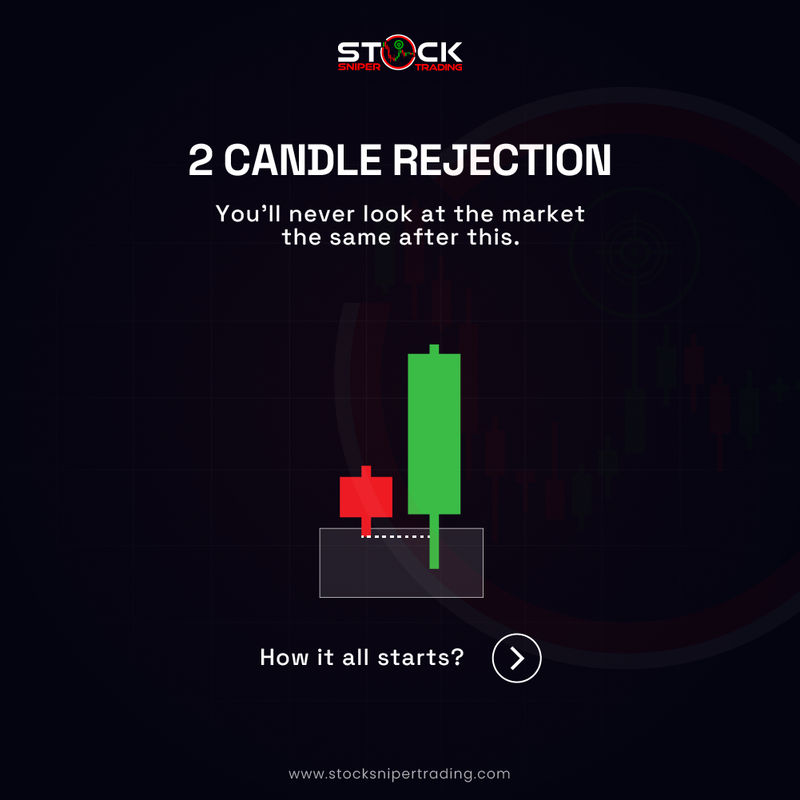

Understanding the 2 Candle Rejection (2CR) Strategy

The 2 Candle Rejection (2CR) is an insightful approach within Candle Science that enables traders to accurately assess whether a PD Array—an important level or zone on a chart—is being respected. It provides a systematic method to interpret how price action interacts with these levels by focusing on the behavior of individual candlesticks.

How the 2CR Strategy Works:

- - Initial Assessment: As the price approaches a PD Array, observe the first candlestick that engages with this level. This candlestick should show distinct signs of rejection, indicating that the level is holding firm. Such signs might include an immediate retracement or a wick forming at the level, suggesting strong selling or buying pressure.

- - Secondary Confirmation: If the first candlestick does not demonstrate clear rejection, attention shifts to the second candlestick. In a bullish scenario, this second candle may dip slightly below the low of the first candle before reversing upward. Conversely, in a bearish scenario, it might breach the high of the first candle before dropping. This sweeping action suggests a false breakout, followed by movement in the expected market direction.

The elegance of the 2 Candle Rejection strategy lies in its straightforward approach. By mastering this technique, traders can sharpen their ability to identify valid price rejections at key levels, enhancing their trading precision and strategy effectiveness.

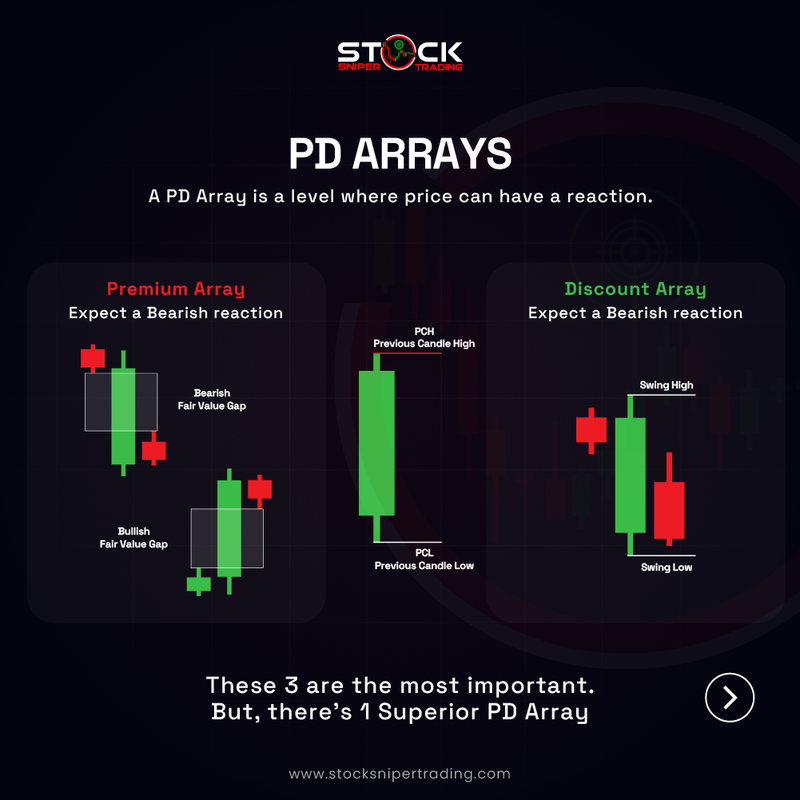

PD Arrays:

- - Illustrates key price levels known as PD Arrays.

