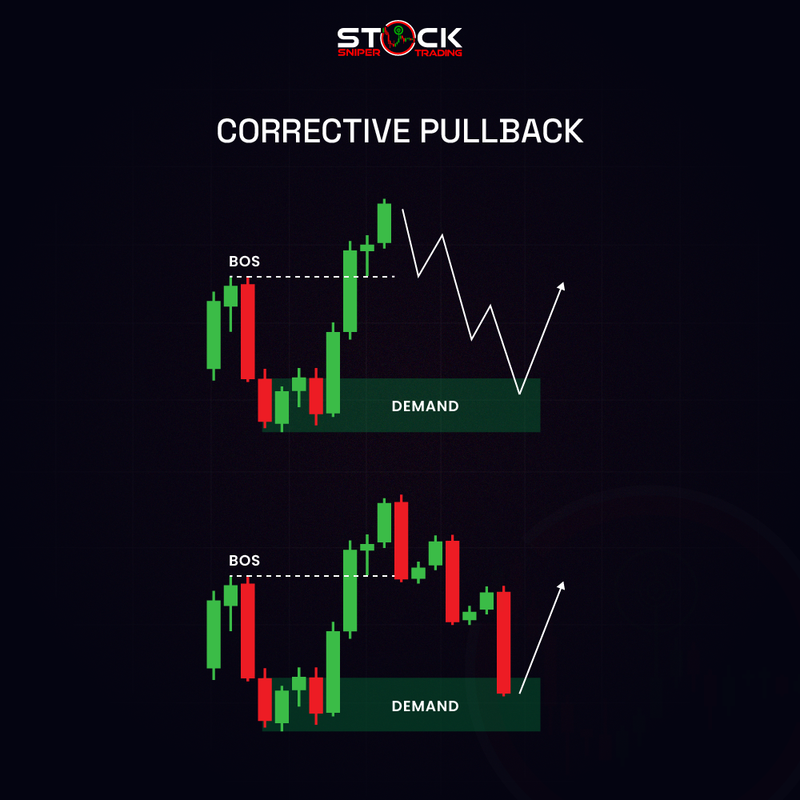

1. Correction Pullback

A correction pullback occurs within the context of a prevailing trend (either bullish or bearish) and refers to a temporary reversal in the price movement. Here are the key characteristics:

- - Nature and Intent: This pullback serves as a natural adjustment in the market, allowing an asset to retrace a portion of its recent gains (in an uptrend) or losses (in a downtrend). It aims to give the market a chance to stabilize before continuing the primary trend.

- - Duration: Correction pullbacks can vary in duration, typically lasting from a few hours to several days, depending on market conditions and the strength of the prevailing trend.

- - Characteristics: During a correction, price movements may create lower local highs or higher local lows in an uptrend or the opposite in a downtrend. This indicator allows traders to identify potential entry points, where they might consider buying in an uptrend or selling in a downtrend as the price approaches key support or resistance levels.

- - Market Psychology: Traders’ emotions often play a role during correction pullbacks. Some may view it as an opportunity to enter the market at a more favorable price, while others may panic and exit their positions, creating volatility.

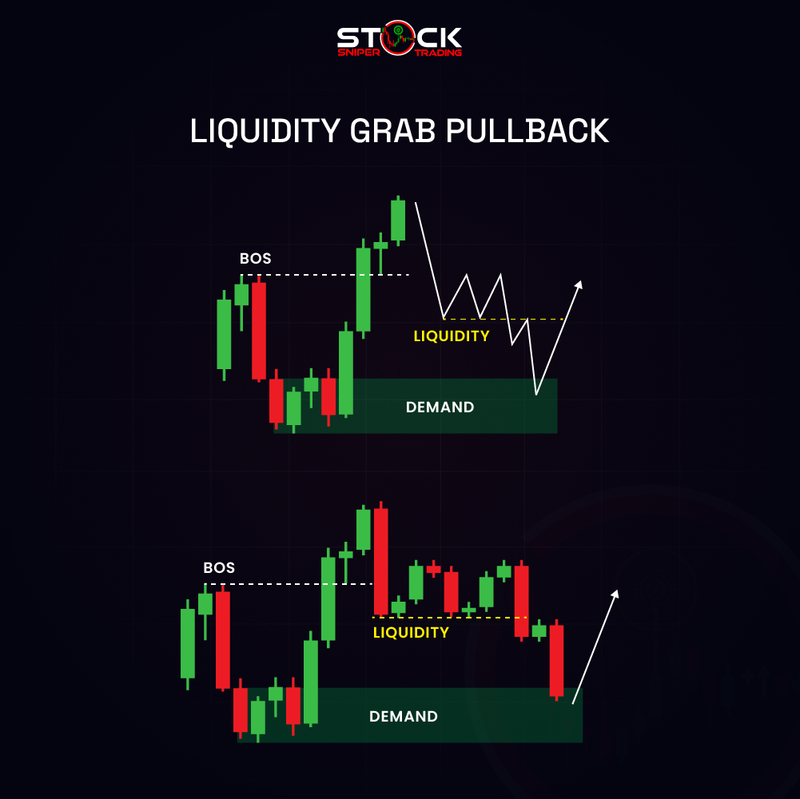

2. Liquidity Grab Pullback

A liquidity grab pullback refers to price movements that are driven by the act of triggering stop-loss orders or attracting market participants to specific price levels. Here are the main characteristics:

- - Nature and Intent: This pullback is usually caused by market makers or large institutional traders who intentionally push the price to specific levels to "grab" liquidity. They do this to fill their orders, whether they are going long or short, and can often result in sudden and sharp price reversals.

- - Mechanism: When the price approaches areas where many traders have set stop-loss orders (often below support levels in an uptrend or above resistance levels in a downtrend), the liquidity grab occurs. Once these stop orders are triggered, it can lead to increased volatility and quick moves in the opposite direction.

- - Duration: Liquidity grab pullbacks are typically short-lived, often lasting only a few minutes to hours, as they rapidly push prices towards the intended level before reversing sharply.

- - Market Effects: This type of pullback can create opportunities for experienced traders to capitalize on quick price movements, but it can also lead to unexpected losses for those who are not prepared for sudden volatility.

Both correction pullbacks and liquidity grab pullbacks are important concepts in trading. The former indicates a natural market pause for adjustment within a trend, while the latter signifies intentional price movements driven by liquidity needs. Understanding these pullbacks can help traders make more informed decisions based on market behavior and price action.