Unlocking the Power of Supply and Demand Strategy in Trading

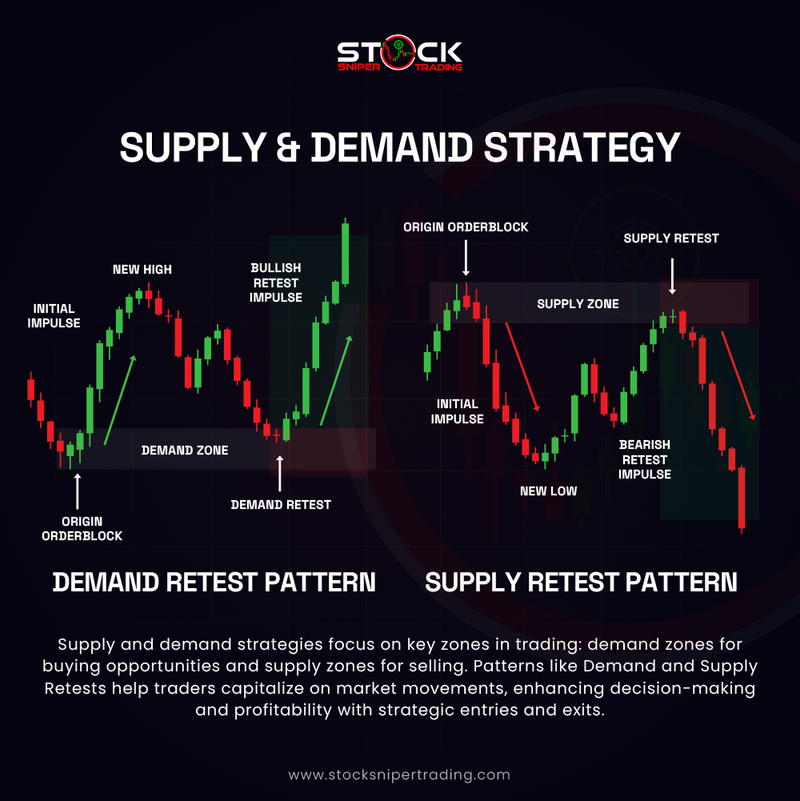

In the fast-paced world of trading, understanding supply and demand dynamics is essential for making informed decisions. Two popular patterns used within this framework are the Demand Retest Pattern and the Supply Retest Pattern. These patterns help traders identify key entry and exit points to maximize profit potential. Let’s dive into what makes these patterns significant and how you can leverage them in your trading strategy.

The Demand Retest Pattern: Capturing the Buying Surge

The Demand Retest Pattern is a powerful tool for spotting potential buying opportunities. This pattern revolves around key price levels called demand zones, which function as robust support areas where buying interest surpasses selling pressure.

Key Components:

Origin Orderblock: This is where a cluster of buying orders commences, creating an initial upward impulse and forming a demand zone.

Initial Impulse: A strong upward price movement begins from the origin orderblock, signaling the start of bullish momentum.

New High: The price reaches new heights, reflecting solid buying strength.

Demand Retest: The market revisits the established demand zone, offering a strategic entry point for traders to go long.

Bullish Retest Impulse: Following the retest, an upward price movement confirms the demand zone's strength, continuing the trend.

Trading Strategy Insights:

- - Support Levels: Demand zones serve as critical support areas, often leading to significant upward price moves.

- - Market Psychology: Demand retests capitalize on buyers’ renewed confidence as prices return to attractive levels.

- - Confirmation Tools: Utilize additional technical indicators, such as RSI or moving averages, to enhance confidence in a bullish retest.

- - Risk Management: Set stop-loss orders just below the demand zone to protect against unexpected downturns.

The Supply Retest Pattern: Navigating Selling Opportunities

Conversely, the Supply Retest Pattern is designed to identify selling opportunities. It focuses on supply zones, which are high-resistance levels where selling pressure dominates.

Key Components:

Origin Orderblock: This marks the initiation of a sell-off, creating a downward impulse and defining a supply zone.

Initial Impulse: The first major downward movement occurs, setting the tone for a potential downtrend.

New Low: As the price dips to new lows, the selling momentum intensifies.

Supply Retest: The market revisits the supply zone, presenting a chance for traders to enter short positions.

Bearish Retest Impulse: A subsequent downward movement confirms the zone's strength and continues the bearish trend.

Trading Strategy Insights:

- - Resistance Levels: Supply zones act as formidable resistance areas, often reversing upward price actions.

- - Trader Sentiment: Supply retests exploit sellers’ regained control and strategic positioning during market pullbacks.

- - Validation Techniques: Incorporate indicators like MACD or stochastic oscillators to verify the bearish signal strength.

- - Protection Measures: Deploy stop-loss orders above the supply zone to safeguard against potential rebounds.

Conclusion

Mastering the Demand and Supply Retest Patterns can significantly enhance your trading strategy by pinpointing precise entry and exit points. By understanding these patterns, traders can leverage the natural flow of market dynamics to their advantage. Combine these patterns with solid risk management practices and complementary technical indicators to optimize your trading outcomes. Remember, successful trading is not about predicting markets but reacting intelligently to the price actions they present.

By integrating these strategies into your trading toolkit, you're well on your way to making more informed and strategic trading decisions.