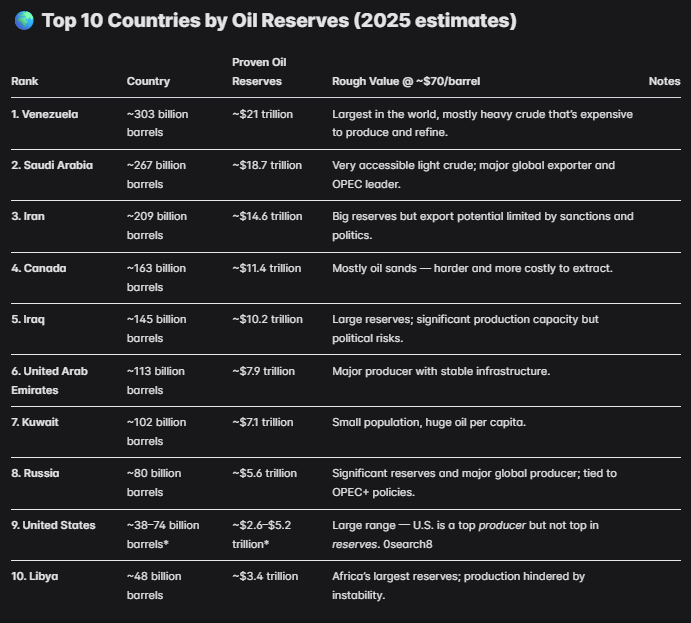

🌍 Top 10 Countries by Oil Reserves (2025 estimates)

💰 How We Estimate “Worth” of Oil Reserves

- - A barrel of crude oil typically trades in a range (e.g., $60–$90+ per barrel, depending on market conditions).

- - Multiplying the number of barrels by a price per barrel gives a rough gross value of the oil underground (before production costs, taxes, transport, refining, etc.).

- - Example:

- - Venezuela: ~303 billion barrels × $70 ≈ $21 trillion worth of crude oil.

- - Saudi Arabia: ~267 billion barrels × $70 ≈ $18.7 trillion worth of crude oil.

💡 Important: This is not net profit — actual economic value depends on extraction costs, infrastructure, politics, and oil quality.

Detailed Breakdown of the Top Oil-Reserve Countries

1. Venezuela — The Most Oil, But Hard to Use

What makes Venezuela #1?

- - It has the largest proven oil reserves in the world — bigger than Saudi Arabia’s.

- - Most of the oil sits in the Orinoco Belt, a massive deposit.

What’s the downside?

- - Much of Venezuela’s oil is heavy or extra-heavy crude:

- - Thick, dense oil that’s difficult and expensive to extract.

- - Requires more refining.

Why production is low despite huge reserves

- - Years of economic collapse, poor maintenance, and sanctions have damaged production infrastructure.

- - Many oil fields, pipelines, and refineries are old or non-functional.

What this means

Venezuela is like someone who owns the world’s biggest gold mine…

but can only dig with a spoon.

2. Saudi Arabia — Big Reserves + Easy Access

Why Saudi Arabia is powerful

- - Although 2nd in reserves, Saudi Arabia has:

- - Very high-quality crude (easy to refine)

- - Very shallow fields (easy to extract)

- - Huge, modern infrastructure

Ghawar Field

- - The largest conventional oil field in the world.

- - Produces oil very cheaply — sometimes under $10/barrel.

OPEC Leadership

- - Saudi Arabia often sets the tone for global oil supply decisions.

What this means

Even if Saudi Arabia doesn’t have the most oil, it has the most profitable and influential oil.

3. Iran — Huge Reserves, Limited Freedom to Sell

Strengths

- - Iran has massive reserves and strong technical expertise.

- - Their oil is generally of good quality.

Challenges

- - International sanctions greatly limit exports.

- - Can’t fully participate in global markets.

- - Politics heavily affect their economy and production levels.

What this means

Iran could be one of the world’s top oil powers,

but global politics keep its potential locked up.

4. Canada — Oil Sands Giant

What makes Canada unique

- - About 97% of Canada’s reserves come from oil sands (tar sands).

- - These are mixture of sand, clay, water, and bitumen (thick oil).

Challenges

- - Expensive to extract and refine.

- - Environmental impact is higher.

- - Transportation is difficult — Canada needs pipelines to the U.S.

What this means

Canada has huge quantities of oil,

but it costs more to produce compared to Middle Eastern nations.

5. Iraq — Huge Potential, Unstable Environment

Strengths

- - Iraq’s oil is high quality and easy to extract.

- - Extraction costs are some of the lowest in the world.

Challenges

- - Political instability.

- - Security issues.

- - Infrastructure damage over decades of conflict.

What this means

Iraq’s oil is excellent and extremely profitable,

but production is constantly disrupted by regional instability.

6. United Arab Emirates — Modern & Efficient

Strengths

- - UAE (especially Abu Dhabi) has massive reserves.

- - Strong investments in:

- - Technology

- - Infrastructure

- - Refining and shipping capacity

Stability

- - UAE is one of the most stable and business-friendly oil regions.

What this means

The UAE combines large reserves with world-class efficiency, giving it outsized influence.

7. Kuwait — Small Country, Massive Oil

Why Kuwait stands out

- - Extremely high reserve-to-population ratio.

- - Oil exports make up the majority of GDP.

Quality & Cost

- - Kuwait’s oil is:

- - Easy to extract

- - High quality

- - Very low production cost

What this means

Kuwait is a small nation with huge economic firepower thanks to low-cost oil.

8. Russia — Vast Land, Vast Resources

Strengths

- - Russia is consistently one of the world’s top producers.

- - Major fields in western Siberia.

Challenges

- - Sanctions from recent geopolitical conflicts.

- - Harsh climate increases extraction costs.

- - Infrastructure over long, remote distances is expensive.

What this means

Russia has huge reserves and strong production,

but geopolitics and geography increase risks and costs.

9. United States — Not Top in Reserves, But #1 in Production

Why the U.S. is a powerhouse

- - Shale oil and fracking revolutionized production.

- - The U.S. produces more oil than any other country.

Reserves

- - U.S. reserves vary widely depending on classification.

- - Much of the oil requires technology-heavy extraction.

What this means

The U.S. doesn’t have the most oil underground,

but it has the most advanced ability to get oil out of the ground.

10. Libya — Huge Oil, Constant Instability

Strengths

- - Libya has the largest reserves in Africa.

- - Oil is very high quality and cheap to produce.

Challenges

- - Political divisions and civil conflict constantly disrupt production.

- - Infrastructure damage makes output unpredictable.

What this means

Libya is incredibly oil-rich,

but unstable conditions make its oil unreliable on the global market.

⭐ Summary in One Sentence Each

- - Venezuela → Biggest oil reserves, but economic collapse and heavy crude limit output.

- - Saudi Arabia → High-quality oil, cheap extraction, strongest global influence.

- - Iran → Huge oil but restricted by sanctions and geopolitics.

- - Canada → Massive oil sands, but costly and environmentally challenging.

- - Iraq → Great oil, low cost, but unstable region.

- - UAE → Efficient, modern, stable, and influential.

- - Kuwait → Easy-to-produce oil and small population = wealth.

- - Russia → Large reserves but political tensions and tough geography.

- - United States → Top producer thanks to technology, not reserve size.

- - Libya → Excellent oil but unstable nation.

Summary – Why It Matters

- - Oil reserves are a key economic asset — they influence global energy markets, geopolitics, and trade.

- - Countries with large reserves have strategic leverage but actual economic value depends on how much oil can be produced profitably, not just how much sits in the ground.