- - These levels are where the price is likely to react, indicating potential reversal or continuation points on the chart.

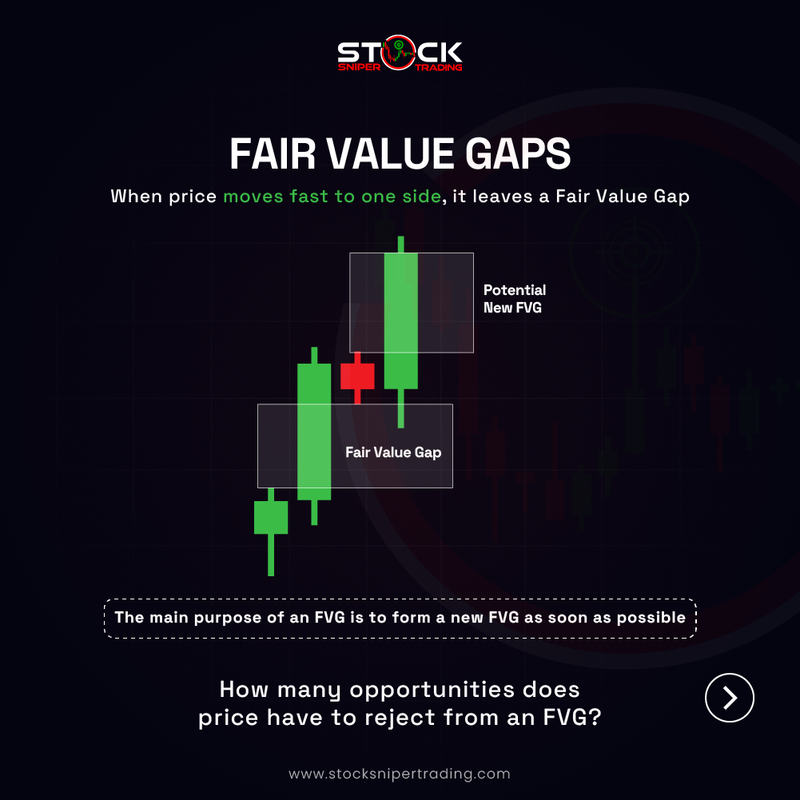

Fair Value Gaps (FVG):

- - Shows zones where price moves swiftly in one direction, creating a gap between candlesticks.

- - Highlights areas that may later be revisited as the market seeks to balance the price.

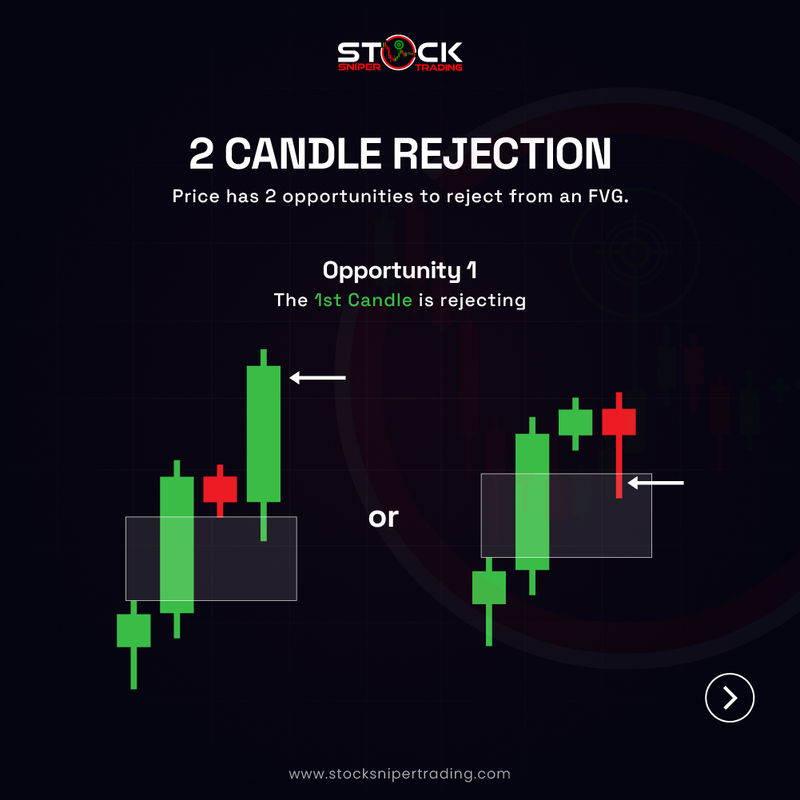

Opportunities for Rejection from FVG:

- - Opportunity 1: The first candle might show rejection from the FVG, suggesting a continuation of the current trend.

