levels:

- - The strategy heavily relies on identifying key support levels where price has historically reversed or paused.

- - Traders look for a temporary breakdown below this support level.

Volume Analysis:

- - Analyze trading volume during the breakdown. A true breakout usually accompanies high volume, whereas a fake out might not have significant volume follow-through.

- - Low volume could indicate a lack of strong selling interest, hinting at a potential fake out.

Candlestick Patterns:

- - Look for bullish reversal candlestick patterns like the hammer or bullish engulfing at or around the support level.

- - These patterns can provide additional confirmation of a potential reversal.

Market Sentiment:

- - Assess overall market sentiment to gauge likelihood of continuation trends. Bullish sentiment could indicate a higher probability of a reversal, turning a fake breakout into a profitable entry.

Indicator Confirmation:

- - Utilize technical indicators such as RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence) to confirm oversold conditions or bullish momentum.

Trading Strategy Steps

- - Identify Support Level: Begin by clearly identifying a robust support level based on historical price data.

- - Watch for Breakdown: Monitor for a breakdown below the identified support level. Check accompanying volume and pattern indications.

- - Confirmation and Entry: Look for confirmation that the breakdown is a fake out. Key confirmations include price quickly moving back above the support level and forming bullish candlesticks.

- - Set Stop-Loss and Take Profit:

- - Place a stop-loss below the lowest point of the fake breakdown to manage risk.

- - Determine a take-profit level based on a risk-reward ratio or subsequent resistance levels.

- - Monitor the Position: Keep an eye on the trade and overall market conditions to react as needed, adjusting the stop-loss or taking profits early if necessary.

Bullet Points

- - Key Concepts:

- - Exploit false breakdowns in price for profit.

- - Focus on strong support/resistance areas.

- - Analysis Tools:

- - Use volume, candlestick patterns, and technical indicators for confirmation.

- - Risk Management:

- - Critical to use stop-losses to protect against adverse price movements.

- - Execution:

- - Be patient and wait for confirmation before entering trades.

This strategy requires a good grasp of technical analysis and discipline in trade execution. It's crucial for traders to continuously assess market conditions and refine their approach to effectively implement the bullish fake out entry strategy.