Exploring the One #CANDLE Theory: A Deep Dive into Fair Value Gaps (FVGs)

In the intricate world of trading, the One #CANDLE theory presents a compelling approach to understanding market dynamics through the lens of Fair Value Gaps (FVGs). These gaps occur when there is a significant movement in price, often triggered by impactful news or a surge in market sentiment. Such movements create a visible gap on price charts, highlighting a discrepancy between the current market price and what is perceived as its fair value.

1. Understanding Fair Value Gaps: A Fair Value Gap arises when rapid price changes leave a void, indicating a lack of trading within that range. This gap reflects a temporary imbalance in market valuation, suggesting that the market may naturally seek to correct itself by returning to this untraded area over time. Traders who recognize these gaps consider them as signals that the price could retrace to these levels to restore balance.

2. Identifying Gaps Across Timeframes: Traders employ various timeframes to spot these gaps, each offering unique insights into potential price movements. Whether analyzing short-term charts for quick trades or long-term trends for investment strategies, identifying FVGs helps traders anticipate where the market might seek equilibrium. This analysis becomes a crucial tool in forecasting future price actions.

3. Developing a Trading Strategy: Leveraging FVGs for trading involves using these gaps as potential entry or exit points in trading strategies. For example, a gap up in the market might hint that the current price is overvalued and likely to decline, leading traders to short the asset, anticipating that the price will "fill the gap." Conversely, a gap down might suggest an undervalued asset, presenting a buying opportunity as the market corrects upward.

4. Practical Applications and Considerations: The FVG concept is versatile and can be integrated into diverse trading strategies. It's often paired with other technical analysis tools, such as support and resistance levels, trend lines, and indicators, to enhance decision-making. While FVGs provide valuable insights, successful application requires experience and awareness of external factors that can influence market behaviors, such as economic reports, geopolitical events, and market sentiment.

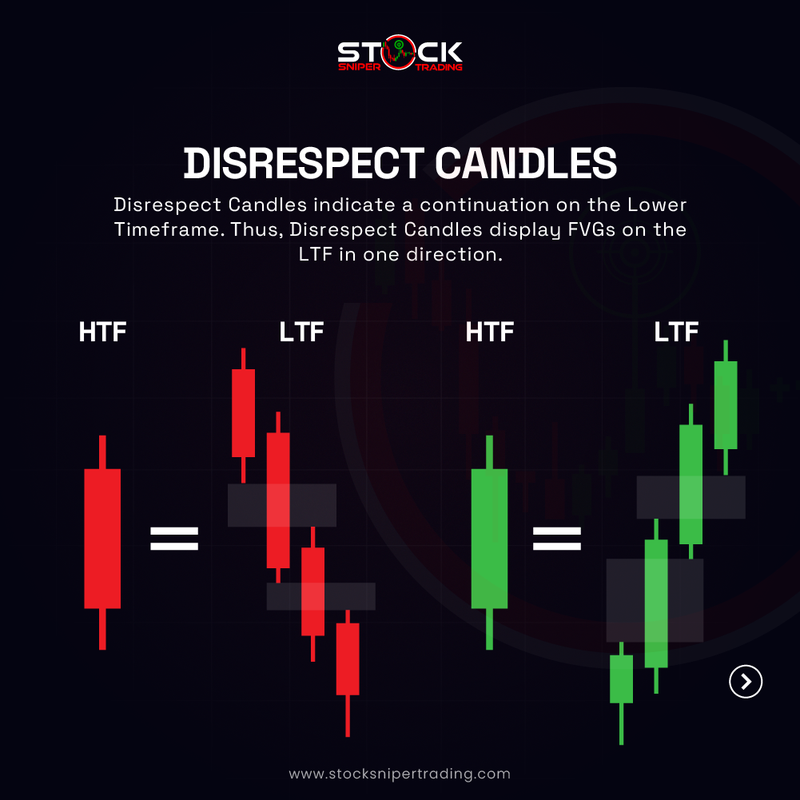

Disrespect Candles:

Disrespect Candles suggest continued market momentum on the Lower Timeframe (LTF), displaying Fair Value Gaps (FVGs) aligned with the ongoing price direction. This pattern helps traders anticipate sustained movements within the current trend.

