🔍 ARIS Mining Corporation – Fundamental Overview

Sector: Gold Mining

Headquarters: Vancouver, Canada

Exchange: TSX (Ticker: ARIS)

Business Summary:

ARIS Mining is engaged in the exploration, development, and operation of gold mining assets in Colombia and Latin America. The company has transitioned from junior exploration to a multi-asset gold producer following strategic mergers and project development. Core assets include the Segovia Operations and Marmato Mine, both located in Colombia, offering long-term production upside.

📊 Financial Health & Valuation

- - Revenue Growth: ARIS has demonstrated improving revenue through increased production volumes and higher gold prices.

- - Earnings: Profitability has been volatile due to fluctuating gold prices and operational restructuring.

- - Cash Flow: Operating cash flow is stabilizing, but capital expenditure on development projects continues to weigh on free cash flow.

- - Debt: Manageable debt levels post-merger, with some exposure to commodity price fluctuations and financing costs.

🏗️ Operational Outlook

- - Production: Segovia is a high-grade underground operation with stable output; Marmato offers expansion upside with a large resource base.

- - Costs: ARIS is focused on lowering all-in sustaining costs (AISC) through operational efficiencies.

- - Guidance: Management expects improved margins as new projects come online and economies of scale improve.

🌍 Macroeconomic & Risk Factors

- - Gold Prices: ARIS is highly sensitive to gold market volatility. A sustained rally benefits margins; a drop would pressure earnings.

- - Country Risk: Operations in Colombia carry moderate political and regulatory risk, although recent reforms have been mining-friendly.

- - Dilution History: The historical chart shows a dramatic decline likely due to reverse splits or heavy dilution post-2011 gold crash. New capital raises must be watched closely.

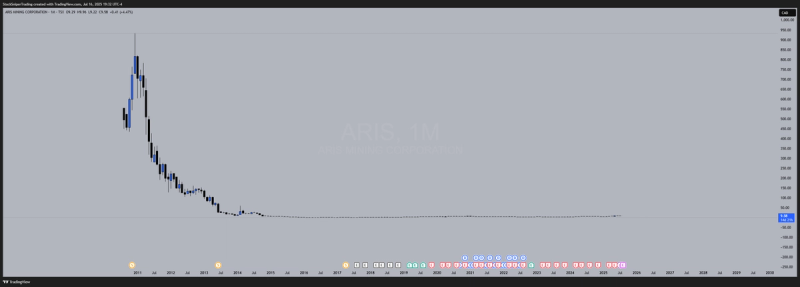

📈 ARIS Mining – Technical Breakdown (1M Chart)

🔻 Long-Term Downtrend:

ARIS has been in a strong bearish trend since its 2010 highs, with a massive collapse from ~$950 to under $10. The long tail and wide gap down suggest past dilution, reverse splits, or major restructurings.

📉 Price Compression:

From ~2014 to ~2021, price moved sideways in an ultra-low volatility range—classic accumulation behavior after a prolonged downtrend.

📊 Volume & Activity:

More recent candles show increased trading activity and stronger closes—suggesting a gradual return of investor interest. Still, the overall range is tight.

🔄 Key Resistance & Support:

- - Resistance: ~$12.00 (multi-year supply zone)

- - Support: ~$7.00–$8.00 (current base area)

- - If price breaks and holds above $12, it opens room toward ~$16–$20

- - Below $8, it risks sliding back into consolidation or new lows

📌 Trend Bias:

Currently neutral with bullish potential if momentum builds and macro/gold fundamentals support it. ARIS is technically basing after a long downtrend. Watch for a clean break above $12 with volume to confirm a new uptrend. Until then, it’s a speculative chart with risk tied to low liquidity and past volatility.

📌 Conclusion

ARIS Mining is a turnaround story in progress — transitioning from a troubled legacy to a leaner, multi-asset gold producer. The fundamentals are improving, but investors must monitor gold prices, capital efficiency, and dilution risk. While the long-term chart is concerning, the company’s asset base and strategic direction may provide value if execution remains solid.