Breakdown of the US30 Sell Trade Based on Supply Zone on the 1-Hour Timeframe

This trade was a supply zone-based sell that capitalized on price rejecting a previously established supply zone on the 1-hour timeframe.

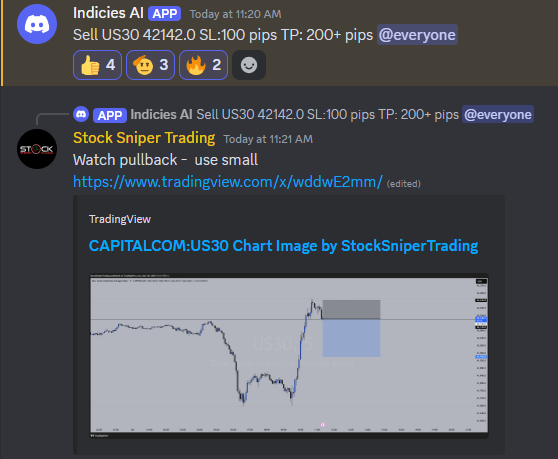

Before the Trade: Identifying the Supply Zone

- - Context: Price had a strong bullish move before hitting a key supply zone.

- - Supply Zone (1-Hour Chart Basis): A previous area where price aggressively dropped in the past.

- - Expectation: Price would react bearishly at the supply zone, offering a sell entry opportunity.

Key Observations Before the Trade

- - Strong bullish impulse leading to the supply zone: Price aggressively pushed up, often leading to exhaustion and reversal.

- - Price reached a previous supply zone where sellers were active before. Institutions typically look to sell at such levels.

- - Bearish rejection candles on lower timeframes confirmed the trade.

- - Entry placed at 42,142.0, which aligned with the supply zone and the psychological level.

Trade Execution: Selling at the Supply Zone

- - Entry: Sell at 42,142.0

- - Stop Loss (SL): 100 pips (above supply zone, ensuring enough breathing room)

- - Take Profit (TP): 200+ pips (targeting next liquidity pool)

Why Was This a Good Sell?

- - Price action confirmed bearish rejection at supply zone.

- - Aggressive buy move into supply was unsustainable.

- - Price began to form lower highs and lower lows on lower timeframes (5-minute chart).

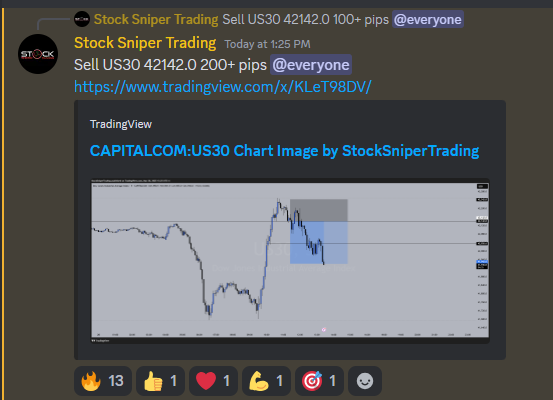

After the Trade: Price Rejected and Dropped

- - The second image shows price dropping after rejecting the supply zone.

- - Price failed to break above the supply zone and began forming bearish candles.

- - The TP of 200+ pips was hit, showing how the supply zone rejection played out perfectly.

Conclusion

- - This was a textbook supply zone trade on US30.

- - Price reached a key 1-hour supply zone, showed rejection, and dropped significantly.

- - Trade execution was precise, with good risk-reward.

- - This type of trade works well when price aggressively moves into a previous supply zone and then reverses.

Discord Before:

Discord After:

This breakdown shows the power of supply and demand trading combined with price action confirmation.