Understanding Order Blocks (OB) and Market Reactions

Order Blocks (OB) are critical tools for traders to predict significant market movements based on accumulations of limit orders. Below are descriptions of charts illustrating OB concepts, complete with strategic points to improve trading decisions.

The Impact of Order Blocks (OB) on Market Movements

This chart demonstrates how Order Blocks (OB) act as zones with substantial limit orders, causing notable market reactions when prices approach. These areas often align with institutional trading, where large buy or sell orders accumulate, signaling potential reversals or continuations as market participants react.

Key Points:

- - Identification of Order Blocks: Look for areas with clustered orders that can lead to strong price movements.

- - Strategic Entry/Exit: Use OBs to refine entry and exit points by anticipating market reactions when price revisits these zones.

- - Institutional Activity: OBs often indicate areas of interest for large institutions, providing insight into potential price movements.

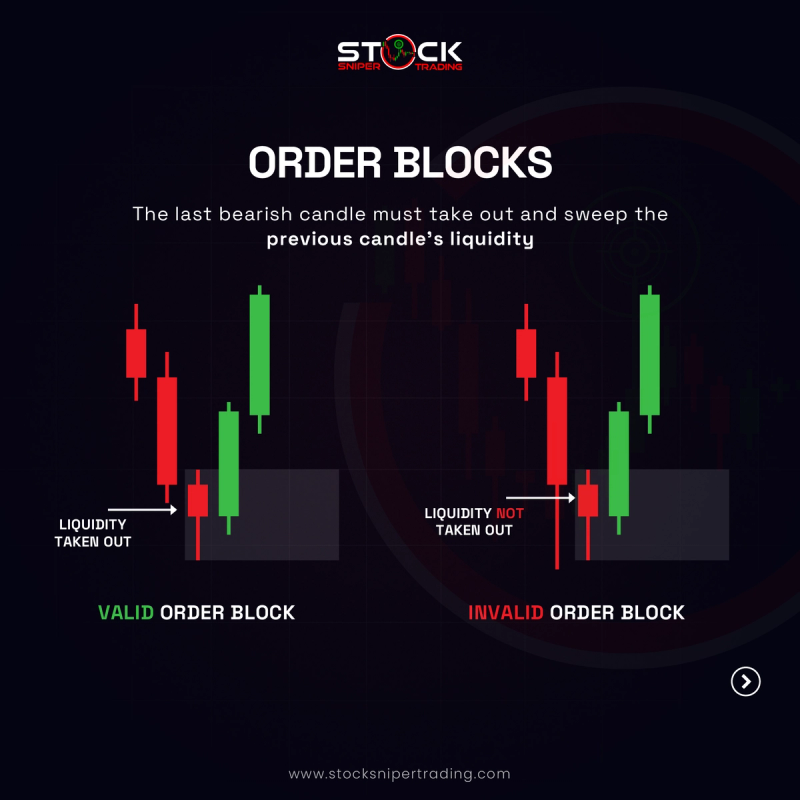

Valid vs. Invalid Order Blocks Based on Liquidity Sweeps

This pair of charts highlights a valid and an invalid Order Block based on liquidity. A valid OB is marked by the last bearish candle sweeping the previous candle’s liquidity, ensuring liquidity is captured before a potential reversal. In contrast, the invalid OB lacks this liquidity sweep, reducing the chance of strong market moves.

Key Points:

- - Valid Order Blocks: Require a liquidity sweep, ensuring robust market reactions post-sweep.

- - Invalid Order Blocks: Lack liquidity sweeps, often failing to result in strong price movements.

- - Liquidity as a Trigger: Ensuring liquidity is taken out provides confirmation for potential reversals or continuations.

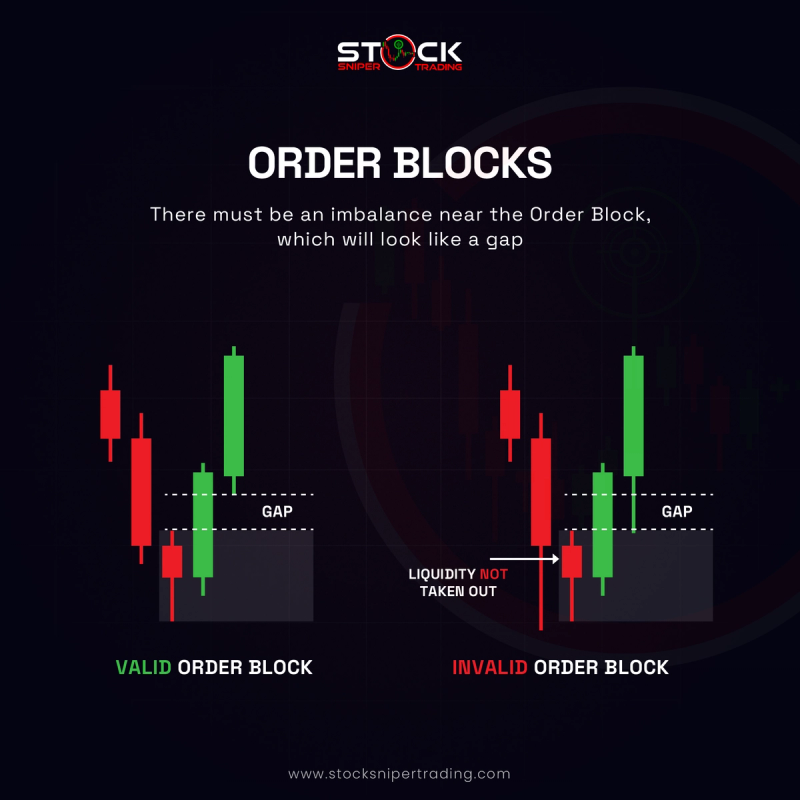

Order Blocks with Imbalances and Market Implications

This set of charts contrasts a valid Order Block with a clear price imbalance (gap) and an invalid one without sufficient imbalance. Valid OBs feature gaps that represent liquidity voids, attracting price back to fill these gaps and reinforcing the strength of the order block. Invalid OBs lack such imbalances, often resulting in weaker market reactions.

Key Points:

- - Imbalance as a Magnet: Gaps near Order Blocks act as magnets for price movement, increasing the likelihood of a revisit.

- - Detecting Market Strength: A valid OB with an imbalance indicates strong market conviction, guiding traders in predicting significant moves.

- - Gap Analysis: Use gap presence as an additional validation criterion for the strength and reliability of Order Blocks.