- - Opportunity 2: If the first candle doesn’t reject and the second candle sweeps the first candle’s low, it signals a possible reversal unless consolidation follows.

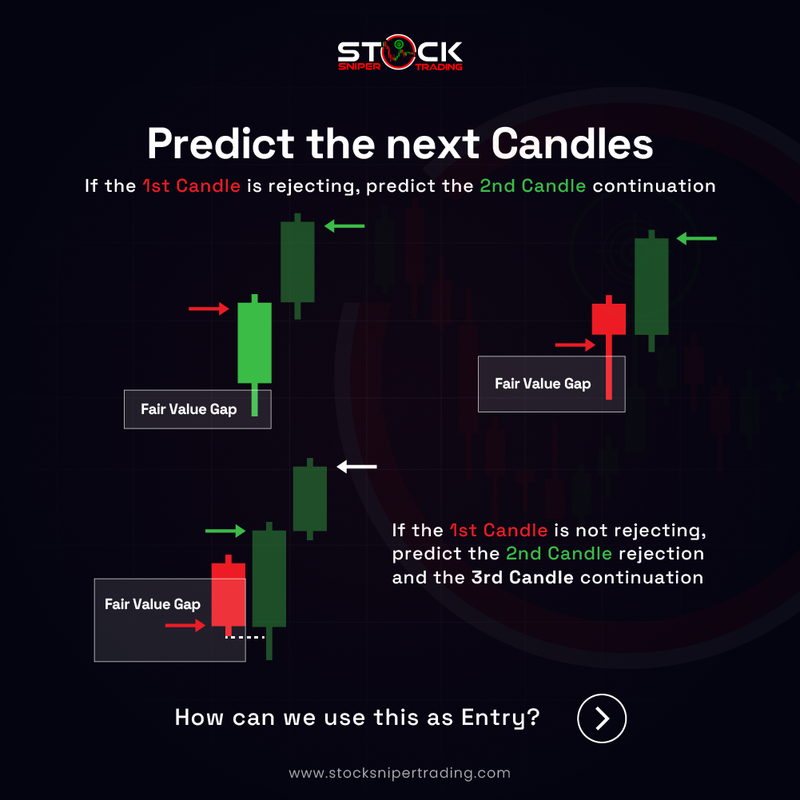

Predicting Future Candles:

- - Emphasizes the predictive power of candle patterns:

- - If the first candle rejects the FVG, the second candle might continue the trend.

- - If the first candle doesn’t reject, anticipate the second candle's potential rejection and the third candle's continuation in the identified direction.

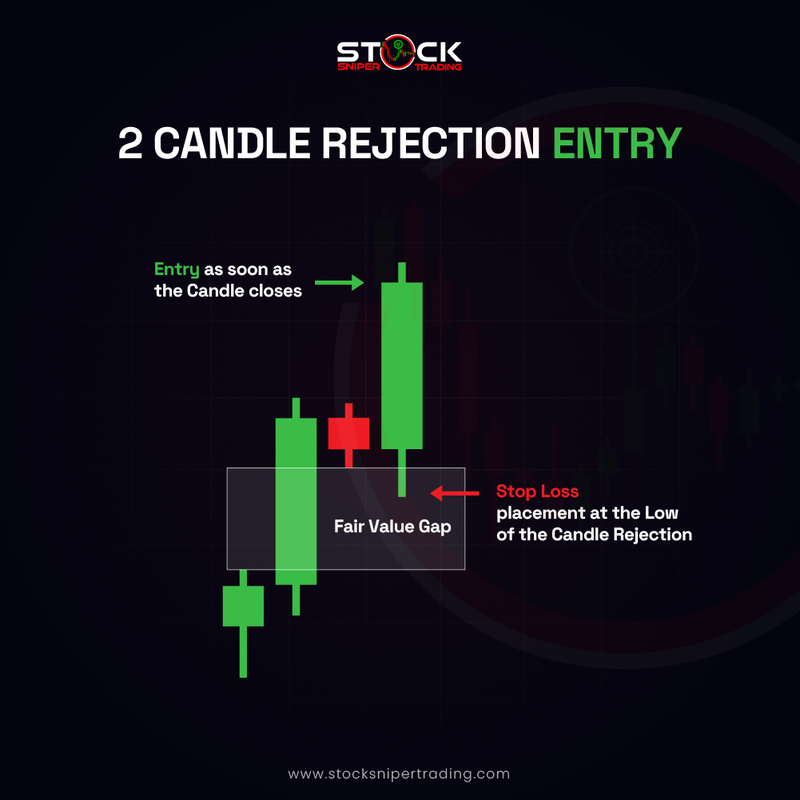

Using Patterns for Entry Points:

- - Point a: Enter a trade immediately after a candle closes with a clear rejection pattern, utilizing its information for timely decisions.

- - Point b: Position a stop loss at the low of the candle that rejects the FVG, providing a calculated risk boundary to protect against adverse moves.

Stop Loss Strategy:

- - Highlight the importance of precise stop loss placement at the rejection low.

- - This strategy helps traders manage risk effectively while affirming their trade setup's validity.