This is Why Your FVGs Don’t Hold

In the intricate world of trading, understanding the dynamics of Fair Value Gaps (FVGs) is crucial for success. Many traders struggle with why their FVGs fail to hold, leading to frustration and losses. Let’s delve into the nuances of FVGs and uncover the factors that determine their efficacy in the market.

A. FVG

FVGs, or Fair Value Gaps, denote areas on a price chart where there is a significant imbalance in supply and demand. These gaps indicate where liquidity on one side of the market is inadequately offered, often due to rapid price movement.

Key Points:

- - FVGs indicate inefficiencies in market liquidity.

- - They can be used as potential areas for retracement or reversal.

- - Recognizing FVGs alone isn't sufficient; their effective utilization is key.

B. Context Is Everything

Not all FVGs are created equal; context is essential. FVGs will not always hold, particularly if they do not align with the current draw on liquidity and market narrative.

Key Points:

- - Assess market context to ensure alignment with broader trends.

- - Analyze volume patterns and news events relevant to the FVG.

- - Using FVGs in context increases the likelihood of respect by price action.

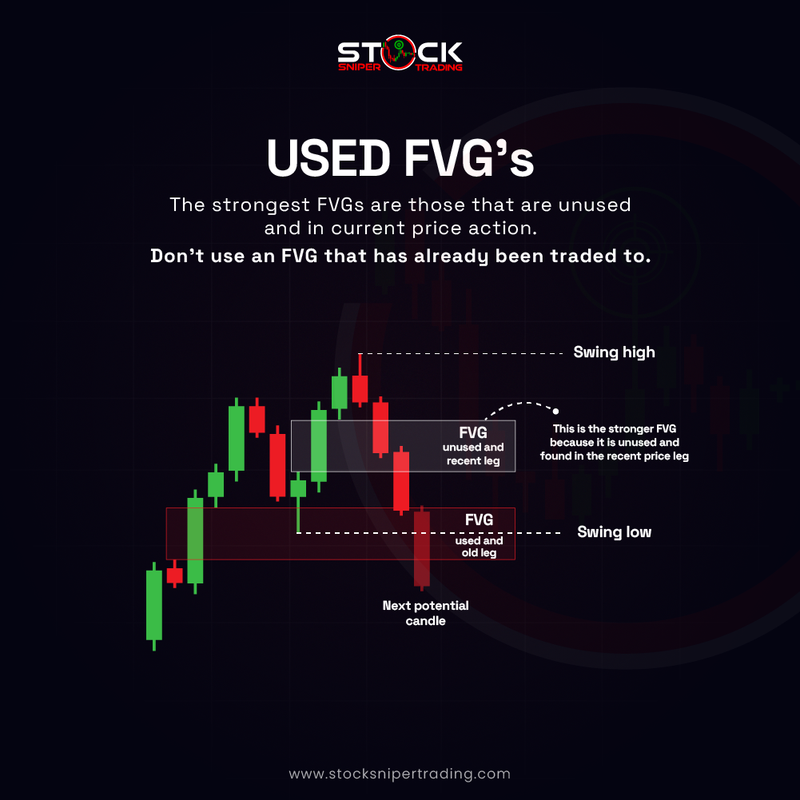

C. Used FVGs

The status of the FVG in relation to current price action is another critical factor. The most potent FVGs are those that remain unused since their formation.

Key Points:

- - "Freshness factor" plays a role in the effectiveness of an FVG.

- - Avoid FVGs that have already been traded to; they lose significance.

- - Focus on untouched FVGs for potential price reactions.

