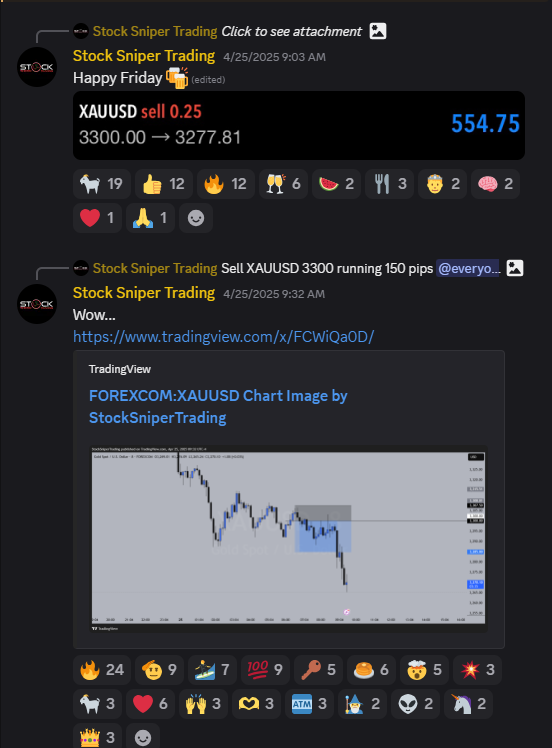

XAUUSD Trade Recap – April 25, 2025

Sell Setup at 3300 | SL: 75 pips | TP: 150+ pips

Introduction

In this trade recap, we break down a recent XAUUSD (Gold) short setup that was shared with our community.

This example highlights the importance of trading with the higher timeframe trend, waiting for proper confirmations like a break-and-retest, and always applying strict risk management principles.

Let's walk through the full trade idea — from the planning stage to execution and outcome — and identify the key takeaways for consistent trading success.

Before the Trade: Setup and Reasoning

Leading into the session, Gold was trading around the 3300 mark after a moderate bounce from recent lows. However, the broader trend on the higher timeframes (4H and Daily) remained clearly bearish, as Gold had been consistently printing lower highs and lower lows.

Several factors aligned for a high-probability sell opportunity:

- - Higher Timeframe Bearish Bias: Despite intraday retracements, the dominant momentum pointed downward.

- - Break and Retest Pattern: On lower timeframes (5M and 8M charts), price broke cleanly below the 3300 level, then retested it as new resistance. This presented a textbook opportunity to enter short after confirmation.

- - Risk Management Strategy:

- - Entry: Sell near 3300 after the retest.

- - Stop Loss: 75 pips above entry, protecting against minor fakeouts or volatility spikes.

- - Take Profit: Targeting 150+ pips for a 2:1 or better Reward-to-Risk ratio, adhering to professional trading standards.

Patience and discipline were key, waiting for the clean retest rather than jumping in prematurely.

After the Trade: Execution and Results

After tagging the 3300 resistance zone:

- - Price struggled to break higher, creating multiple rejection wicks — clear evidence that sellers were active.

- - Soon after, momentum shifted bearish, and Gold sold off aggressively in line with the higher timeframe trend.

- - The move quickly traveled toward our profit target, delivering a full 150+ pips while respecting the pre-defined risk parameters.

- - Risk management played a critical role — even if the trade hadn't worked, the capped loss would have been minimal compared to the potential reward.

This was a textbook example of waiting for the market to come to us, trading with trend, and letting clear structure drive decision-making.

Final Thoughts

This trade perfectly demonstrates the power of trading with the trend, proper technical confirmation, and strict risk management.

- - By aligning with the bearish higher timeframe bias,

- - Waiting for a clean break-and-retest entry,

- - And managing risk properly from start to finish,

We positioned ourselves for a high-quality, high-probability trade that worked exactly as planned.

Remember: consistency in execution matters more than any single trade outcome.

Stay patient, stick to your trading rules, and let the setups come to you — just like this one.