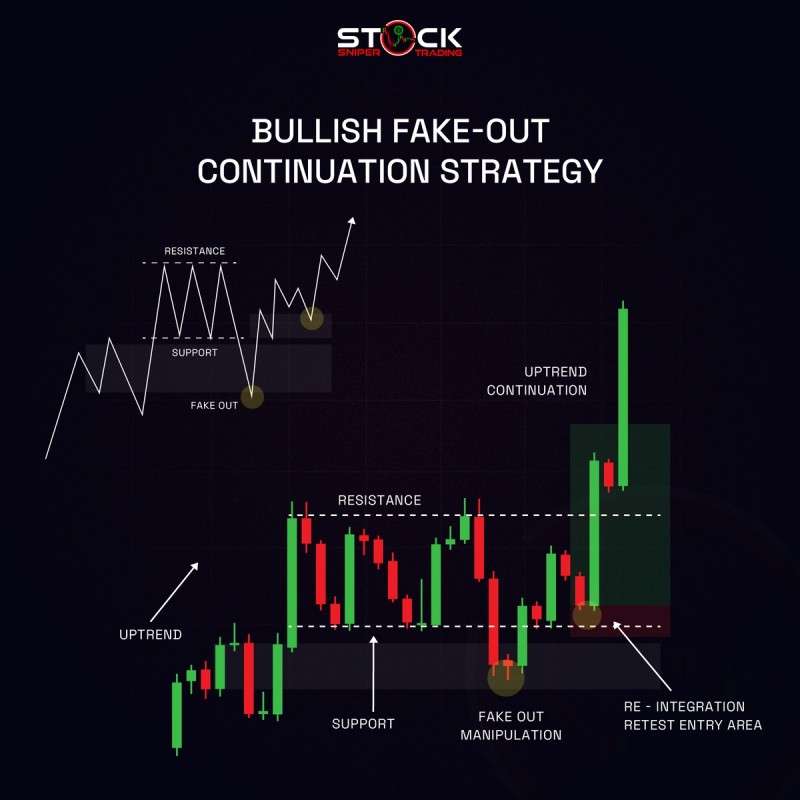

The bullish fake-out continuation strategy is a trading approach used to capitalize on a situation where the market appears to break out below a support level, only to quickly reverse and continue in the opposite direction (typically upwards). This strategy is based on identifying false breakouts, which can often trap traders anticipating a new trend direction, but instead result in a continuation of the previous trend.

Here's a detailed explanation of how this strategy works:

Key Components of the Bullish Fake-Out Continuation Strategy

Identification of Support Levels:

- - Identify a significant support level on the price chart where price action has previously bounced upward. This is typically a horizontal line where buyers have consistently entered the market.

Observation of a Break Below Support:

- - Watch for the price to drop below the identified support level. Initially, this suggests a bearish breakout and often leads traders to expect further declines.

Recognition of the Fake-Out:

- - Watch the behavior of the price after the breakout. If the price quickly rebounds back above the support level after breaking below it, this indicates a potential fake-out. The speed and volume of the recovery are crucial in confirming the fake-out.

Confirmation:

- - Look for additional confirmation signals such as bullish candlestick patterns (e.g., bullish engulfing), increased trading volume, or supportive technical indicators like RSI (relative strength index) moving higher from oversold conditions.

Entry:

- - Enter the trade once the fake-out is confirmed, ideally after the price closes above the support level again. This entry point often has a favorable risk-reward ratio because the initial stop-loss can be placed just below the recent low of the fake-out move.

Target and Stop-Loss Placement:

- - Set a stop-loss below the recent low to manage risk. Targets can be set at previous resistance levels, or based on a risk-reward ratio strategy, ensuring a positive expectancy from the trade based on historical price action.

Benefits and Considerations

- - Market Psychology: This strategy leverages the psychology of market participants. In a fake-out scenario, traders who shorted the breakdown may cover their positions, and sidelined buyers may re-enter the market, contributing to the upward momentum.

- - Risk Management: It's crucial to have strict risk management in place since fake-outs can sometimes result in significant price moves against the anticipated direction, leading to losses without proper stop-losses.

- - Market Conditions: This strategy is typically more effective in ranging markets or during specific phases of market consolidation. It can be less effective during strongly trending markets where breakouts are more likely to follow through.

The bullish fake-out continuation strategy requires patience, careful analysis of market conditions, and the ability to act quickly once a fake-out is recognized. As with any trading strategy, it should be tested and adjusted according to individual trading plans and risk tolerance.