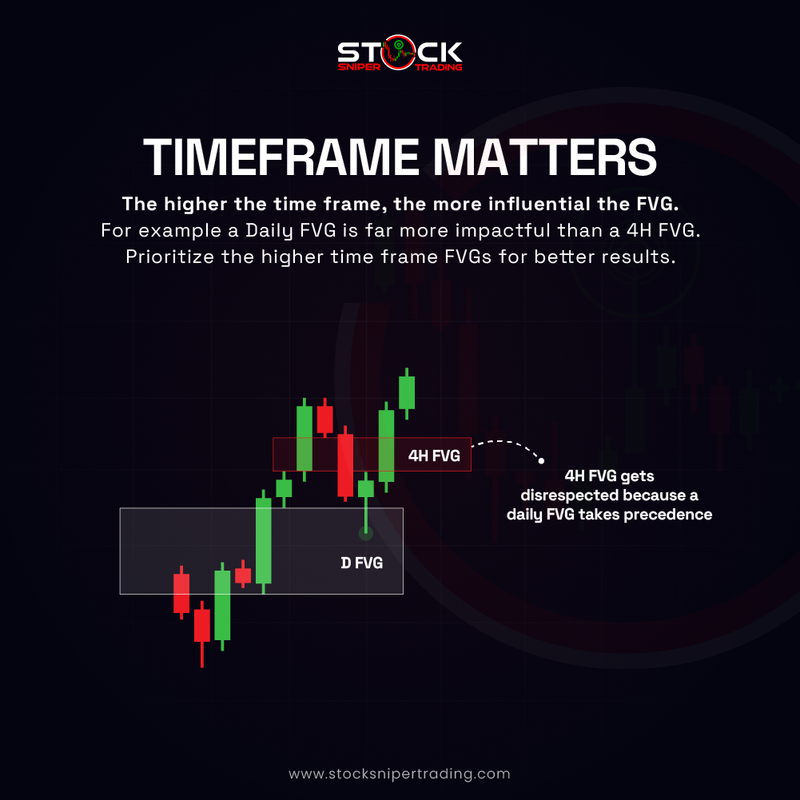

D. Timeframe Matters

Timeframes significantly impact the reliability of FVGs. Higher timeframes carry more weight than lower ones due to larger trading volumes.

Key Points:

- - Daily or weekly FVGs are more influential than 4-hour or hourly FVGs.

- - Higher timeframes reflect stronger market sentiment and liquidity.

- - Prioritize higher timeframe FVGs for better trading results.

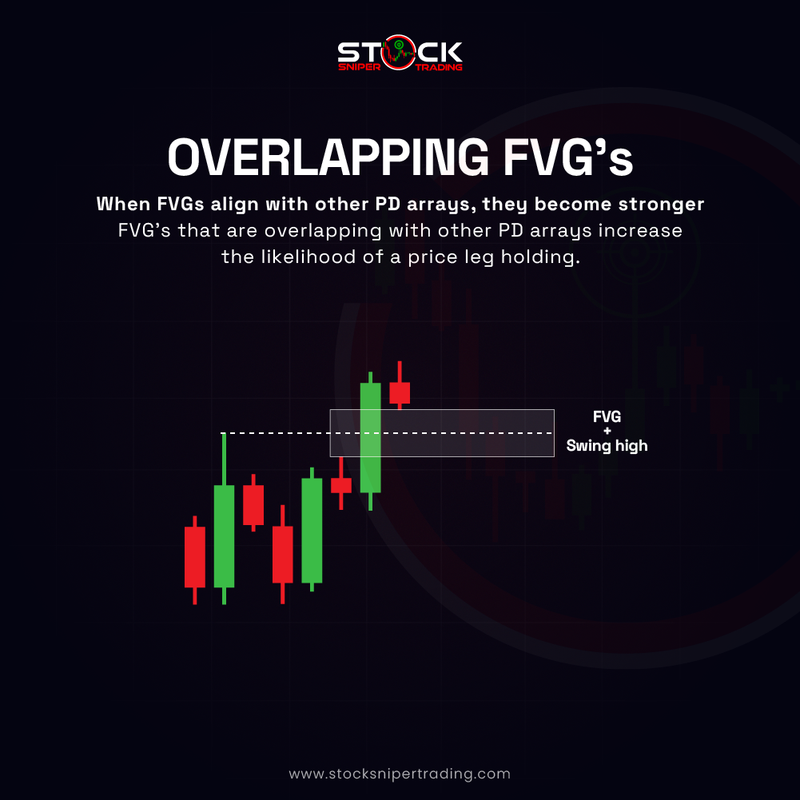

E. Overlapping FVGs

The presence of other price development (PD) arrays overlapping with FVGs can amplify their effectiveness. When multiple significant price levels coincide, it signals a stronger reaction point in the market.

Key Points:

- - Overlapping FVGs with support and resistance levels can create stronger signals.

- - Increased buying or selling interest at overlapping levels enhances reliability.

- - Seek areas where FVGs coincide with multiple key price levels for more robust trading opportunities.

In conclusion, to improve your trading strategy involving FVGs, focus on their context, ensure they are unused, prioritize higher timeframes, and seek overlapping signals with other key price levels. By adopting this comprehensive approach, you can enhance your ability to pinpoint reliable trading opportunities.