Finding the Best Orderblocks in Trading: A Step-by-Step Guide

In the world of trading, identifying and utilizing orderblocks can provide insights into potential market movements and opportunities. However, not all orderblocks are created equal, and discerning the most promising ones can enhance your trading strategy. Here’s a step-by-step guide to finding the best orderblocks:

Step 1: Contextual Trading Using Previous Price Displacement Arrays (PD Arrays)

Rather than trading any visible orderblock on a lower timeframe, gain a more strategic perspective by analyzing Previous PD Arrays such as Fair Value Gaps (FVGs). Orderblocks that form in response to these gaps often present better opportunities.

Description: By aligning orderblocks with previous FVGs, traders leverage the market inefficiencies created by these gaps, which can often lead to meaningful price corrections or continuations. This alignment signals that the market acknowledges and reacts to these perceived value discrepancies, enhancing the validity of the orderblock.

Step 2: Observing Fair Value Gaps Left by Orderblocks

A critical observation is the Fair Value Gap left behind by an orderblock after it is created. An FVG following an orderblock increases its likelihood of holding its position effectively.

Description: The presence of an FVG signifies a momentary price imbalance, drawing attention to the orderblock's robustness. Such orderblocks often attract liquidity as the market tends to fill these gaps, thereby increasing the probability that the price will revisit these levels, affirming the orderblock's strength.

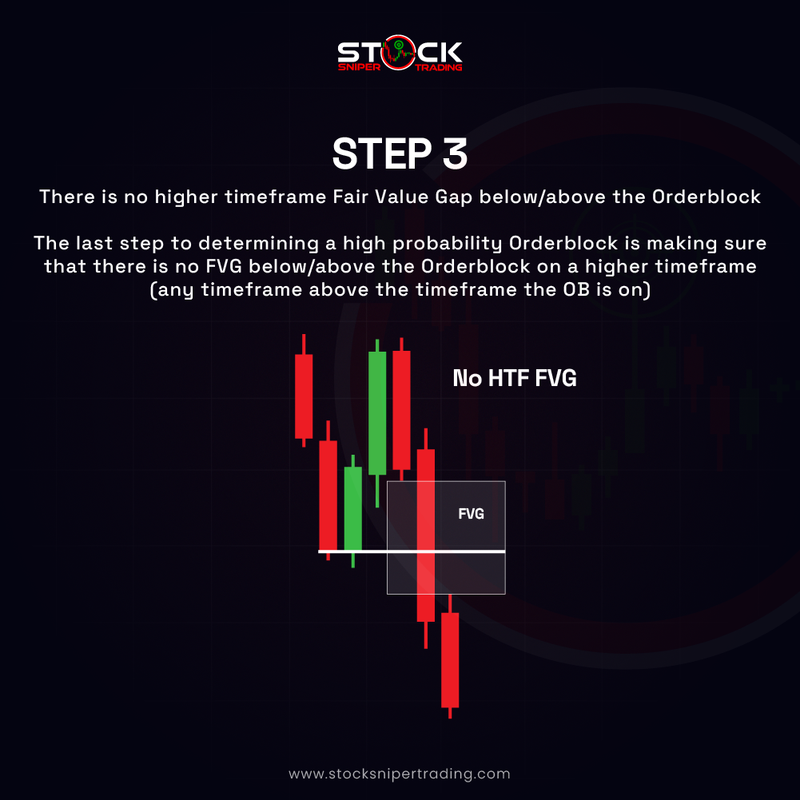

Step 3: Higher Timeframe Confirmation

Ensure that no Fair Value Gaps exist immediately below or above the orderblock on any higher timeframe than the one you are analyzing. This condition helps confirm the orderblock’s integrity and reduces the risk associated with potential resistance or support from other levels.

Description: Examining higher timeframes provides a macro view and ensures that the identified orderblock stands without conflict from lingering gaps that could divert price movements. This comprehensive analysis protects against premature reversals or continued trends that contradict your position, facilitating more informed and strategic trading decisions.

Conclusion:

Utilizing orderblocks effectively requires a blend of technical insight and strategic foresight. By integrating analysis of Fair Value Gaps and higher timeframes into your trading routine, you can more reliably identify high-probability orderblocks. This structured approach not only enhances your trading accuracy but also positions you to capitalize on market movements with greater confidence. Understanding and incorporating these elements into your trading methodology is key to unlocking the potential of orderblocks as a powerful tool in technical analysis.