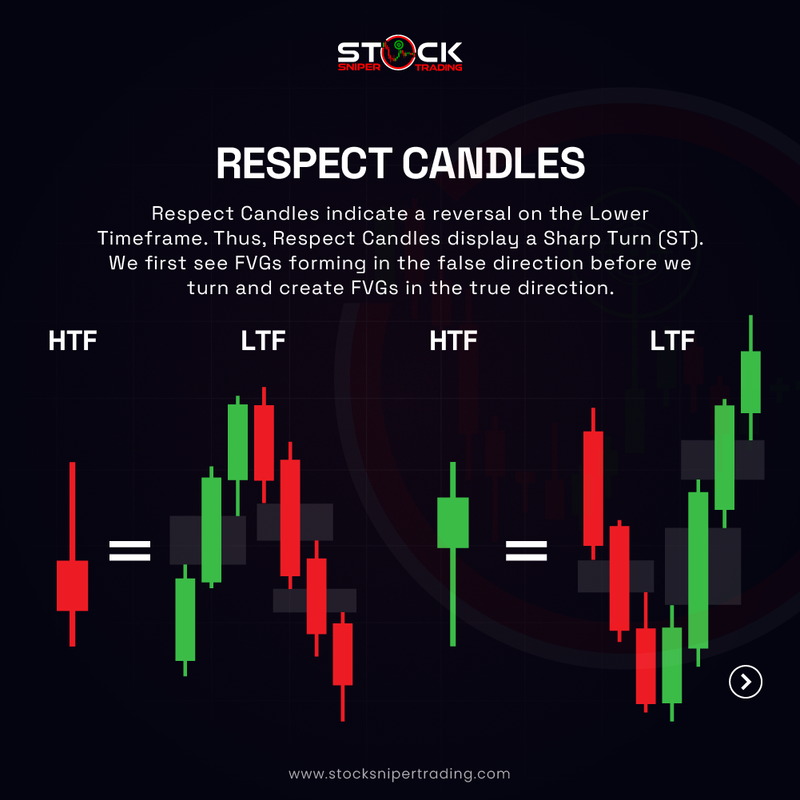

Respect Candles:

Respect Candles signal potential reversals on the Lower Timeframe (LTF). Initially, FVGs form in a misleading direction before sharply turning, establishing new FVGs in the genuine trend direction, indicating a market pivot.

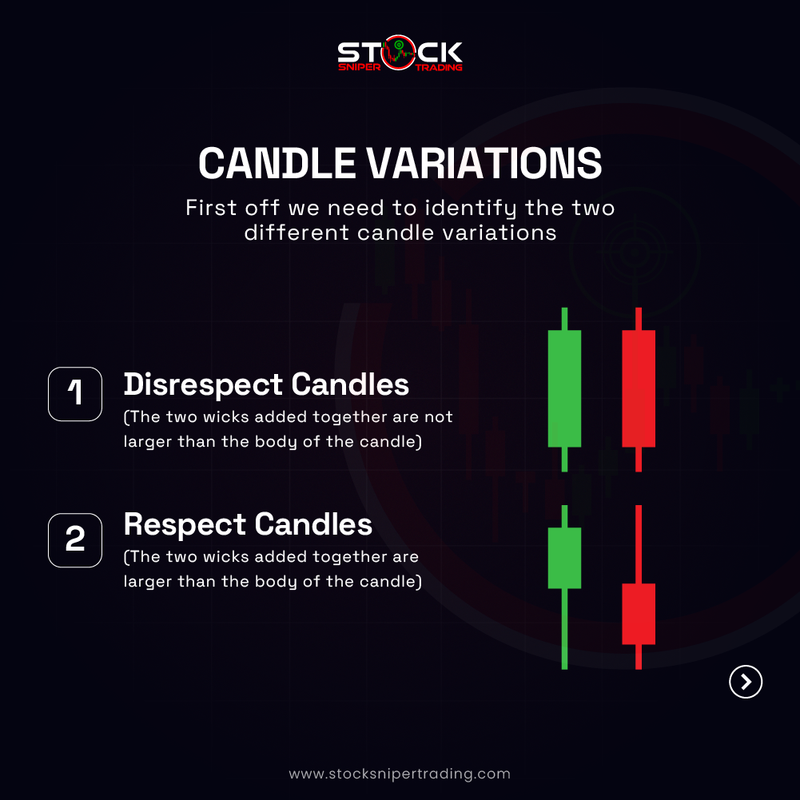

Candle Variations:

Understanding the market requires recognizing two primary candle variations, which signal different market intentions and outcomes. These variations help traders identify potential entry and exit points in their analysis.

