In this trade breakdown, we’ll explore a Gold (XAU/USD) setup that capitalized on a classic break and retest strategy. The market initially gave a strong impulse breakout, signaling potential bullish momentum. Instead of jumping in immediately, we waited for confirmation with a retest at a key level, leading to a 230 pips gain with no drawdown. This trade exemplifies how combining strong technical analysis with proper entry strategies can lead to consistent success in the markets.

Breakdown of the XAU/USD (Gold) Trade:

Scalper Pro Alert:

Trade Setup Overview:

- - Entry: Long XAU/USD at 3295.87

- - Stop Loss (SL): 75 pips

- - Take Profit (TP): 150+ pips, which hit 230 pips in this case.

Initial Impulse Breakout:

- - The price initially broke out strongly with an impulse candle, indicating a potential bullish trend. The breakout above the recent resistance level highlighted the possibility of a move to the upside.

- - This breakout candle demonstrated increased buying pressure, which led traders to consider a long position.

Key Levels:

- - The breakout occurred near a significant price level, and the next target zone for gold was the $3300–$3350 range.

- - However, instead of entering immediately after the impulse candle, traders waited for a break and retest to confirm the validity of the move.

During the Trade:

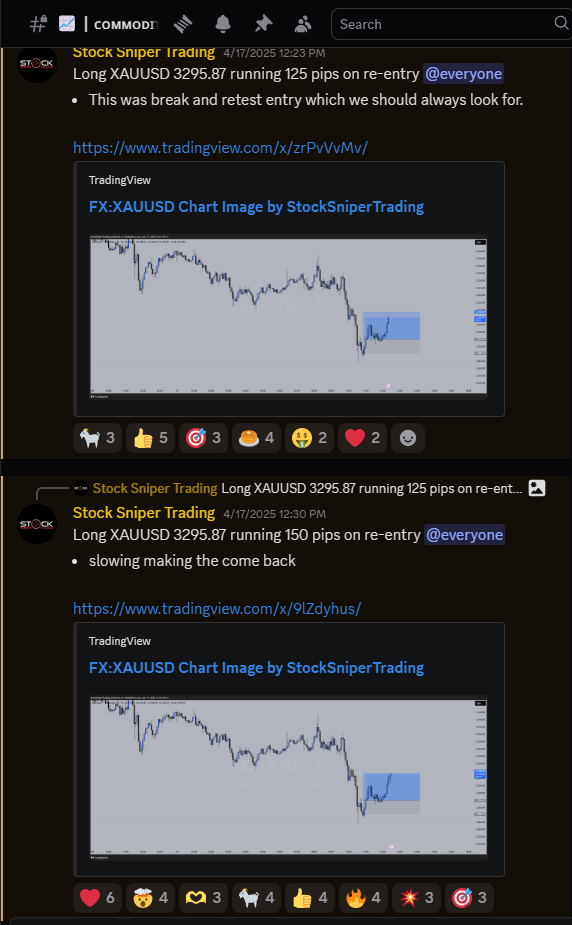

Break and Retest Entry:

- - After the breakout, the price retraced back into the previous resistance-turned-support level, providing an ideal entry for confirmation.

- - This "pullback" into support (the retest) aligned with the market’s natural ebb and flow, providing a low-risk entry point with clear stop-loss placement.

- - The price didn’t break lower, confirming that the support held, and the bullish trend remained intact.

Entry Confirmation:

- - The entry trigger was confirmed by the price respecting the support level, with a small bullish candle or pattern forming as the price bounced back, suggesting the trend was likely to continue.

- - Risk-to-reward ratio was favorable, with a 75-pip SL and a target of 150+ pips.

After the Trade:

Smooth Price Movement:

- - After the perfect break and retest, the price moved higher without any significant retracement, hitting the take profit (TP) level, providing 230 pips of profit.

- - This trade executed without any drawdown, showing that the confirmation from the break-and-retest strategy worked effectively.

Final Outcome:

- - Result: +230 pips, the price moved steadily upward after the retest, confirming the initial analysis was correct.

- - The entry was high probability due to the clean breakout, followed by a well-defined retest at the support level.

Summary:

- - This trade illustrates the power of combining breakout trading with a break-and-retest strategy.

- - The initial impulse candle gave the first signal of a potential trend shift, and the retest allowed for a low-risk entry with minimal drawdown.

- - By waiting for confirmation and sticking to a well-planned risk-to-reward ratio, the trade ended up hitting the target of 230 pips with zero drawdown.

This is a great example of a high probability trade based on clear price action and market structure!

Discord Screenshots: