Trade Recap: USOIL Long – Break and Retest Execution to Full TP

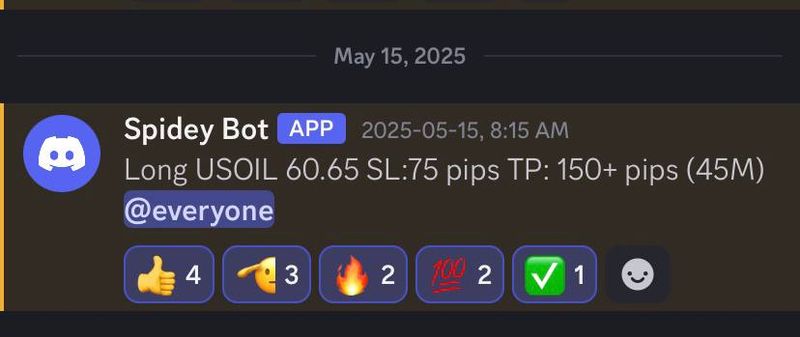

Trade Alert Recap:

Instrument: USOIL (WTI Crude Oil)

Entry: 60.65

Stop Loss: 75 pips

Target: 150+ pips

Timeframe: 45-Minute Chart

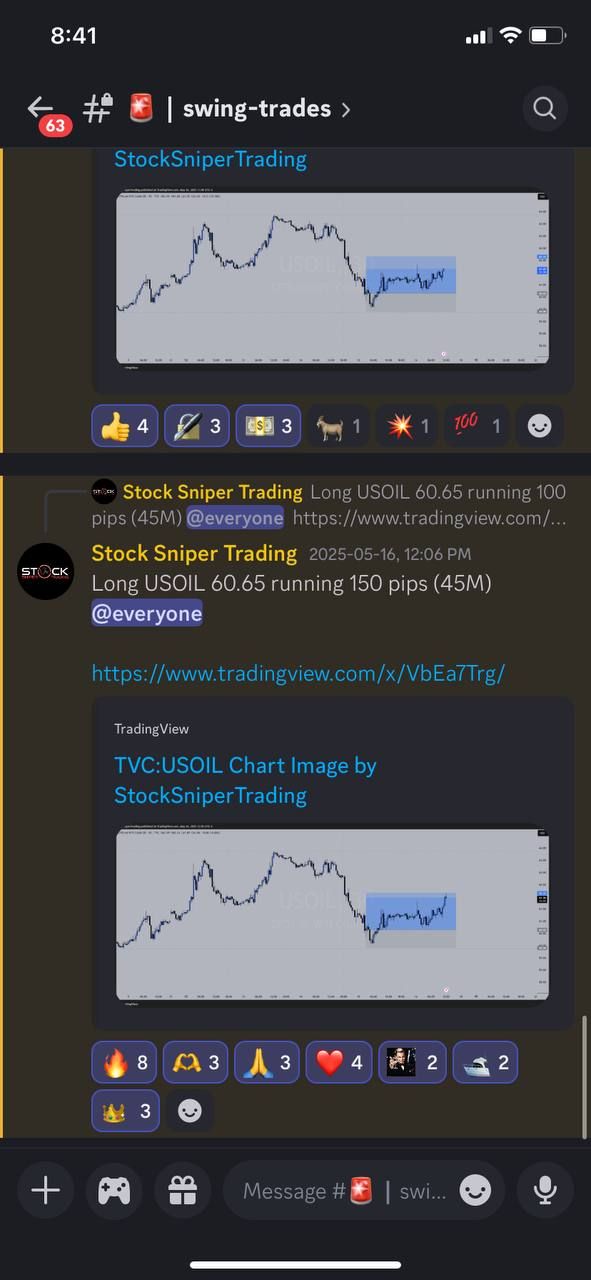

Result: Full TP Hit

What Is USOIL and Why Do We Trade It?

USOIL refers to West Texas Intermediate (WTI) Crude Oil, one of the most actively traded crude oil benchmarks in the world. It’s a grade of oil primarily sourced from North America and is considered a global pricing reference for energy markets.

Why it's commonly traded:

- - High Liquidity: WTI oil futures and CFDs are among the most liquid instruments, with tight spreads and deep order books.

- - Volatility: Oil prices are sensitive to global events—OPEC decisions, geopolitical tensions, economic reports—creating frequent opportunities for traders.

- - Clear Technical Behavior: Because of its high volume, USOIL often respects technical levels well—making it suitable for price action strategies.

Market Context Before the Trade

Leading up to the trade, WTI had experienced a sharp decline, followed by a sideways consolidation. On the 30M–45M timeframe, price formed a well-defined range between ~60.65 and ~62.15.

This signaled market indecision and potential accumulation, which often precedes directional moves. We marked the bottom of the box (~60.65) as a key level for a possible long position if buyers defended it.

The Trade Breakdown

1. Range Formation

- - Price moved into consolidation after a drop, creating multiple taps at both range highs and lows.

- - This suggested accumulation—the market was likely building orders before a breakout.

2. Entry at Support

- - We entered long at 60.65, the bottom of the range, after multiple rejections from this level and a small bullish engulfing on the lower timeframe.

- - This entry had low risk due to a tight SL just below the structure and high potential upside if the breakout occurred.

3. Break & Retest Confirmation

- - Price broke above the 62.15 range high and pulled back for a clean retest.

- - The retest respected the prior resistance turned support, giving further confidence that bulls were in control.

- - Members who missed the first entry had a second opportunity to get in on the confirmation.

Risk Management Approach

Risk management was a key component of this trade:

- - SL Placement: SL was positioned 75 pips below entry, just under the recent lows—protecting us from random volatility while honoring structure.

- - TP Objective: A 150+ pip target gave us a 2:1 R/R ratio, meaning even if only 50% of similar trades play out, we remain profitable.

- - Position Sizing: Members were reminded to size their positions based on the SL, not the temptation to overleverage. This helps sustain long-term consistency and avoid emotional errors.

Outcome and Takeaway

The trade played out exactly as planned:

- - Entry held perfectly at support

- - Breakout followed by a retest

- - Price surged and hit full take profit for over 150 pips

Key Lessons for Members:

- - Let the market come to your level. We didn’t chase—entry was preplanned and precise.

- - Structure + Patience = Edge. The range and retest gave us structure. Patience allowed for a high-probability setup.

- - Risk Management is Non-Negotiable. Without a clear SL and calculated lot size, this same setup could go from win to wipeout.

Conclusion: This was a great example of how clean structure, disciplined execution, and proper risk management can come together to deliver a high-quality trade. USOIL continues to be a top-tier instrument for traders seeking volatility and opportunity—with the right mindset, it can be a consistent part of your trading plan.