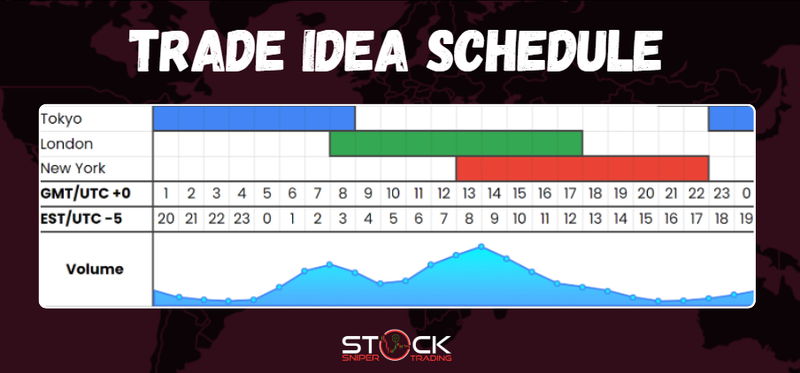

Trading the financial markets effectively requires an understanding of market hours and the best times to engage in trading activities. The markets operate through various sessions that correspond to different financial centers around the world, specifically the Sydney, Tokyo, London, and New York sessions. Here’s a detailed breakdown of each session, along with the best and worst times to trade:

Major Trading Sessions

1. Sydney Session (Asia-Pacific)

- Opening: 5 PM EST

- Closing: 2 AM EST

- Characteristics:

- This session often sees lower volatility and volume compared to other sessions.

- It is influenced by the Asian markets, with commodities such as gold and oil being particularly active due to Australia being a major exporter.

- Best for: Traders interested in commodities or those looking to capture moves in overnight markets.

2. Tokyo Session (Asian)

- Opening: 7 PM EST

- Closing: 4 AM EST

- Characteristics:

- The Tokyo session can be volatile due to major Asian economic data releases.

- Currency pairs involving the Japanese yen (such as USD/JPY) are especially active during this time.

- Best for: Forex traders focusing on Asian currency pairs and traders looking to react to relevant economic releases.

3. London Session (European)

- Opening: 3 AM EST

- Closing: 12 PM EST

- Characteristics:

- The London session is the most significant and one of the most active trading sessions, often experiencing the highest volume.

- Major economic releases from Europe can lead to significant movements in the markets.

- Best for: Day traders and scalpers due to increased volatility and major price movements.

4. New York Session (North American)

- Opening: 8 AM EST

- Closing: 5 PM EST

- Characteristics:

- The New York session sees a crossover with the London session for a few hours, leading to some of the highest trading volumes.

- Influenced by U.S. economic data releases and news, this session can often lead to strong price movements.

- Best for: Traders looking to take advantage of U.S. market movements and increase volatility as the day progresses.

Best Times to Trade

- Overlapping Sessions:

- London/New York Overlap (8 AM - 12 PM EST): This is arguably the best time to trade due to high liquidity and volatility. Many major financial institutions and traders are active during this time, leading to significant price movements.

- Key Economic Releases:

- Plan to trade during major economic releases (e.g., Non-Farm Payrolls, GDP figures, interest rate decisions) as these can result in substantial market volatility and opportunities.

Worst Times to Trade

- Holiday Periods:

- Trading during holidays generally results in low volume and volatility, often leading to unpredictable price movements. Major holidays include Christmas, New Year’s, and Independence Day in the U.S.

- Market Openings and Closings:

- The first 30 minutes and last 30 minutes of trading in any session tend to experience increased volatility due to order filling and profit-taking. This can lead to unpredictable price action, making it a risky time for traders.

- Midday Lull:

- Generally, the period between 12 PM and 3 PM EST, especially during the New York session, can see reduced activity as traders take lunch breaks. This can lead to lower volatility and fewer trading opportunities.

- During Major Events:

- Trading during major geopolitical events or major announcements not directly related to economic data can lead to unpredictable and risky market behavior.

Conclusion

Understanding the best and worst times to trade is crucial for developing a successful trading strategy. The key takeaway is to focus on the overlap of major sessions—especially the London/New York overlap—for maximum trading opportunities. Avoid trading during low activity periods or around significant news/events unless you are prepared for the inherent risks involved. By keeping these factors in mind, you can better time your trades for optimal results.

Join the Sniper Team and take your trading to the next level Stock Sniper Trading