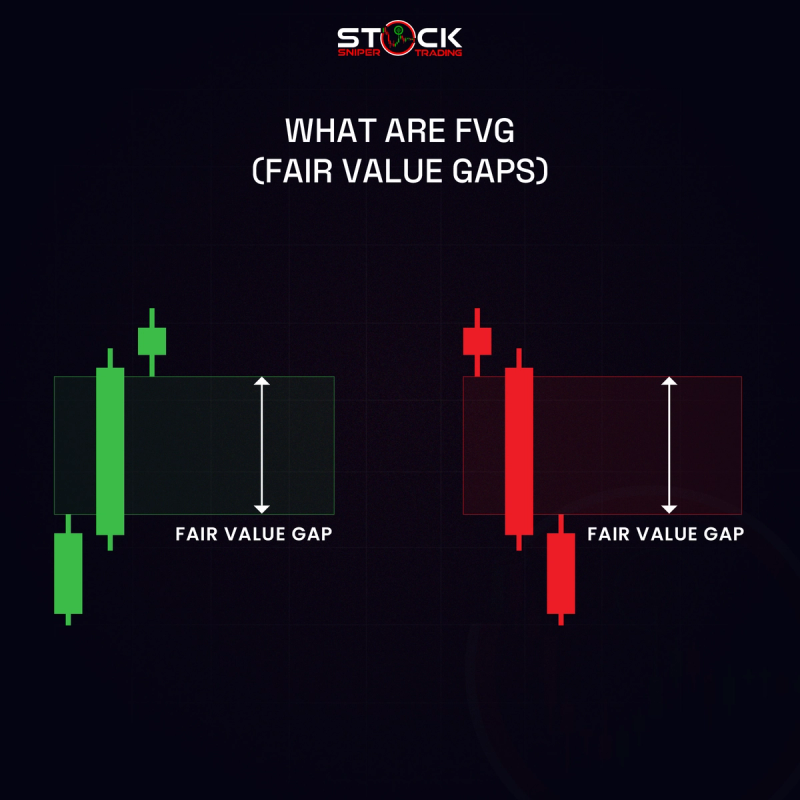

What are FVG (Fair Value Gaps)

Fair Value Gaps, often referred to in the context of forex and stock trading, are areas on a price chart where there is a significant disparity between the price of an asset and its "fair value." These gaps are typically identified in technical analysis and can represent potential trading opportunities. Here’s a breakdown of the concept:

1. Definition:

A Fair Value Gap occurs when the price of an asset moves sharply, leaving behind a gap on the chart. This gap often indicates that there was not enough time for buyers and sellers to establish equilibrium, which may lead to a correction or filling of the gap in later trading sessions.

2. Identification:

Traders often identify Fair Value Gaps by looking for areas where the price has jumped significantly up or down on the chart, which are usually accompanied by increased volume. These gaps can appear on different time frames, from minutes to daily charts.

3. Theory:

The underlying theory is that market participants may have been unable to transact at the prices within the gap due to rapid price movement. As the market continues, it might return to these zones to allow traders to complete those transactions, thus “filling” the gap.

4. Trading Strategy:

Traders might use Fair Value Gaps as part of their trading strategy to determine entry and exit points. For example, they could look to buy when the price approaches the lower edge of a gap after a sharp drop, anticipating that the gap will fill.

5. Risk Management:

Like any trading strategy, trading based on Fair Value Gaps should include risk management measures. Since market conditions can change rapidly, it is essential to have stop-loss orders in place to protect against adverse price movements.

6. Technical Analysis:

Fair Value Gaps are often used alongside other technical indicators and chart patterns to confirm trading signals. Traders might integrate other forms of analysis (like support and resistance levels, trend lines, etc.) for a more comprehensive view.

As with any trading strategy, it is essential to backtest and practice thoroughly to understand how Fair Value Gaps behave in various market conditions.