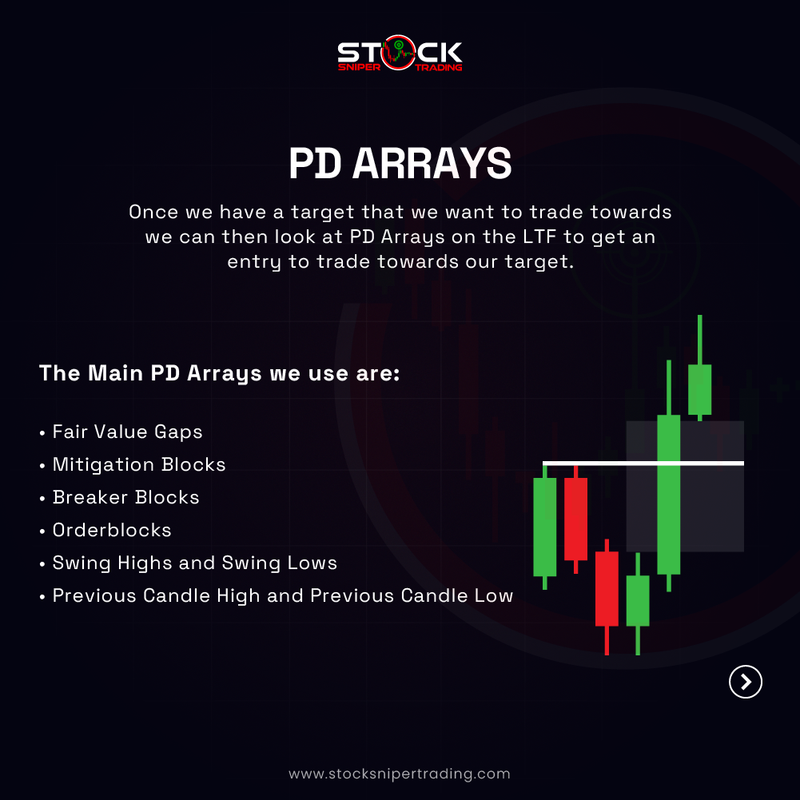

PD Arrays:

After setting a trading target, PD Arrays on the Lower Timeframe (LTF) help pinpoint strategic entry points to efficiently reach that target, enhancing precision in trade execution.

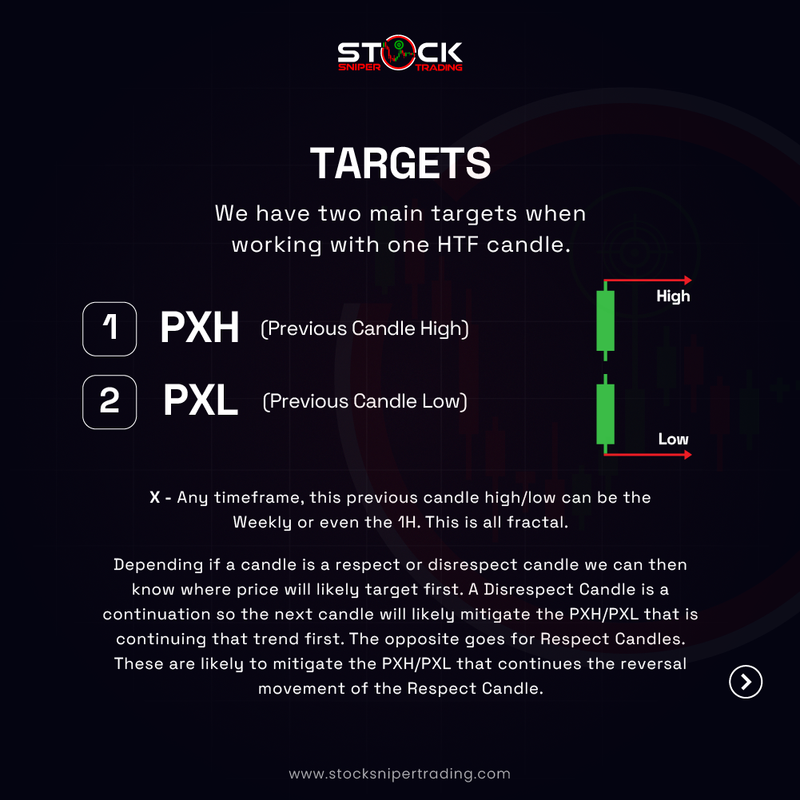

Targets:

In trading with a single Higher Timeframe (HTF) candle, focus on two main targets, which guide entry and exit strategies to maximize potential market movements.

How Do We Put This into Action?:

To implement, analyze the Daily FVG on a 1H Timeframe seeking a 1H Sharp Turn (ST) for entry. This approach aims at the PWH, leveraging previous Weekly Respect Candle highs for strategic advantage.

How Do We Put This into Action? (Example):

Explore practical examples of applying these concepts, demonstrating entry and exit decisions grounded in analyzing FVGs and candle patterns, sharpening your strategic trading skills.

Mastering the use of Fair Value Gaps involves a blend of technical skill and strategic foresight. By incorporating FVG analysis into your trading arsenal, you position yourself to better understand and navigate the complexities of the market, turning potential gaps into profitable opportunities.