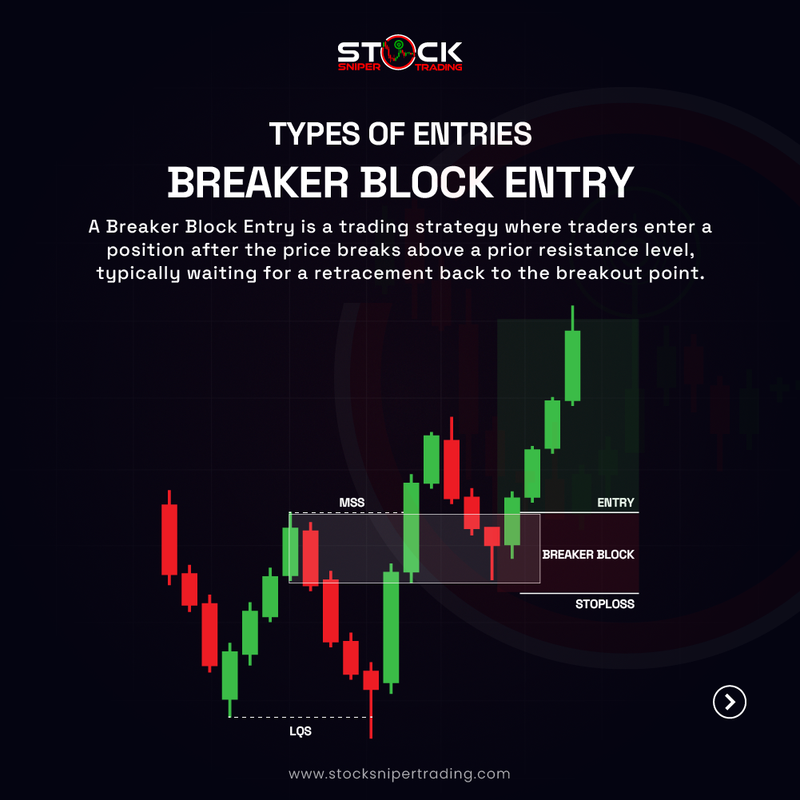

Types of Entries

Breaker Block Entry

A breaker block entry is a trading strategy that capitalizes on previous price levels where significant reversals have occurred. This technique involves identifying a price level or zone where the market has shown a strong reaction, indicating a potential change in the market structure. Traders look for these areas to place their entries, anticipating that the price will return to this zone for a retracement before continuing in the direction of the prevailing trend.

Important Points:

- - Market Structure: It relies on understanding the market’s supply and demand dynamics.

- - Confirmed Reversals: Look for strong price action or volume at these levels, suggesting a high probability of price reversal.

- - Risk Management: Traders often set stop-loss orders just beyond the block to limit potential losses.

