Different Supply Strength Zones

In the dynamic world of financial markets, understanding supply strength zones is crucial for traders and investors. Supply zones represent specific price levels where sellers outnumber buyers, potentially pushing prices down. These zones are categorized into strong, normal, and weak, each distinguished by the intensity of selling pressure. Let’s dive deeper into these zones and explore how they influence market behavior.

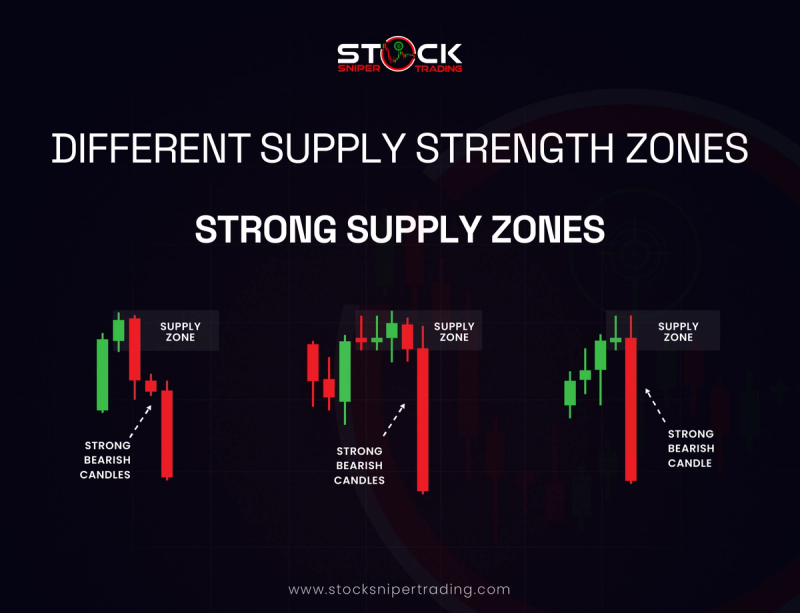

1. Strong Supply Zones

Strong supply zones emerge when sellers dominate the market significantly, causing a noticeable reversal in price direction. These zones often coincide with levels of recent price highs where traders previously sold their positions in large volumes. A strong supply zone is characterized by rapid price declines as sellers continue to overwhelm buyers. Traders identify these zones using historical data and technical indicators like resistance levels. Recognizing strong supply zones can be valuable for anticipating potential market downturns and making strategic trading decisions.

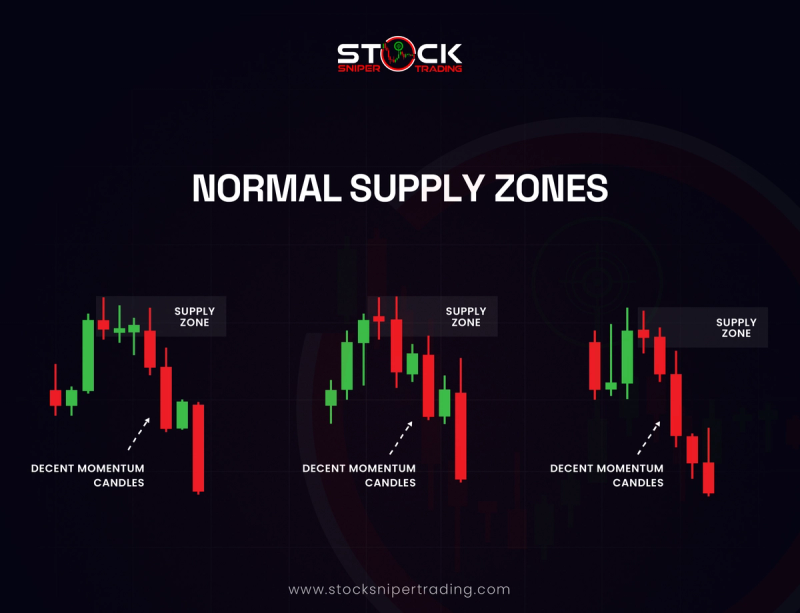

2. Normal Supply Zones

Normal supply zones occur more frequently and indicate moderate selling pressure. Unlike strong supply zones, these do not cause drastic price reversals but can slow down an upward price trend. Normal supply zones often align with standard resistance levels, where historical data shows a balanced struggle between buyers and sellers, temporarily halting upward price movements. Traders and investors might notice price consolidation in these zones before the market decides its next move. Monitoring normal supply zones can help traders refine their entry and exit strategies, focusing on the natural ebb and flow of market activity.

3. Weak Supply Zones

Weak supply zones exhibit minimal selling pressure and have a limited impact on price movements. They often represent minor resistance areas, where sellers are not sufficiently dominant to influence a significant downward shift. These zones might temporarily halt a price rise but are likely to be breached as buying interest exceeds seller resistance. Weak supply zones are typically less reliable for making substantial trading decisions, but they still offer insight into minor price fluctuations and market sentiment.

By understanding these supply zones, traders can better interpret market mechanics and enhance their strategies for buying and selling assets. Identifying whether sellers hold strong, normal, or weak sway over prices guides decisions, aiding in managing risks and optimizing potential gains. Ultimately, mastery of supply strength zones equips traders with the knowledge to navigate the often unpredictable waters of the financial markets.