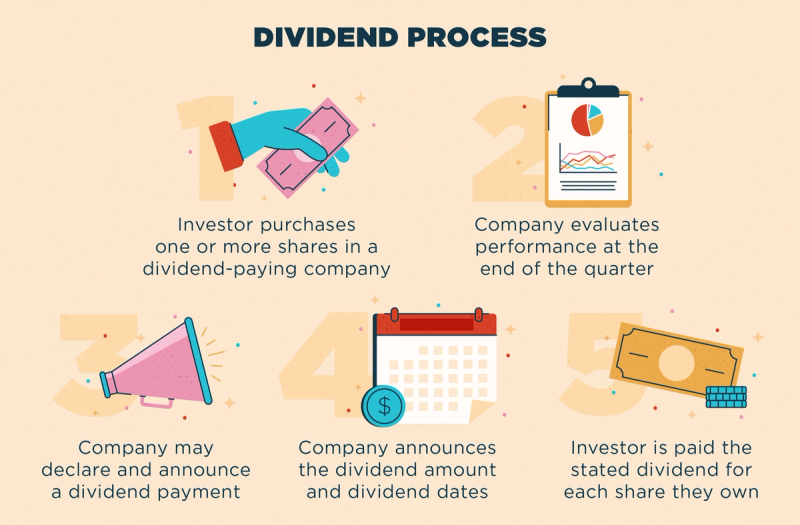

Dividends are payments made by a corporation to its shareholders, usually in the form of cash or additional stock. They represent a portion of the company's profits that is distributed to investors, typically on a quarterly basis. Dividends are often seen as a sign of a company's financial health and stability, as they indicate consistent profitability and a willingness to share profits with shareholders.

Why Dividends are Great for Passive Income:

1. Regular Income Stream: Dividends provide a consistent income stream without requiring the sale of shares. This makes them particularly attractive for retirees or anyone seeking regular passive income.

2. Compound Growth: Reinvesting dividends can lead to compound growth over time, as reinvested dividends purchase additional shares, which can generate more dividends.

3. Less Volatile Returns: Dividend-paying stocks tend to be less volatile than non-dividend-paying stocks, as stable companies with predictable earnings often issue dividends.

4. Inflation Hedge: Companies that consistently increase their dividends can help investors maintain purchasing power in the face of inflation.

5. Tax Advantages: In many jurisdictions, dividend income is taxed at a lower rate than ordinary income, making it a tax-efficient way to receive income.

Importance of Adding Dividends to Your Portfolio:

- Diversification: Including dividend-paying stocks can diversify your investment portfolio and reduce risk.

- Stability and Predictability: Dividend stocks often belong to well-established companies, providing a level of predictability and security.

- Total Return Enhancement: Total return from dividend stocks includes both capital appreciation and dividend income, potentially boosting overall portfolio performance.

Examples of High-Paying Dividend Securities:

Here are some examples of high dividend-yielding stocks listed on the NYSE, NASDAQ, and TSX, although these can change with market conditions:

NYSE/NASDAQ:

1. AT&T Inc. (T): Historically known for a high dividend yield, although changes in strategy or debt load could affect this.

2. Verizon Communications Inc. (VZ): Offers a solid dividend from a stable telecommunications business.

3. Altria Group, Inc. (MO): Provides a high dividend yield, supported by its tobacco products business.

TSX:

1. Enbridge Inc. (ENB.TO): Known for a strong dividend yield, supported by its energy infrastructure operations.

2. Bank of Nova Scotia (BNS.TO): A major Canadian bank with a history of reliable dividend payments.

3. Canadian Imperial Bank of Commerce (CM.TO): Offers a substantial dividend yield among Canadian banks.

These stocks are typically sought after for their reliability in paying dividends; however, it's important to conduct thorough research or consult with a financial advisor before making investment decisions, as individual needs and circumstances vary significantly.

Join the Sniper Team today and take your trading to the next level! Stock Sniper Trading