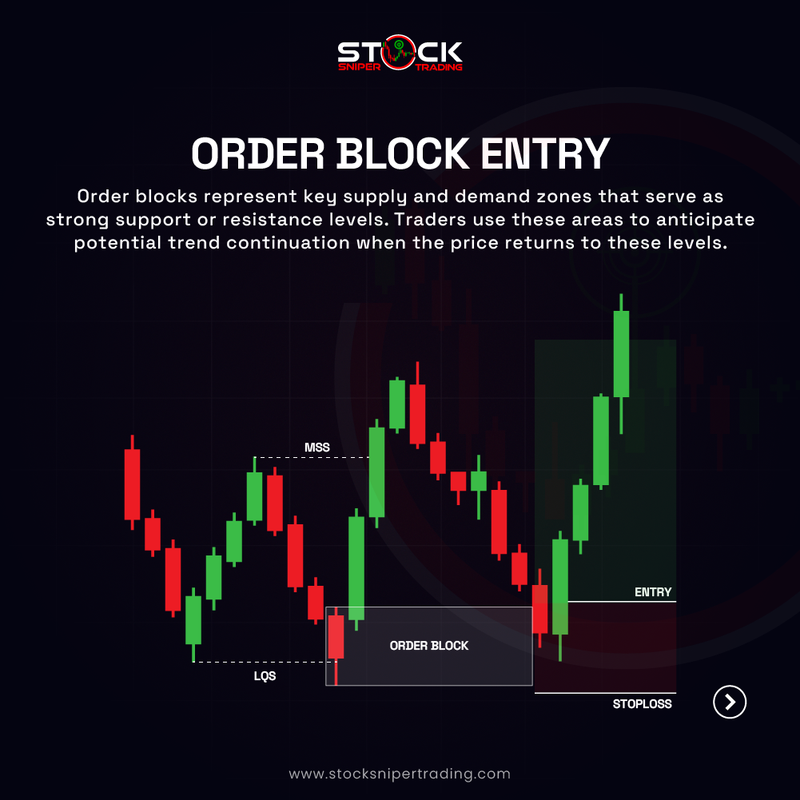

2. Order Block Entry

Order block entry is a strategy based on identifying areas in the market where there are significant orders from institutions, creating potential zones of support or resistance. These zones are formed when large buyers (bulls) or sellers (bears) enter the market in large volumes, resulting in dramatic price movements. Traders aim to enter the market near these blocks, anticipating that the price will react to the existing order flow, either bouncing off the level or consolidating before making its next move.

Important Points:

- - Identifying Blocks: Successful identification requires thorough analysis of previous price movements and volume spikes.

- - Institutional Influence: Understanding that big players can dictate the market direction helps traders make informed decisions.

- - Confirmation Signals: Look for confirmation signals such as candlestick patterns or breakouts before executing a trade.

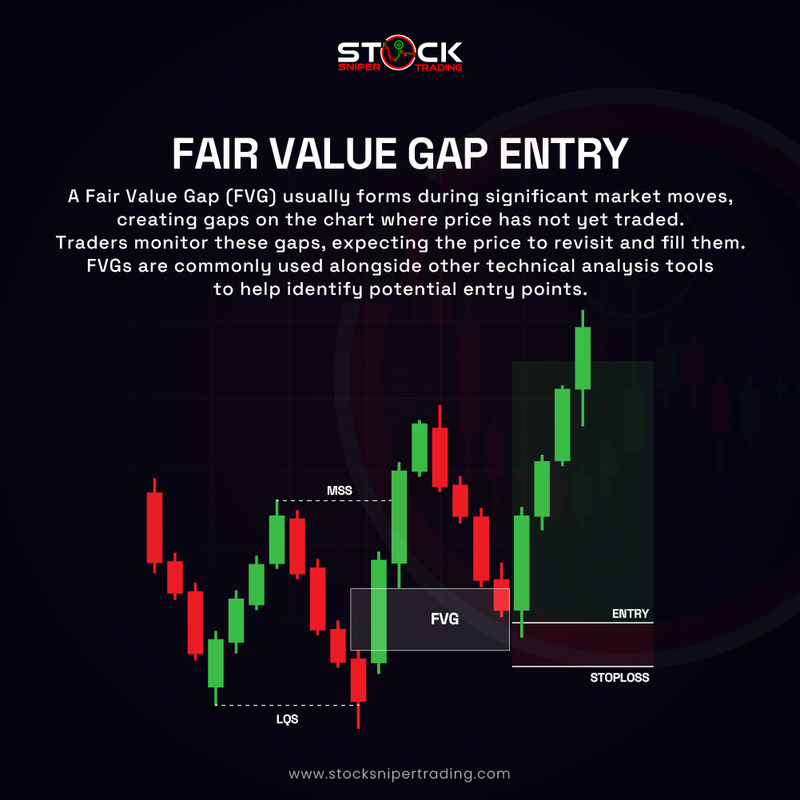

3. Fair Value Gap Entry

Fair value gap entry refers to the strategy of trading gaps in price created by sudden moves, indicating inefficiencies or imbalances in the market. When the price moves rapidly, it can create a ‘gap’ where no trades occur, suggesting the price will eventually return to fill this gap. Traders may enter the market when they believe the price will revert to the fair value level, thus capitalizing on the return to equilibrium.

Important Points:

- - Gap Analysis: Identifying the size and location of gaps is crucial for predicting potential price movement.

- - Market Sentiment: Understanding the sentiment behind the gap—whether bullish or bearish—can enhance entry timing.

- - Stop-Loss Strategies: Implementing stop-loss higher or lower than the gap can protect against adverse movements.