Breakdown of the Scalper Pro Trade Idea (Long XAUUSD on April 11th, 2025):

Introduction to Gold:

Gold has been a vital asset for centuries, valued not only as a precious metal but also as a symbol of wealth and security. In the modern world, it serves as both an investment vehicle and a hedge against inflation and economic uncertainty. It is used in various industries, including electronics, medicine, and jewelry, but it is especially prominent in financial markets as a store of value. Central banks hold large reserves of gold to stabilize their currencies and economies. Investors and traders alike use gold to diversify their portfolios, with its price often moving inversely to stock markets and the U.S. Dollar. Gold also plays a key role in geopolitical events, with shifts in global tensions often driving increased demand for the metal.

Trade Setup:

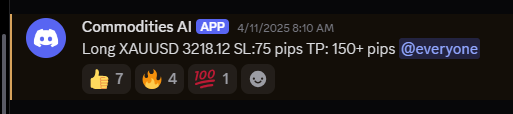

The trade idea sent on April 11th, 2025, at 8:10 AM EST for XAU/USD involved a long position at 3218.12, with a stop loss of 75 pips and a take profit (TP) set to target 150+ pips. This was a pullback entry into a higher time frame demand zone, a common and effective strategy for identifying potential reversal points.

- - Entry: Long position at 3218.12 (XAU/USD).

- - Stop Loss (SL): 75 pips below the entry, at 3211.37 (3218.12 - 75 pips).

- - Take Profit (TP): 150+ pips, aiming for 3368.12 (3218.12 + 150 pips).

The trade setup was confirmed by a perfect break-and-retest entry, which is a solid technical pattern where the price breaks through a significant level, then retraces back to it, providing a confirmation for the direction of the move. Given the demand zone's strength and the price action's confirmation, the trade was highly likely to succeed, and it eventually hit the full take profit. This trade was shared with the Discord Trade Idea group, highlighting the solid technical analysis behind the setup and the potential for profit.

This trade idea involves entering long on XAU/USD (Gold) with a defined risk-to-reward ratio. Let's break this down with proper risk management:

Risk Management:

Position Sizing: The first step in effective risk management is calculating the appropriate position size. This depends on your account size and risk tolerance. Typically, risk management suggests risking no more than 1-2% of your total account on a single trade.Example: If your account size is $10,000 and you choose to risk 1%, this means you can risk $100 on the trade.The formula for position size is: Position Size=Risk in DollarsStop Loss in Pips×Pip ValuePosition Size=Stop Loss in Pips×Pip ValueRisk in Dollars For simplicity, assume the pip value for XAU/USD is $1 per pip (which can vary depending on your broker or account type).If the SL is 75 pips, then: Position Size=10075=1.33 contracts (or lots)Position Size=75100=1.33 contracts (or lots) Thus, risking $100 on this trade would mean entering 1.33 contracts.

Risk-to-Reward Ratio: The risk-to-reward ratio is an important measure of the trade's potential profitability compared to the risk being taken. For this trade, the risk is 75 pips, and the reward (TP) is 150+ pips.This gives a 2:1 risk-to-reward ratio, meaning for every pip you risk, you are aiming to gain 2 pips. This is considered a solid ratio for high-probability trades.

Total Risk: The total risk for this trade is determined by the stop loss of 75 pips. If your position size is 1.33 contracts, the total risk in terms of money would be: 75 pips×1.33 contracts=100 dollars75 pips×1.33 contracts=100 dollars This aligns with the earlier example of risking $100 on the trade.

Target Profit: The TP target is set at 150+ pips, which, if hit, would result in a reward of: 150 pips×1.33 contracts=200 dollars150 pips×1.33 contracts=200 dollars This ensures a potential profit of $200, confirming the 2:1 risk-to-reward ratio.

Conclusion:

By using proper risk management:

- - You are risking $100 on this trade (1% of a $10,000 account).

- - The trade has a 2:1 risk-to-reward ratio, which means for every $1 you risk, you could potentially gain $2.

- - The position size is 1.33 contracts, making sure you don't exceed the calculated risk of $100.

This trade setup, with a defined SL and TP, is well-managed and adheres to good trading principles. The break-and-retest entry after the pullback into the demand zone further supports the idea of this trade reaching its profit target, as it follows a solid technical pattern for higher probability setups.